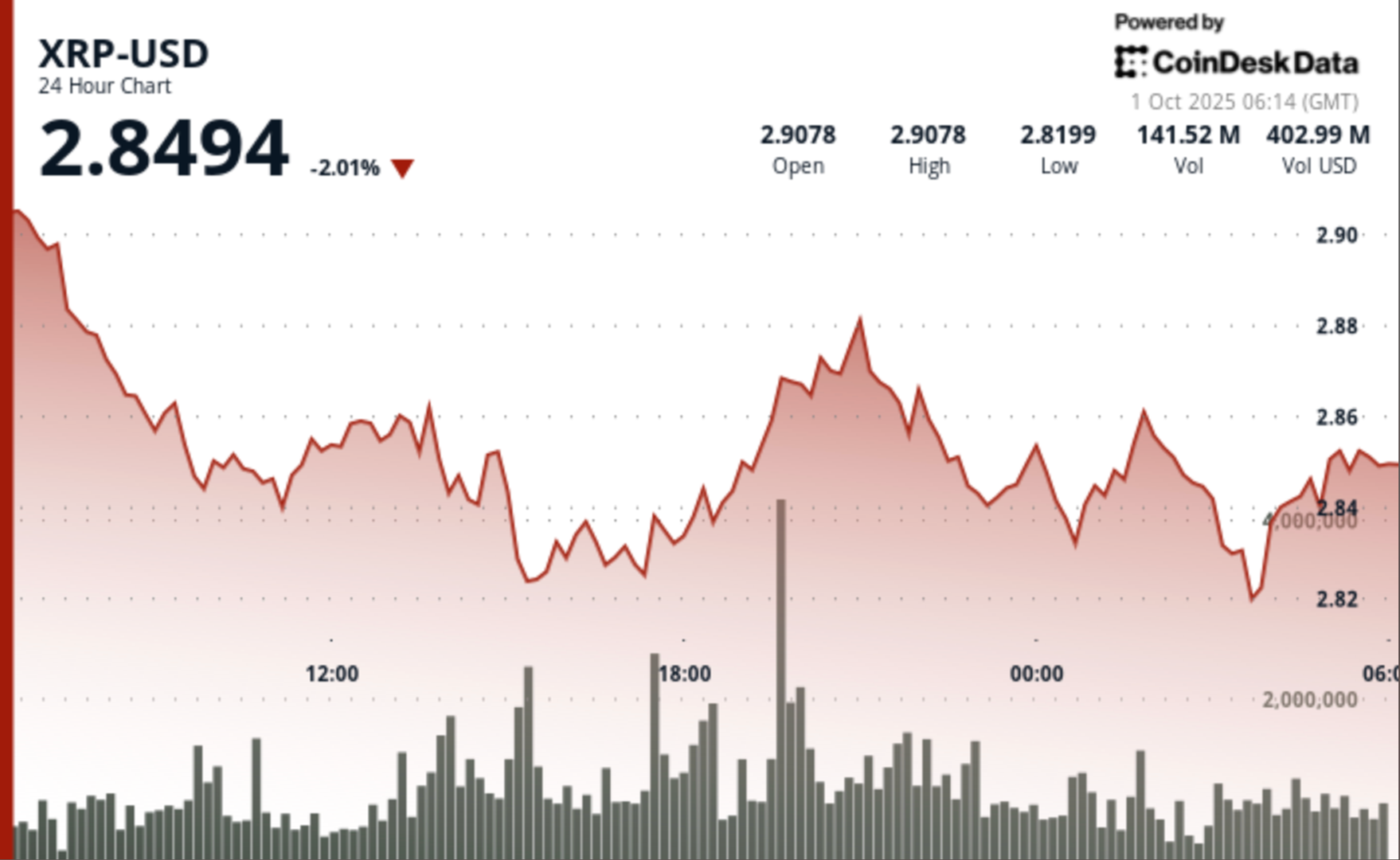

Holds $ 2.85 after 3% swing while ETF flows meet income acquisition

XRP exchanged within a compressed $ 0.09 corridor after an early push to $ 2.91 was met with sharp income extraction. Consumers defended the $ 2.82- $ 2.84 zone, leaving the token integration -with $ 2.85 in closely as volumes. Analysts have dropped bearish divergences as the reserves increased to Binance, which increased the preservation of the $ 3.00 trial.

News background

- The XRP has seen flows of more than $ 6 billion in two days, encouraged by the adoption of the Treasury and positioning of the speculation.

- The focus of the regulation was sharp as reports filed a zero corporate buying orders in Binance despite increasing reserve.

- Wall Street technical tables advise caution up to a breakout above the $ 3.00 threshold confirms the direction of the trend.

Summary of price action

The aggressive purchase pushed the XRP to $ 2.91 at 6am at 49.8 million in volume.

Cut-Taking cut price returns to $ 2.82- $ 2.84, with a proper shift above the 24-hour average of 56.8 million.

Stabilizing a $ 2.85- $ 2.86 band, with a volume of thinning up to 4.9 million.

The market cap is closed near $ 2.85, integration -with the acquisitions but failing to retest session highs.

Technical analysis

- The resistance hardened to $ 2.91 with heavy declines.

- The support has been proven to $ 2.82- $ 2.84 with multiple purchases of spikes.

- Breakout by $ 2.85 at 01:43 to 1.5 million tokens signed demand driven by Algo.

- Late-session combining shows reduced sales pressure but is weak.

- The differences -that make up the indicators of momentum cap reversible risk in the near term.

What do entrepreneurs watch

- Can the XRP get $ 2.91 and close above $ 3.00 to do resistance?

- Impact of increasing 19% Binance reserves and if the outflows represent the sale of liquid.

- The regulation of the regulation around the exchange of exchange and reported lack of corporate bids.

- The tone of Fed’s Dovish at rates as a tailwind for Q4 crypto flow.