Ibit and GLD volumes rise on Thursday

Trade in debasement, also known as the sound of money or hard trade assets, is fine and real life. Bitcoin (BTC), at more than $ 120,000, just a stone disposal from a full time of $ 124,000. Meanwhile, meanwhile gold has almost got 50% year-to-date, setting fresh record highs almost daily and now trading below $ 3,900.

Flows exchanged funding feature enthusiasm behind this trade. Both Blackrock’s ishares Trust (ibit) and the SPDR Gold ETF (GLD) ranked in the top 10 most -traded ETFs on Thursday, a rare occurrence According to Bloomberg Senior Etf Analyst Eric Balchunas.

The GLD saw $ 4.88 billion in volume, making it the fourth most traded ETF, while Ibit arrived at the seventh for $ 3.21 billion. The top exchanged ETF is the SPDR S&P 500 ETF (SPY) with over $ 26 billion in volume.

“Everyone wants the debaser trade I think,” Balchunas said.

Comedian and sound advocates Dominic Frisby told CoinDesk exclusively that both Bitcoin and Gold share a unique possession: they cannot be reprinted by governments.

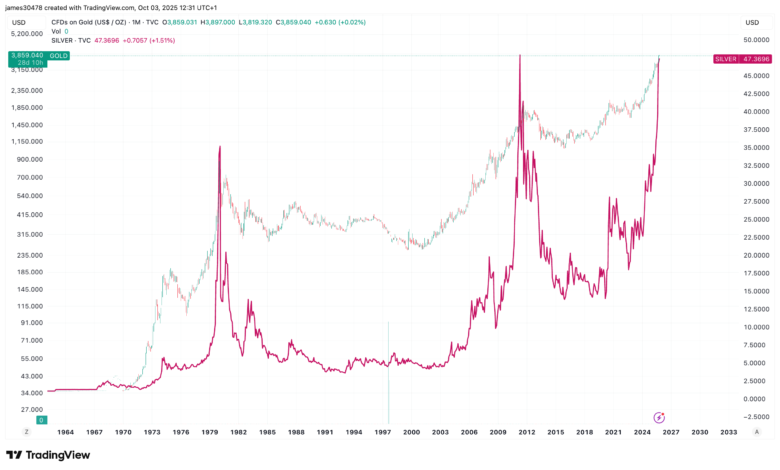

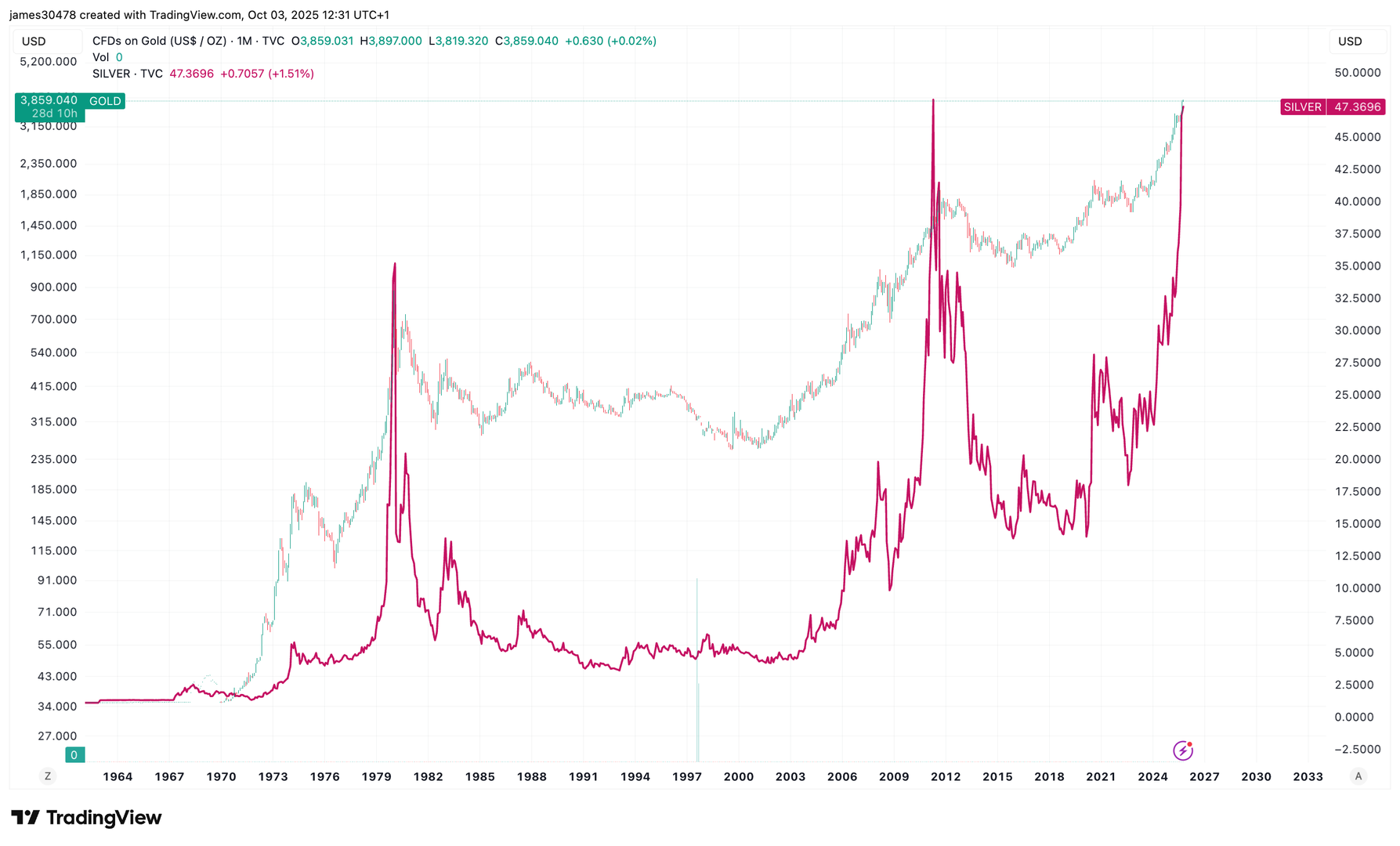

Frisby: “The inside of Bitcoin for a percentage of all times high. The golds of all times high. Closing silver all the time high. It is almost when people lose faith in Fiat. Nothing lasts forever, of course. But the main currencies of which are immune to government debasement are their day.

Silver advanced next to gold, which is currently trading below $ 48, the third highest level behind the peaks in 2011 and 1980. It is noteworthy, in both of those years, the leading silver coincides with gold. If the rhymes of history, it can suggest that when silver ends its parabolic run, the gold can be raised as well. That situation can only create a path to Even more upside down that potential For Bitcoin.