HBAR is tumble 5% while whales are triggered by sale

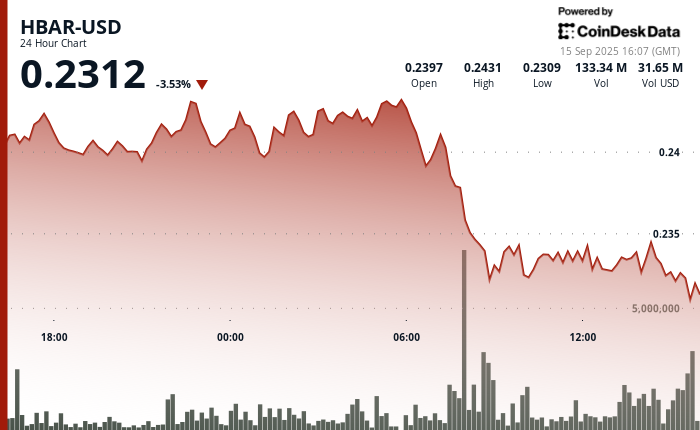

The Hedera Hashgraph’s Hbar Token endures steep losses in a volatile 24-hour window between September 14 and 15, falling 5% from $ 0.24 to $ 0.23. The token trade coverage is extended by $ 0.01 – a move that is often linked to outsized institutional activity – as heavy corporate sale of excessive support levels. The sharp move came between 07:00 and 08:00 PM on September 15, when concentrated extermination pushed prices less after days of resistance to around $ 0.24.

Institutional trading volumes advanced to the session, with more than 126 million tokens changing hands on the morning of September 15 – almost three times the standard for corporate flow. Market participants link the spike to the portfolio to re -balance large stakeholders, with jitters of business adoption and regulatory evaluation that provides backdrop for sale.

Recovery efforts briefly emerged at the last time of trading, when corporate consumers tried to make a $ 0.24 level before retreating. Between 13:32 and 13:35 UTC, an accumulation PUSH found 2.47 million tokens deployed in an effort to establish a price floor. However, buying momentum eventually failed, with HBAR returning to support at $ 0.23.

The excitement emphasizes the token’s weakness in institutional distribution events. The analysts point to the failed breakout above $ 0.24 as a confirmation of fresh resistance, with $ 0.23 serving as critical support in the zone. Climbing volume suggests major corporate participants are repetitive regulatory changes, leaving HBAR’s near-term perspective that depends on whether business consumers can mount prolonged defenses above the basic support.

Technical summary

- Corporate resistance levels have been -crystallized at $ 0.24 where the pressure of the institution’s sale continues to hurt the purchase of the business in many trading sessions.

- Institution support structures have emerged around $ 0.23 levels where corporate purchase programs systematically absorb the sale of pressure from retail and smaller institutional participants.

- The unprecedented volume of trading volume up to 126.38 million tokens during the next morning session reflects enterprise-scale distribution techniques that hurt corporate demand on major trade platforms.

- The subsequent institutional momentum was proven uncertain because the systematic sale of pressure was discontinued between 13: 37-13: 44, the driving corporate participants back to $ 0.23 support zones with a long volume exceeding 1 million tokens, indicating the institutional distribution.

- Last trading periods showed a reduction in corporate activity with zero recorded volume between 13: 13-14: 14, suggesting institutional participants who adopted strategies for positioning HBAR combined with $ 0.23 amid business uncertainty.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.