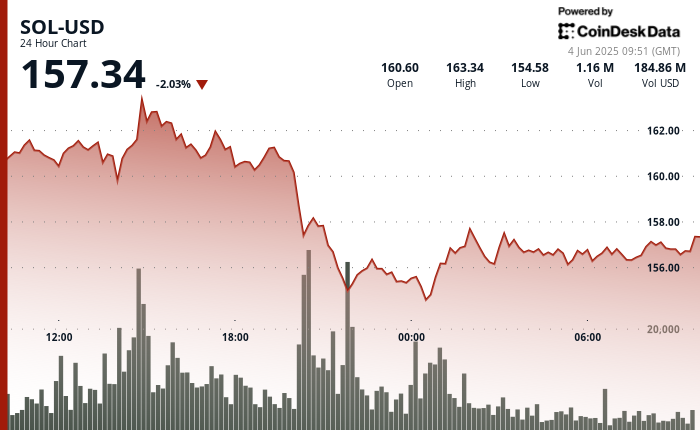

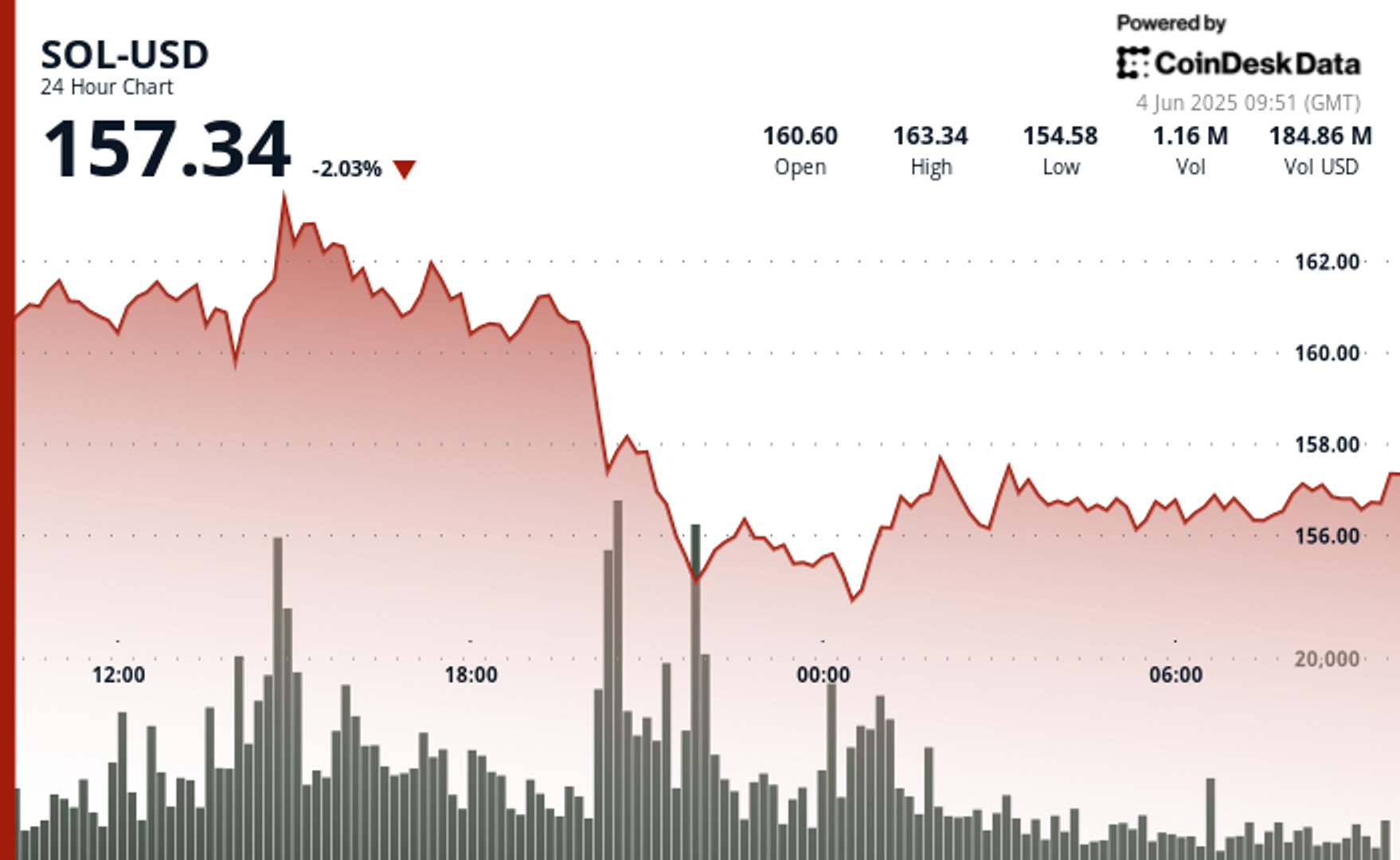

Sol stabilized above $ 157 after a sudden 6% collapse from $ 163 peak

Solana (Sol) saw a sharp pullback after holding a high $ 163.65, pouring almost 6% before recovering from the trading above $ 157 on Tuesday morning. Price action reflects the increased volatility of the market as bulls and bears vie for control near major psychological levels.

Despite the correction, the institutional interest in the SOL appears to be unspecified. The recent Canary Capital filing for a Solana ETF area and the launch of a walletconnect token to the network emphasizes the growing ecosy system. On-chain data also supports this narrative, with increased daily active address and a 26% increase in transaction volumes.

The analysts remain carefully optimistic, with some pointing to $ 165 as the next level of resistance to watch. Long -term projections remain bullish, which are reinforced by the expansion of Solana’s developer base and ecosystem traction as a leading alternative Ethereum.

Technical assessments

- Sol exchanged with a wide range of $ 9.23 (5.64%), which peeked for $ 163.65 before falling to $ 154.42.

- Heavy sale around $ 163.50 led to a sharp 4% collapse during the 20: 00-21: 00 window.

- The main support generated at $ 154.50, which boosts recovery at the level of $ 157.

- Immediate objection stands at $ 157.70, with a price currently combined with more than $ 157.30sol -bouncing from a low $ 156.18 with known spike quantities near 07:51, confirming a local bottom.

- A short-term uptrend channel built between $ 156.40- $ 156.70, which now moves to greater integration above $ 156.50.

- Structure of volume and price indicates consumer control over current levels, with a bullish emotion that stabilizes correction