Cardano ($ ADA) drops more than 5% while entrepreneurs are watching signs of an upside down

Cardano is there

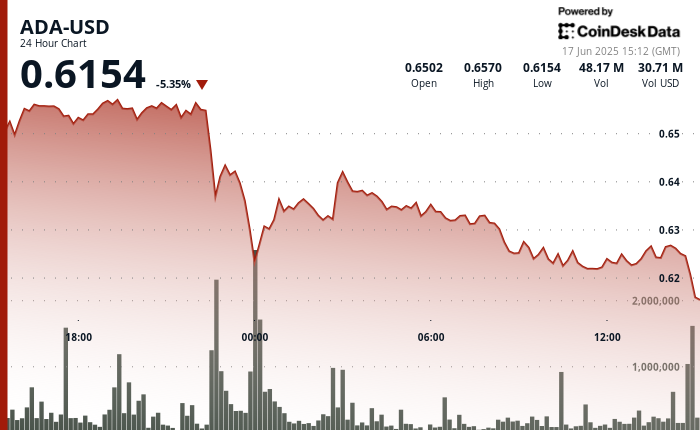

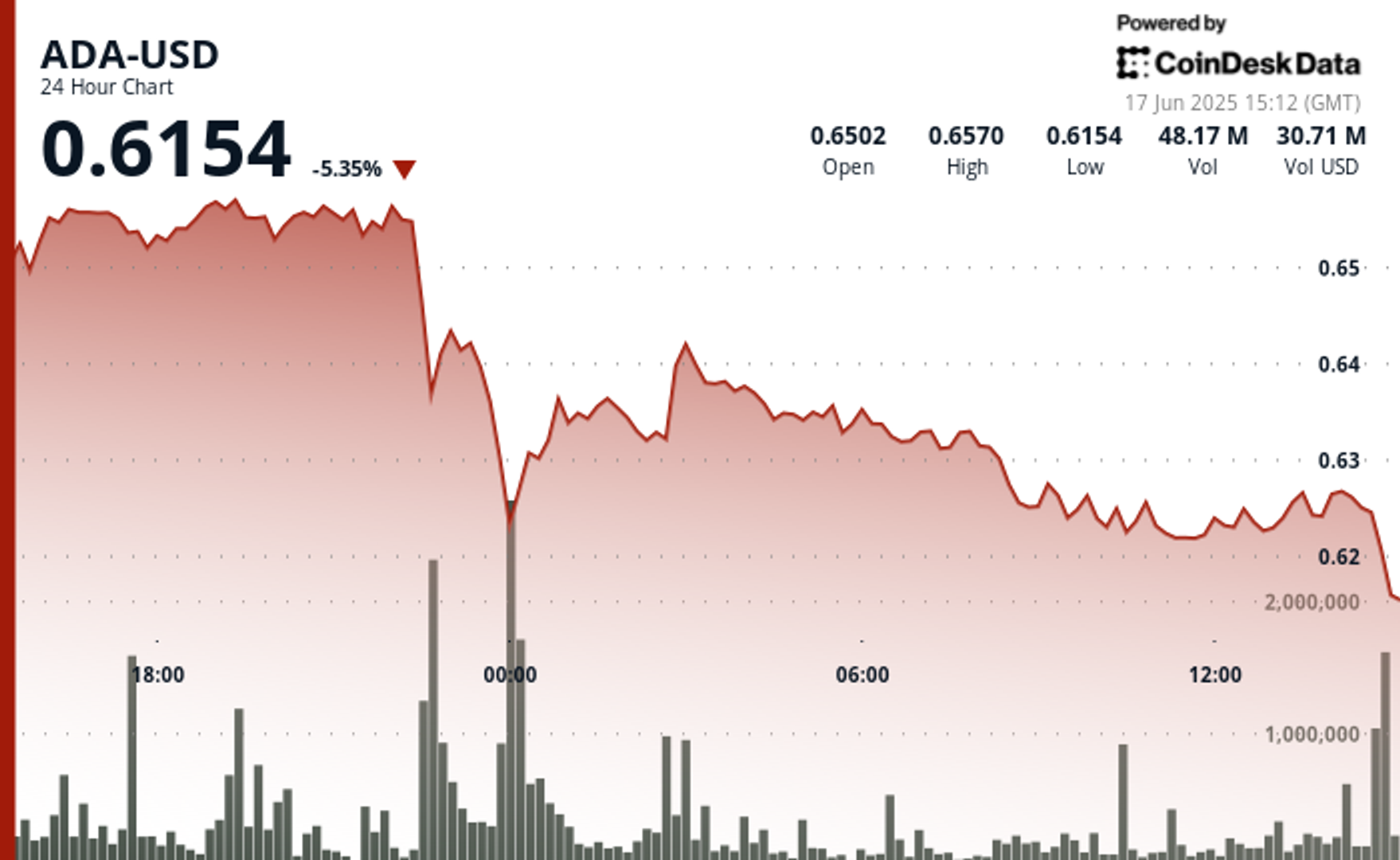

The token exchanged $ 0.6154 Monday afternoon, extending its fall to 5.35% over the past 24 hours. The token dropped consistently through many support levels after a late-session-off-session began around 22:00 UTC on June 16. Despite a brief recovery attempt earlier in the session, the bearish structure remained intact heading at noon on Tuesday.

Correction mirrors are more widespread in danger-off behavior throughout the digital assets as global macroeconomic conditions remain tense. Trade disputes and financial tightening in major economies have added pressure to risk markets, ADA dragging and other large tokens lower.

However, some technical analysts have taught the potential signs of a reversal to the ADA structure. A short bounce from $ 0.622 to $ 0.626 earlier in the session was formed by a small upward sloping channel, with a price test of $ 0.624- $ 0.625 band several times. That area has now appeared as a potential pivot zone, even the volume since tapered and volatility are narrow.

With ADA trading just above the low -day -to -day, the bulls are watching for stabilizing around $ 0.615- $ 0.620. A clear moving direction from it may depend on whether the support of the zone is handling and if the wider market conditions begin to recover.

Technical assessments

- A sharp decline began at 22:00 UTC on June 16 as ADA broke down below the $ 0.650 level of high -volume support.

- Multiple failed attempts to recover $ 0.630 have created a new resistance band around $ 0.640.

- The lower highs are formed per bounce, proving the downward pressure throughout the season.

- A zone support built between $ 0.620 and $ 0.622 as the volume selected at those levels.

- The price enters a descending channel with a similar lower highs and lower lows.

- A short recovery from $ 0.622 to $ 0.626 created an upward sloping micro channel in the middle of the volume increase.

- The resistance was formed at $ 0.626, with a $ 0.624- $ 0.625 area acting as a pivot range in repeated tests.

- Recent candles have shown a reduction in volatility and volume, signing a integration near local lows.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.