HBAR has fallen by 3.85% in Pabagu -change of session as institutional purchase appears

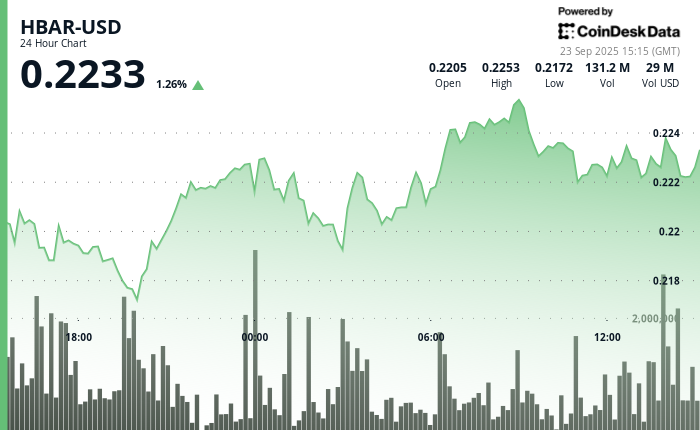

HBAR saw a volatile 23-hour stretch between Sept. 22 to 15:00 and September 23 and 14:00, with the token trade in a narrow band between $ 0.217129 and $ 0.225507. The session opened with a sharp sale that dragged prices to $ 0.217408 before the heavy purchase activity was restored the momentum.

That rebound was strengthened by strong support at a level of $ 0.217129, as the trading volume moved forward. The Bulls pushed prices to a peak that was just shy of $ 0.225507, even though the resistance appeared near $ 0.224358, which was still tedious. At the end of the session, the HBAR closed at $ 0.222759, marking a 2.5% recovery from the intraday lows and establishing a position above the midpoint range, which signed a bullish bias that would go to the next trading phase.

The final time of the session added another layer of optimism. HBAR posted a moderate 0.06% gain in a strictly concentrated 60-minute window that ended in Sept. That narrow band reflected the integration -together but also showed the underlying strength, as the prices remained continuous beyond the midpoint levels of the session.

At this time, volume spikes are highlighting the intensity of market activity. A breakout at 13:27 pushed a turnover to 881,924 tokens, followed by an extraordinary advance of 1.58 million tokens before 14:00. Participation explosions have helped strengthen support for $ 0.2221, while $ 0.2230 has been capped immediate efforts reversed. Despite the forced incidence, prolonged demand suggested accumulation rather than fatigue.

In general, the performance of the late-session has expanded the broader 23-hour HBAR recovery. The bulls maintain control, with the support levels of the stable whole and the prices close near the upper end of the range. The stable bid tone indicates the ongoing bullish momentum that goes to the next session, keeping the participants in the viewing market for a potential breakout above the short -term resistance.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.