Blog

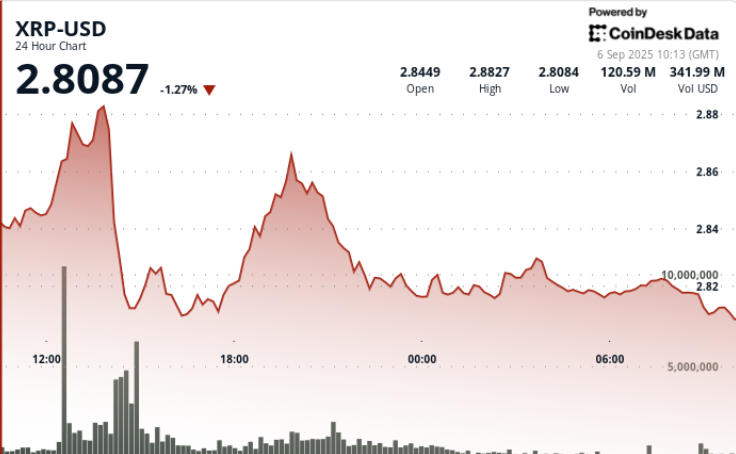

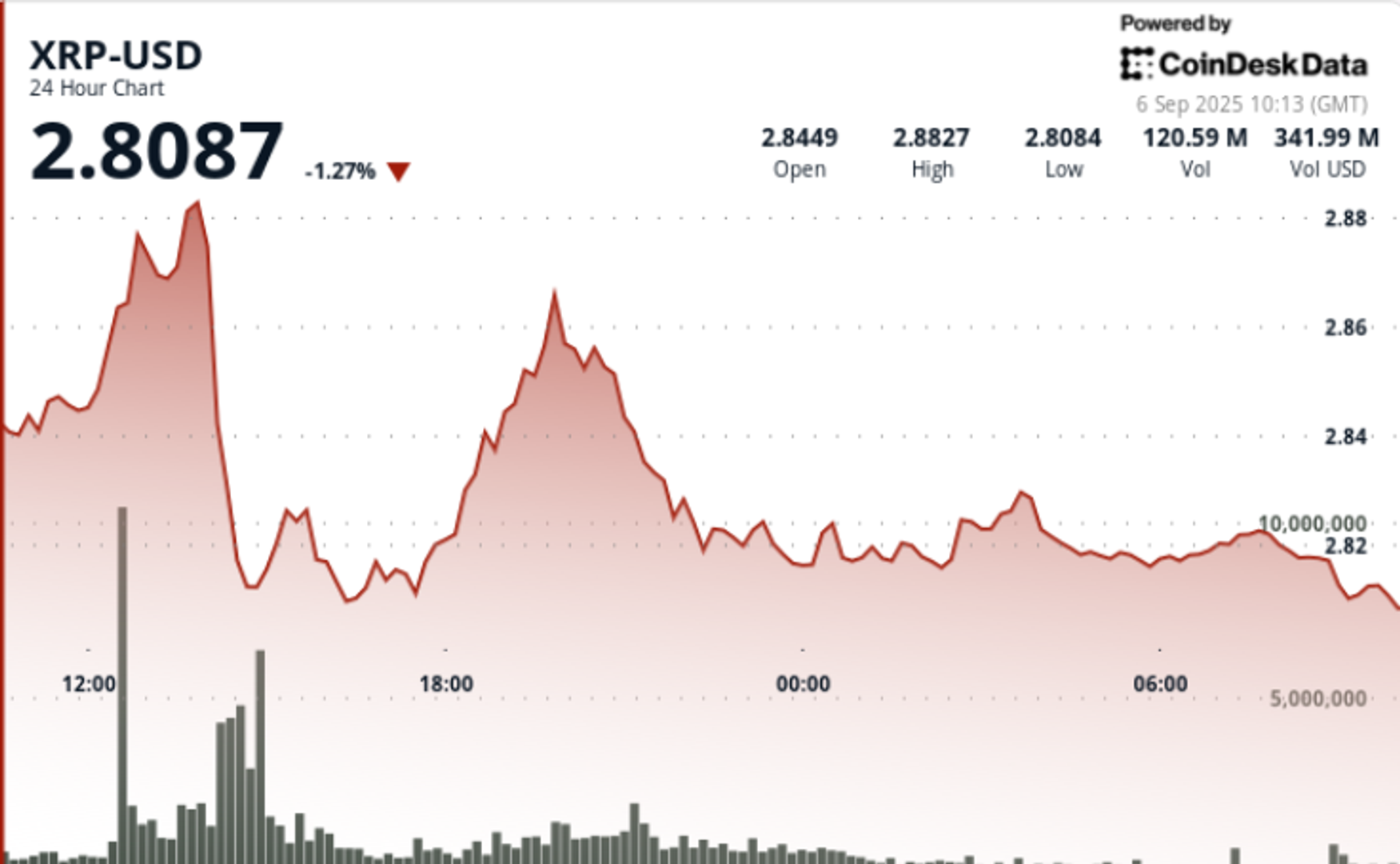

Holds above $ 2.82 after sharp decline, technical ones point to $ 3.30 breakout

The XRP failed to maintain momentum above $ 2.88- $ 2.89, which triggered a 4% decline while the institutional sale was in advance. Strong volume confirmed resistance to those levels, as consumers reappear at the incidence of $ 2.81- $ 2.83 to stabilize price action.

The move maintains the XRP locked in a 47-day integration at under $ 3.00, with entrepreneurs now viewing $ 2.77 pivot support and October’s Sec ETF decisions as the next catalists.

News background

- Six institutional asset managers filed XRP ETF applications, with SEC decisions expected in October.

- The whale accumulation continues, with approximately 340 million tokens purchased in recent weeks despite continued volatility.

- Balances of exchange remain above 3.5 billion XRP, raising questions of potential supply pressure if the sale continues.

- Changes in Federal Reserve policy and inflation copies shape greater liquidity conditions throughout the risk ownership.

- Past attempts to break the higher saw 227.7 million trading tokens near $ 2.88- $ 2.89, proving the zone as a stable resistance.

Summary of price action

- Exchanged by XRP within a range of $ 0.08 from $ 2.81 to $ 2.89, representing 3% volatility.

- The sharp decline came at 14:00 on September 5, dropping from $ 2.88 to $ 2.81 to nearly 280 million tokens exchanged.

- The stabilization followed, with integration between $ 2.82 and $ 2.83 in lighter volume.

- Price closing close to $ 2.82 kept XRP above just $ 2.77 pivot support, viewed as the next key downside guardrail.

Technical analysis

- Support: Strong bid zone identified at $ 2.77– $ 2.81 following repeated defenses.

- Resistance: immediate ceiling to $ 2.88- $ 2.89, with a $ 3.00 psychological level and $ 3.30 breakout threshold above.

- Indicators: The RSI is sitting in the mid-50s, reflecting the neutral-to-bullish bias.

- The MacD Histogram is converting to the Bullish Crossover, which signed a possible momentum shift if the volume returns.

- Structure: Continued 47-day integration under $ 3.00, with close more than $ 3.30 opening the potential path to $ 4.00+.

What do entrepreneurs watch

- If $ 2.77 holds as a decisive support level when selling a resume.

- Price behavior in retests of $ 2.88– $ 2.89 resistance, especially if the volume is more than sunny averages.

- How the offsets of whale accumulation have raised the exchange balances, suggesting a risk.

- October SEC Decisions on Spot XRP ETF, viewed as a major catalyst for institutional adoption.

- Macro drivers from fed policy and inflation data releases that can influence flows on digital assets.