Metaplanet destroys the bottom of the 1x MNAV Benchmark as Bitcoin Dwindles

Metaplanet (3350) is now trading below a 1.0x multiple to net asset value (MNAV) at the first time since the launch of the Bitcoin Treasury approach in 2024.

MNAV can be defined as a scale that measures the market capitalization of a company’s market related to the cost of crypto assets it holds in its balance.

According to Company websiteIt currently costs at 0.99x MNAV. The MNAV metaplanet definition includes a total debt, which stands at $ 24.68 million, representing the combined -with -the -residual debt. Metaplanet is the fourth largest Bitcoin treasury in the world, with 30,823 BTCs, representing a treasury worth $ 3.5 billion.

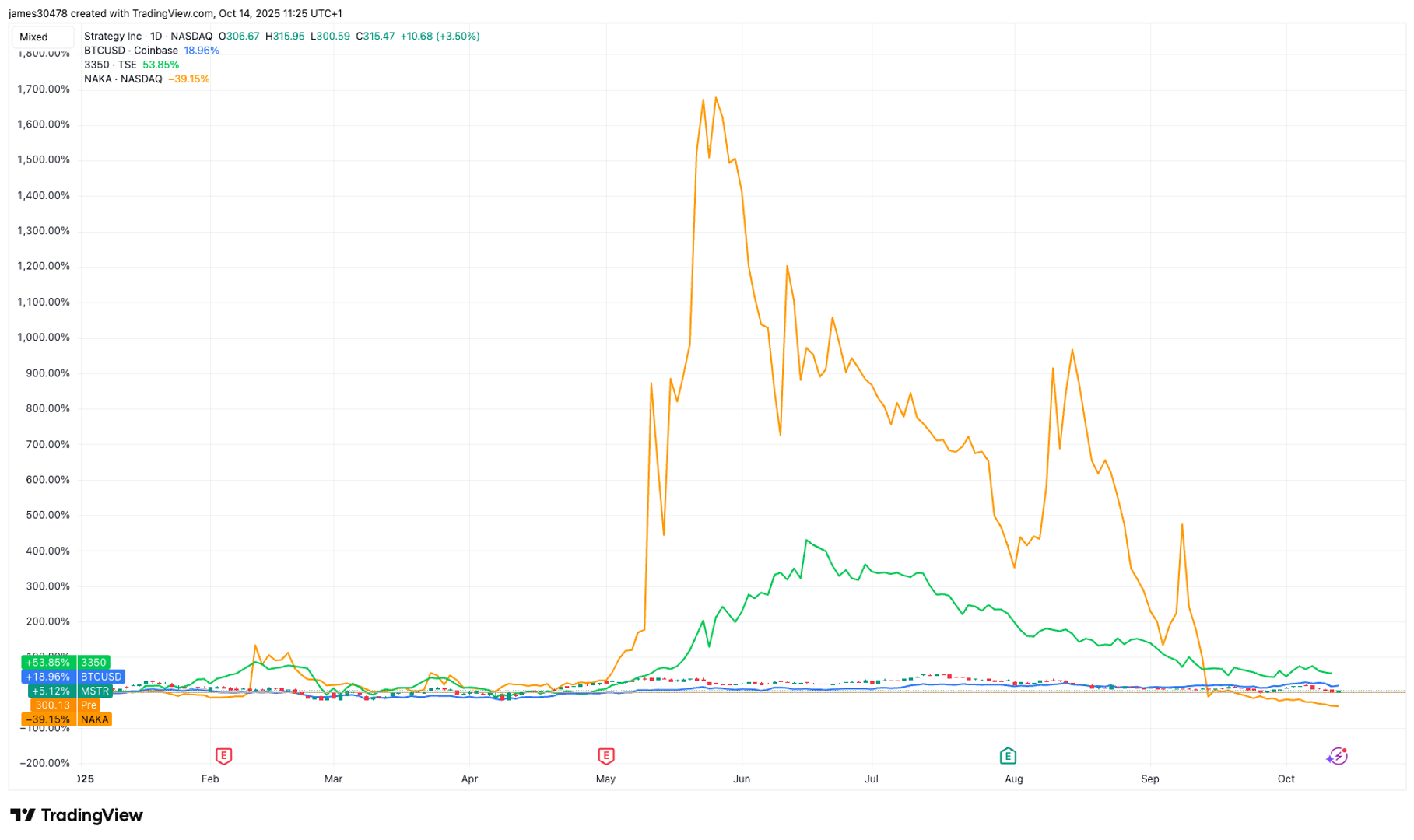

The company’s sharing price fell 12% on Tuesday, closing at 482 yen. Meanwhile, its sharing price reached 35% year-to-date.

Similarly, this is, Kindlymd (turned) also traded below a 1.0x MNAV. Its Shows on the website Those shares are currently worth 0.959x MNAV. The air is holding 5,765 BTCs worth the current prices of $ 646 million. Its current sharing price is to trade at $ 0.85, down by more than 95% from all times high.

Meanwhile, Bitcoin’s largest treasury holder, Strategy (Mstr), continues to command one of the highest premiums in the industry with a Much MNAV of 1.48x. This figure includes the value of the business, incorporating perpetual preferred sharing and convertible debt.

The approach holds 640,250 BTC, which costs nearly $ 72 billion in current prices. Despite this massive treasury, and accumulating 193,850 BTC in 2025, the company’s stock was immutable, just getting 5% year-to-date compared to the 19% Bitcoin increase at the same time.

According to ForbesMore than 228 companies exchanged publicly were announced by a digital asset treasury (DAT) in 2025, which collectively invests $ 148 billion in crypto. The report also noted that 15% of these DATs trade below a 1.0x MNAV,.