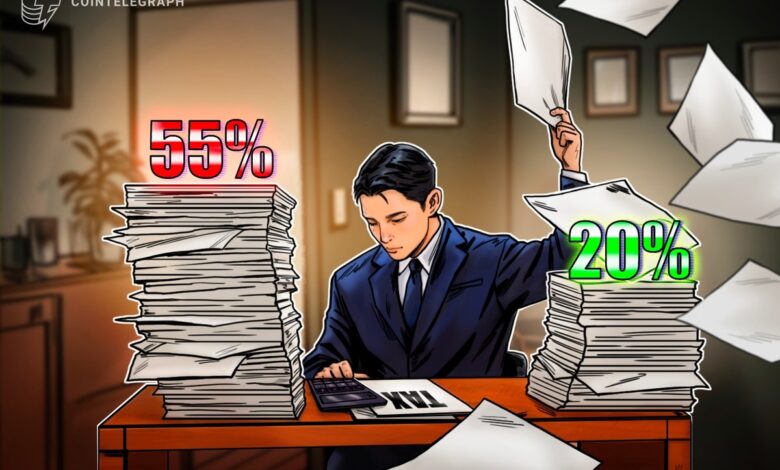

Japan plans major crypto tax cuts – from 55% to 20% in 2025

Key takeaways

-

Japan plans to replace progressive crypto tax rates up to 55% with a flat 20% by fiscal year 2026.

-

New policies will align digital possessions with equality, increasing insider trade care and unfair practice.

-

Investors will get a three-year loss of provisions of carrying, which alleviates volatility and improves the delicacy of the portfolio.

-

Japan has moved from strict post-hack regulations to a web3-friendly framework that balances a security change.

Japan has prepared for a significant change in cryptocurrency tax policies. Currently, investors should deal with a strict system that taxes crypto transactions at steep rates – up to 55%. This policy discouraged participation, encouraged many merchants outside Japan and left crypto disabilities compared to stocks taxing a flat 20%.

However, the ruling liberal democratic party (LDP) in Japan has dedicated to reforms That will introduce a more interesting flat tax rate for crypto. This could change Japan’s position as a global hub for digital assets.

This article discusses how the ruling party in Japan introduced the crypto tax reforms and how these developments would affect the homegrown crypto market.

Suggested Crypto Tax Reforms and Japan regulatory changes

The proposed tax regime is likely to take place in the financial year of 2026, subject to parliamentary approved. This change will introduce a significant removal from the existing tax system.

Reforms will also introduce equities-like insiders Trading Regulations for Cryptocurrencies.

This tax reform is not a measure but part of a broader economic approach to align cryptocurrencies with traditional investment, which makes it competitive and smooth.

The 2025 tax tests can also include investor precautionary measures, such as allowing the three-year loss provisions, bringing crypto consistent with equality and providing essential flexibility to a volatile market.

Do you know? Bitcoin (Btc) was the first cryptocurrency to be exchanged, with the first exchange rate in 2010 just $ 0.003 per BTC.

How Crypto Tax Reforms can announce a new season for Japan entrepreneurs

Japan is moving from one of the most difficult crypto tax regimes to a fair, more investor system. The government sees it as a way to strengthen its role as a global hub for digital ownership.

Financial minister Katsunobu Katō opens the crypto area to various portfolios. He noted its volatility but emphasized that developing the right environment can be a legitimate investment choice. He underlines the need for stability and transparency to generate confidence in the investor.

The ruling liberal democratic party has made these reforms part of its policy platform. The plan included moving crypto to a flat-rate tax regime and expanding the style of equities, which signed that digital assets are now sitting inside Japan’s broader economic approach.

The Financial Services Agency (FSA) prepares details. The proposals include a flat 20% tax on crypto acquisitions from fiscal 2026, three-year loss of forward policies and crypto reclassification under the Financial Instruments and Exchange Act. That change will allow the implementation of insider trading policies and investor protections similar to those in the traditional market.

Do you know? Leverage trading in crypto can reach up to 100x on some platforms, strengthening both income and risks noticeable.

Japan: From strict regulations to web3 embrace

To the following high-profile hacks, especially the Fall of Mt. Gox In 2014 and the Annoying coincheck hackIn 2018, Japan adopted some of the strict cryptocurrency regulations worldwide.

FSA implemented strict standard for Crypto exchange Caution services, anti-money laundering (AML) and Know your customer (KYC) Skills and cybersecurity, prioritizing investor protection, even at the cost of change.

Under former prime minister Fumio Kishida, Japan began to move gears. As part of its broader “new capitalism” and web3 approach, the government signed a blockchain hug and Decentralized Finance (DEFI)To maintain domestic tech talent and remain competitive worldwide.

Public consultations and legislation planning will follow to restore Japan’s crypto policy, balancing security with web3-friendly change and growth.

Do you know? Automatic bots hold a large portion of crypto trading, using algorithms to take advantage of the ineffective markets.

Possible impact on the Japanese Crypto’s reform market

If Japan conducts suggested tax reforms, both corporate and individual crypto adoption are likely to accelerate. Lower tax and clearer rules can boost liquidityAttract institutional capital and encourage development in digital asset infrastructure.

Reforms are also tied to a greater goal: positioning in Japan as a global digital financial hub to compete Crypto-friendly jurisdictions like Singapore and the UAE .

A regulated, environmental-investor can help draw global capital, stimulate domestic markets and strengthen Japan’s role in the web3 economy.

Optimism around these reforms is already visible. Metaplanet, Japan’s largest corporate holder, was added to the FTSE Japan Index, a sign of growing major acceptance. On August 25, 2025, the company bought another 103 BTC, which increased its total handling to 18,991 BTC.

Challenges and views on the future

Many challenges have faced Japanese cryptocurrency tax reforms, including the natural volatility of digital assets, which motivates concerns about market stability and investor protection.

Regulation implementation presents an additional drawback, as ensuring compliance with new insider trade policies requires stable supervision. In addition, the parliamentary approved for a 20% flat tax rate may encounter delays due to political debates or priorities competing.

Japan’s 2026 planned reform signed a major move towards the investor’s friendly policy and a stronger global position of the country. These changes are expected to pave the way for a rapid growth of the Japanese crypto industry while provoking the emergence of yen-back StablecoinsLike JPYC.

In crypto reforms, Japan puts the premise to become a leading regulated cryptocurrency hub in Asia, appealing to both investors and institutional investors with enhanced clarity, taxation and infrastructure.

This article does not contain investment advice or recommendations. Every transfer of investment and trading involves risk, and readers should conduct their own research when deciding.