Blog

Ripple edges higher at $2.4 as volume surges above the weekly average

XRP posted a modest gain amid a clear uptick in trading activity, suggesting professional positioning ahead of critical resistance zones.

News background

- XRP climbed 0.7% over the past 24 hours, closing near $2.43 as volume spiked 12% above its weekly average. The subdued price action comes as the broader crypto markets combine following Bitcoin’s steady rise and avoiding volatility in equities.

- Analysts said the surge in XRP trading reflected updated institutional flows ahead of the SEC’s pending ETF decisions and Ripple’s continued capital increase.

- Despite the limited advance, traders noted that volume-led phases are often preceded by directional expansion, especially if the price is firm under resistance.

Summary of Price Action

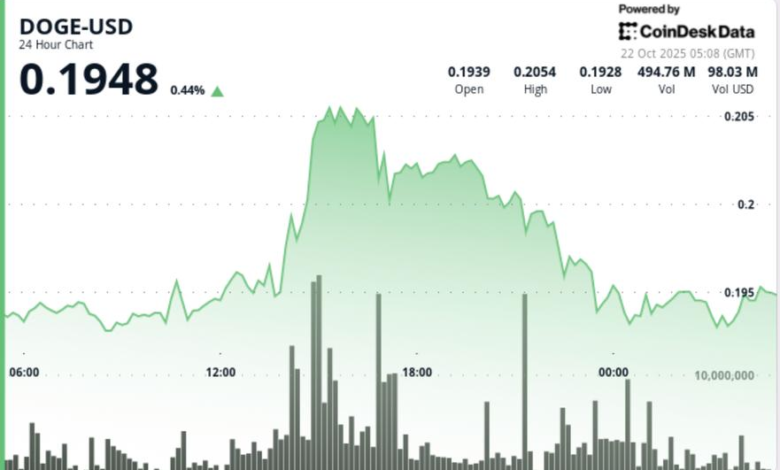

- The token traded within a $0.13 band between $2.41 and $2.54 in the October 21-22 session, testing intraday highs before sliding into consolidation.

- Volume reached 155.8 million tokens—higher than the seven-day average—proving significant participation at current price levels.

- Peak activity occurred between 14:00 and 16:00 GMT, overlaying institutional trading hours, where large buy orders lifted XRP above the $2.42 threshold and established higher lows near $2.40.

- The price stabilized in the $2.41-$2.43 zone nearby, forming a narrow base that traders interpreted as preparatory accumulation.

Technical Analysis

- The short-term structure remains constructive. A series of higher lows from the $2.40 base and repeated resistances of $2.41-$2.42 support the corridor underlining firm demand.

- Resistance sits near $2.45 and then $2.50 – the upper bound of the recent range.

- Volume expansion amid price gains typically reflects institutional buildup, though failure to expand above $2.45 could trigger a near-term pullback to $2.40.

- The RSI reading is near neutral, suggesting room for continuation if buyers maintain contact above $2.42.

What traders are watching

• If the $2.42 floor continues to attract institutional bids.

• Potential breakout through $2.45-$2.50 to confirm bullish continuation.

• ETF-related developments or ripple fundraising updates as sentiment catalysts.

• Broader cross-asset tone-Bitcoin’s drift higher and gold’s weakness remain key directional cues.