Near the struggles to break from the bearish momentum despite the support

Near the protocol is caught in the crosscurrents of global economic uncertainty, along with price action that reflects greater market disturbance as investors have navigted complex geopolitical development.

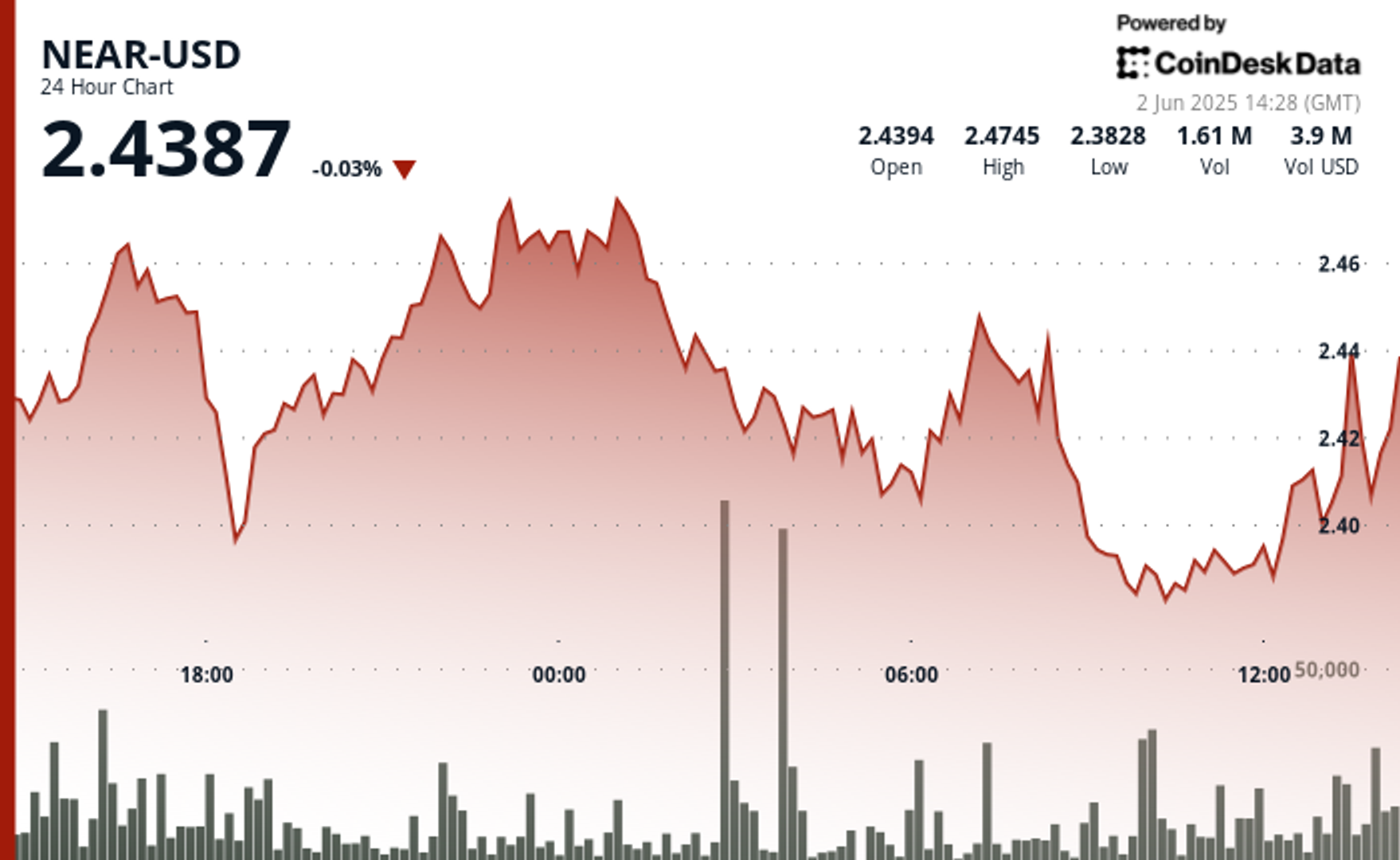

Cryptocurrency has experienced significant volatility over the past 24 hours, establishing a trade range between $ 2.38 and $ 2.49.

The token performance reflects tension in traditional markets, where increasing US-China trade disputes threatened global supply chains and created specific uncertainty for technology-focused properties such as nearby.

Meanwhile, the European Central Bank signals towards potential rates in the middle of the slowdown of inflation provide a mixing -a -long insight for digital assets as policy policies change the major economies.

Increasing the complexity of the market, the intensification of the Middle East conflicts with the new penalties affecting oil prices, which further contributes to the market volatility that is seen in the changing -price change.

Technical analysis

- The high volume of zone support was formed around $ 2.38- $ 2.40, with constant consumer intervention during 09: 00-11: 00 timeframe above-average volume exceeding 2.5 million units.

- The Descending Resistance Trendline established after reaching $ 2.481 at 1pm, indicating the ongoing bearish momentum despite recovery attempts.

- Bullish surgers from $ 2.399 to $ 2.439 (1.67% gain) at the last time, with a well -known resistance to $ 2.420 followed by incorporating -including near $ 2.435.

- The sharp pull of $ 2.399 at 14pm before recovering to $ 2.414, suggesting a strong purchase interest at the support level of $ 2.400.

- Price -stabilization within a narrower range indicates the potential continuity of upward motion if the support support remains strong.

Denuch: Parts of this article are created using AI.