The basis of curve finance pitches yield, a $ 60m plan to become CRV tokens in income assets

Founder of curve finance michael egorov opened a proposal In the curve DAO Governance Forum that will provide token holders of Decentralized Exchange a more direct way to earn income.

The protocol, called the basis of the yield, aims to distribute the sustainable return to CRV holders running on tokens that participate in management votes, receiving vecrv tokens replacement. The plan moves despite the occasional airdrops that define the platform’s token economy to the present.

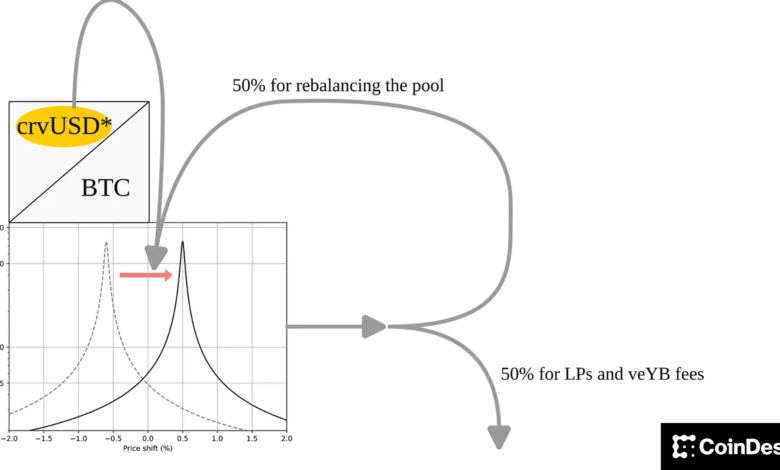

Under the proposal, the $ 60 million of the curve’s crvusd stablecoin was mininted before the yield basis began. Funds from the sale of tokens will support three Bitcoin -focused pools; The WBTC, CBBTC and TBTC, each were jailed for $ 10 million.

The basis of the yield returns between 35% and 65% of its value to VECRV holders, while allocating 25% of yield basis tokens for the curve ecosystem. Voting the proposal runs from September 17 to Sept. 24.

Protocol is designed to attract institutional and professional traders by offering transparent, sustainable bitcoin yield while avoiding unknown loss issues common to Automatically makes market.

Loss of loss occurs when the amount of genitals that are locked in a changing pool of wine (or greater losses) When they retreat.

The new protocol came against a rear of financial chaos for Egorov himself. The founder suffered a curve There are many high-profile liquids In 2024 tied to CRV purchases.

In June, more than $ 140 million worth of CRV positions were liquid after Egorov borrowed against the token to support its price. That episode left a curve with $ 10 million in bad debt.

Most recently -But, in December, Egorov was liquid for 918,830 CRV (about $ 882,000) After the token drops 12% on a single day. Eventually he told X that the position was linked to funds from Uwu and represents the payment of a promise of UWU founder.

CRV has increased around 1% in the past 24 hours.