HBAR 4% progressed while ETF’s speculation was pushing for institutional trading activity

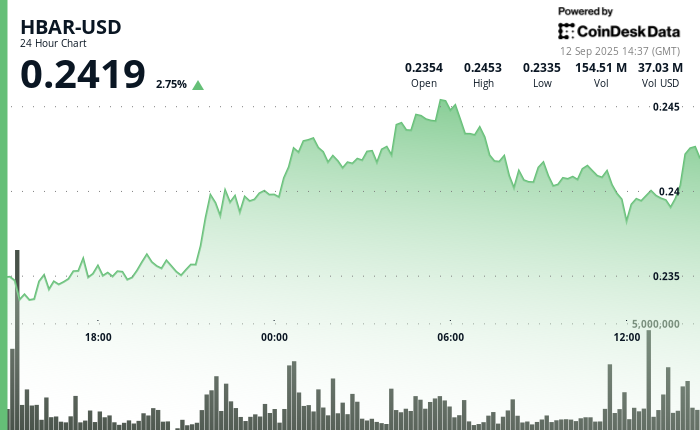

Hedera’s native HBAR token posted moderate acquisitions in the September 11-12 window, climbing from $ 0.237 to $ 0.245 before closing to $ 0.240. The move reflects a promotion in institutional participation, with market activity closely tied to fresh developments around potential exchange-exchanged products.

Corporate momentum built after Grayscale investments revealed plans for a potential HBAR trust and the Deposit of Trust and Corporate Clear (DTCC)) Added a Canary Hbar ETF that filed in its regulation database. The list, under the suggested Ticker HBR, is accompanied by similar submission for Solana and XRP, which emphasizes the growing appetite on Wall Street for digital assets beyond Bitcoin.

Businessmen responded strongly to the news. Technical resistance to $ 0.245 triggered income extraction, while $ 0.240 emerged as a major level of institutional support, which was powered by session volume spikes led to 17 million tokens. Analysts said the speculation -haka could set up a test of the $ 0.25 psychological threshold if the momentum continued.

However, industry observers are cautious that DTCC integrations represent only initial steps, not approved by the SEC. Regulators remain focused on responding to market manipulation risks and investor protection standards for non-Bitcoin crypto properties, leaving the timeline for any unsure HBAR based. To date, filings have put the hedera tightly on the Wall Street radar, driving at the institutional attention even in the middle of the regulation fog.

Market data shows institutional trading patterns

- Intraday trading has established a $ 0.012 range that represents 4.24% volatility between a session high of $ 0.2456 and less than $ 0.2335.

- The main upward momentum occurred during the 21: 00-05: 00 trading window as the HBAR advanced from $ 0.235 to peak levels close to $ 0.245.

- The volume activity averaged 54.7 million during major breakout periods, exceeding the 24-hour average of 50.1 million and indicated institutional participation.

- The price level of $ 0.240 showed strong institutional support with high volume of defensive trade throughout the session.

- The sale of pressure exacerbates $ 0.245 in the elevated volume, suggesting coordinated income acquisition of institution holders.

- Late-session volume of 17.08 million at 11:32 triggers systematic sale and price integration around support levels.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.