Perpetual Market Share Tank to 38% as Aster and Lighter Ground Ground

Hyperliquid, which when no separate leader in the on-chain perpetuals market, is fast ceding ground on emerging platforms such as lighter and aster.

At one point in May, hyperliquid costs 71% of the on-chain crypto perpetuals market. Number now stands at 38%, according to Pseudonymous DUNE ANALYTICS SER.

Meanwhile. These percentages are based on the weekly trading volume and exclude trading washing numbers.

The On-chain Perpetuals Market refers to the decentralized trading of Perpetual Futures Contracts (with no expiry) That occurs directly in a blockchain, ensuring transparency and inability.

Perpetuals are derivatives without expiry date, allowing entrepreneurs to think of price movements of the underlying possessions. These contracts use a unique funding rate mechanism to maintain the eternal price aligned with the price of the underlying owner.

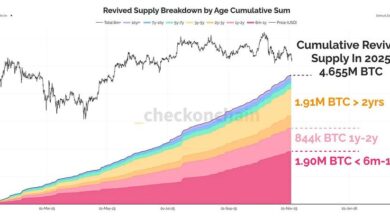

The on-chain Perpetual Market has experienced rapid growth. All platforms combined are registered with a combined -joint trading volume of nearly $ 700 billion over the past four weeks, with an activity of up to $ 42 billion in the last 24 hours.

The number of protocols has grown significantly from just two to 2022 to over 80 to date. This expansion perfectly reflects capitalism at work: a developed market attracts floods of new enterprises, increased competition and explosion of market sharing and earnings of early pioneers.

The absence of traditional barriers to entry or release, a major feature of the crypto market, enables anyone with technical knowledge to launch new protocols and compete.

Recently, a war of types has been opening between hyperliquid and aster. Last week, Hyperliquid listed the aster’s native token of aster, allowing users to have a long or short token with 3x leverage. On Monday, Aster responded by offering Hyperliquid’s Hype Perpetuals with 300x leverage.