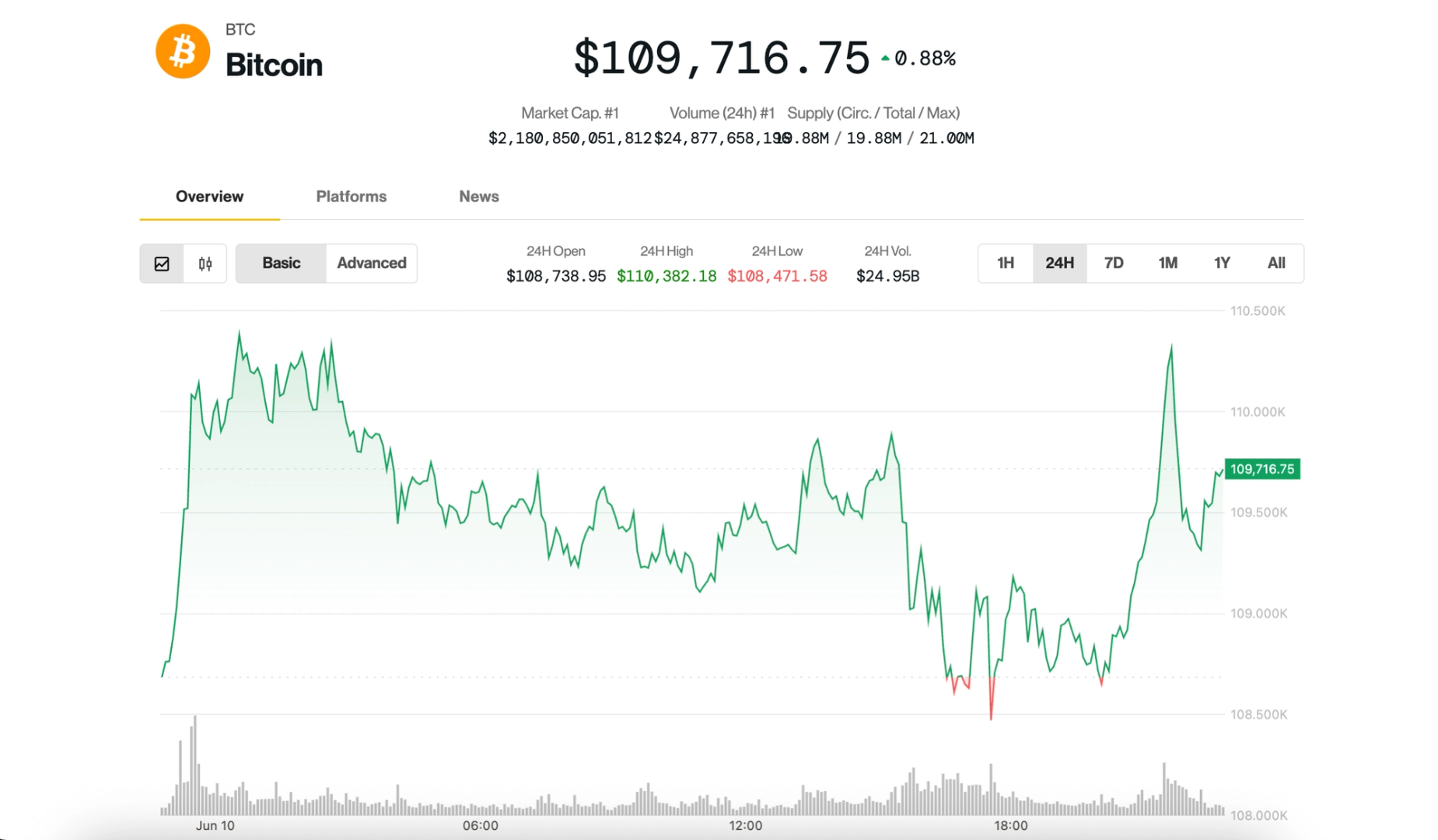

News of Bitcoin Price (BTC): Test of $ 110k level again

Bitcoin re -picked up the $ 110,000 level for the second consecutive day, probably dragging higher than even larger ones in the Altcoins.

Up to 0.9% over 1% in the last 24 hours, Bitcoin traded just above $ 110,000 shortly after closing US stocks Tuesday. CoinDesk 20 – an index of the top 20 cryptocurrencies by market capitalization, excluding stablecoins, exchange coins and memecoins – rose 3.3% over the same period of time, most thanks to Ether

, Solana Chainlink everyone gets 5%-7%.

Standout performances, however, were placed by Uniswap

and Aaave, which rose to a whooping 24% and 13%, respectively. The motion is Sinning Through optimistic comments on the subject of the DeFI by the Securities and Exchange Commission (SEC) chair Paul Atkins on Monday.

Things remained relatively calm in front of equities, with most crypto stock stocks in the sun. A well -known exception is the Semler Scientific (SMLR), a firm aimed at following the Strategy (MSTR) playbook and vacuum up as much as possible. Shares have fallen another 10% now, including stock today Trading for less than bitcoin value in its balance.

Despite the sun’s acquisitions, positioning in crypto markets still reflects a more defensive tone.

“The rates of funding and other leverage proxies are pointing toward a continuous careful emotion in the market,” Vetle Lunde, head of research in K33 Research, pointed out in a Tuesday report. “The extensive appetite is quite weak, given that the BTC is trading near former all-time highs.”

BTC’s BTC Perpetual Swaps posted negative funding rates for many days last week, with an average annual funding rate sitting at just 1.3% – a level commonly associated with local market markets instead of the tops, Lunde mentioned.

“Bitcoin is not usually peak in environments with negative funding rates,” he wrote, adding that previous instances of such positioning were more often preceded by rallies than corrections.

Flow to leveraged bitcoin ETFs painted a similar picture. Proshares 2x Bitcoin ETF (BITX) is currently holding an exposure equal to 52,435 BTC – which is less than December 2023 peak of 76,755 BTC – and the streams remain air -conditioned. The defensive positioning, according to Lunde, leaves the room for a potential “healthy rally” at BTC to form.

However, not all observers in the market are convinced that the current price action marks the start of a sustainable breakout.

“Is this a real breakout that will continue? In my view, maybe not,” said Kirill Kretov, senior automation expert in coinpanel. “More likely, it is part of the same twist of volatility in which we see a rally today, followed by a sharp collapse that is a negative announcement or some other narrative transfer.”

According to Kretov, the current environment favors the experienced entrepreneurs who can navigate the structure driven by volatility. Technically, he sees the next basic BTC support levels to $ 105,000 and $ 100,000 – zones that can be evaluated when selling pressure.