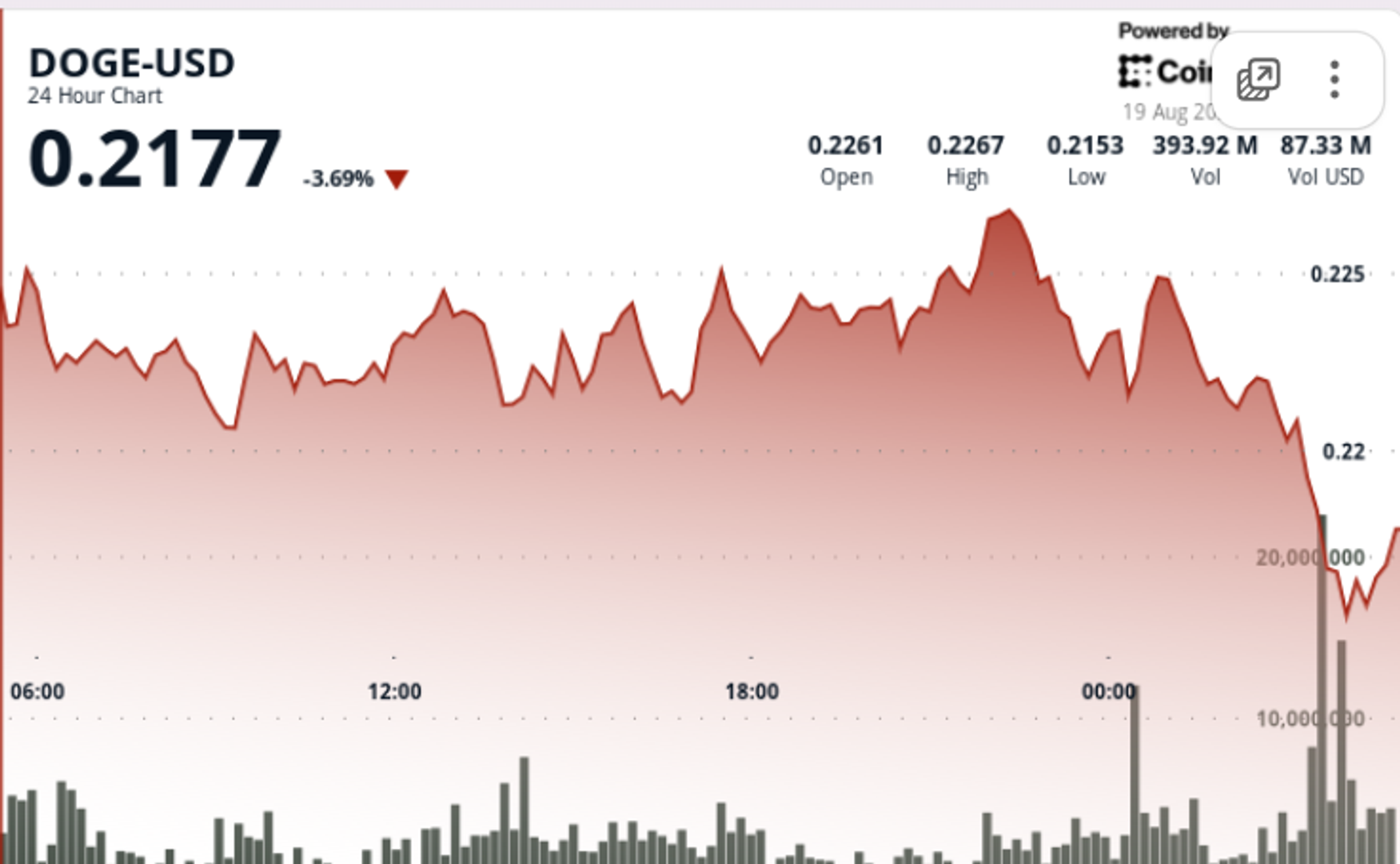

Doge Tests 22-Sentimo Support as $ 782M Volume Unleashes Stop-Loss Cascade

Dogecoin overnight, eliminating the acquisitions despite heavy institutional accumulation, as $ 782 million in trading volume is greatly supportive of support levels and the token is sent to correction mode.

The move comes next to wide crypto liquid, reflecting the increased macro pressure.

News background

• Dogecoin dropped from $ 0.23 to $ 0.22 to a 24 -hour window ending August 19 at 7am, marked a 4% decline.

• A sharp wave of extermination struck between 03: 00-04: 00, where volumes rotated to 782 million doge-alternatively double the daily average.

• Decline occurred as industrial liquids preceded $ 1 billion, triggered by copies of US inflation that beat the expectations and expectations of the feed rate.

• Despite the collapse, institutional consumers have accumulated 2 billion mice worth nearly $ 500 million this week, carrying total reported handles at 27.6 billion.

Summary of price action

• The Doge has exchanged for a $ 0.01 band, reflecting 5% volatility of intraday.

• Overnight crashing pushed the token to test the support of $ 0.22, which is now viewed as the main level to defend.

• A late-session rebound attempt raised prices moderately back to $ 0.22, which signed demand on lows.

• Resistance builds near $ 0.23, where earnest and heavy sellers of orders reappear.

Technical analysis

• Destruction from $ 0.23 is incorrectly the previous bullish structure, with $ 0.22 emerging as a new short -term floor.

• Volume of 782 million dogs confirms the sale of capitulation – a potential precursor in the development of the bottom.

• Support: $ 0.22 (critical), followed by $ 0.21 if pressure continues.

• Resistance: $ 0.23 (immediate), $ 0.25 (main breakout threshold).

• The indicators suggest the mix -mixing signals: the RSI approaching the oversold, but the momentum remains negative.

What do entrepreneurs watch

• If institutional accumulation continues for $ 0.22 cracks – a sign of intelligent beliefs or backwards.

• Broader market risk sentiment: equity weakness and macro headwinds remain dominant driver.

• $ 1 billion+ in liquid crypto features destruction; Another macro shock can deepen the downside.

• A reclaiming of $ 0.23 can be seen as a short-term reversal trigger, otherwise $ 0.21 support trial is likely.