MicroStrategy Bitcoin (BTC) Holdings Rise to 461K

Disclaimer: The analyst who wrote this piece owns shares of MicroStrategy (MSTR).

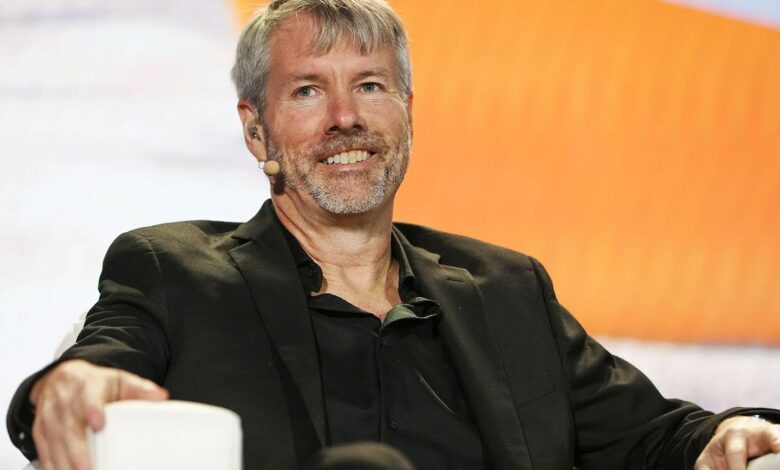

Led by Executive Chairman Michael Saylor, MicroStrategy (MSTR) has again added to its massive bitcoin (BTC) stack.

In the week ending Jan 19, the company purchased 11,000 BTC for $1.1 billion, taking its total holdings to 461,000 BTC. This latest bitcoin average purchase price was $101,191, increasing MicroStrategy’s overall average purchase price to $63,610.

Once again, Michael Saylor teased the announcement on X on Sunday with the caption, “Things will be different tomorrow.” Since the tweet, Saylor has posted multiple photos of himself with Eric Trump, crypto czar David Sacks and Robert Kennedy Jr.

MSTR shares are down modestly in premarket action, with bitcoin trading at $104,500, lower by a hair from late Friday afternoon. U.S. stocks were closed on Monday due to the MLK holiday.