Metaplanet launches $500m Bitcoin share buyback

Tokyo-listed Bitcoin Treasury firm Metaplanet Inc. has opened a 75 billion Japanese yen (around $500 million) share repurchase program of a Bitcoin-collateralized credit facility, following a decline in its value based on net assets (MNAV) below 1.

On a Tuesday announcementthe company said the move aims to maximize bitcoin (BTC) yield per share and restore confidence in the market as the stock is below the value of its bitcoin holdings.

The buyback program, approved by the Board, allows for the repurchase of up to 150 million common shares, representing 13.13% of the total issued shares. The repurchase will run from October 29, 2025, to October 28, 2026, through purchases on the Tokyo Stock Exchange under a discretionary trading agreement.

To execute the plan, Metaplanet said it has established a Bitcoin-backed credit line with a borrowing capacity of nearly $500 million, enabling flexible funding for either share repurchases or additional bitcoin acquisitions. The facility, the company said, could also serve as bridge financing for a planned preferred share offering.

Related: Metaplanet becomes the 4th largest holder of corporate Bitcoin

Metaplanet’s MNAV drops to 0.88

Metaplanet’s MNAV, a ratio between the company’s value and its bitcoin holdings, drop to as low a number as possible 0.88 last week before rebounding, according to in official data. The metric currently stands at 1.03.

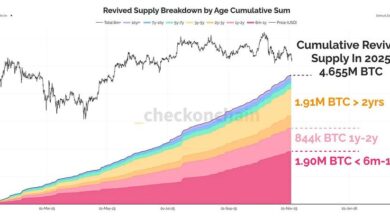

The firm also halted new purchases of Bitcoin amid the fall in MNAV. The company currently holds 30,823 BTC ($3.5 billion) on its balance sheet, following latest acquisition of 5,268 BTC on Sept.

On Monday, Ethzilla too announced A $40 million share issue while its stock continues to trade at a sharp discount to NAV. The company said it has repurchased nearly 600,000 shares worth $12 million since Oct. 24 under a $250 million buyback program.

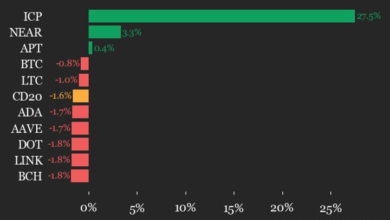

In a recent report, 10x Research revealed that Bitcoin Treasury companies have saw their NAVs fallwiping out billions in paper wealth.

Analysts say that the boom in Bitcoin Treasury companies, which have issued shares in multiple amounts of their actual BTC value, has “come full circle,” leaving investors with losses while the companies have accumulated real bitcoin.

Related: Bitcoin Treasuries can earn more bitcoins, says Willem Schroé

S&P assigns a “B-” rating to Michael Saylor’s strategy

Meanwhile, the S&P Global Ratings Michael Saylor’s strategy is assigned A “B-” credit rating, classifying it as speculative and non-investment grade, even with a solid outlook.

The agency flagged the firm’s heavy Bitcoin concentration, limited business diversification, weak capitalization and low US dollar liquidity as key weaknesses.

Magazine: Back to Ethereum – How Synthetix, Ronin and Celo saw the light