Price stable amid $240B real estate tokenization integration

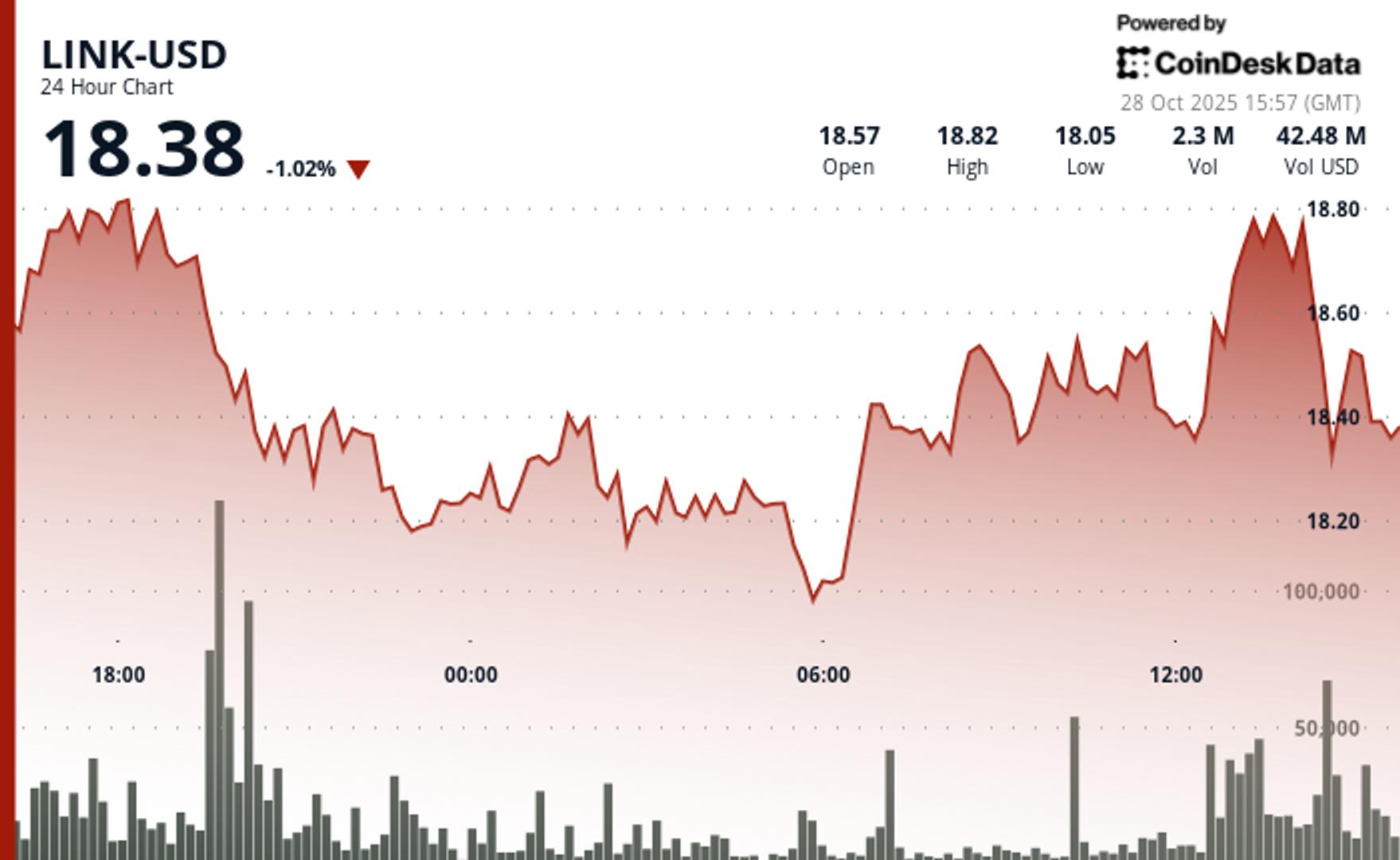

Oracle Network Chainlink’s native token was trading just above $18 in a volatile Tuesday session amid momentum in real-world adoption.

Trading volume rose to 2.27 million tokens, 91% above the daily average, but the resistance at the $19 level was trapped by several rally attempts, Coindesk Research’s market analysis model showed.

On the news front, Chainlink inked a partnership Tuesday with Balcony, a real estate tokenization platform that works with local governments. The platform will use ChainLink’s Runtime Environment (CRE) to bring more than $240 billion worth of government-owned data Onchain. The collaboration aims to make real estate assets programmable, transparent and verifiable, starting with records at the parcel level.

Balcony’s Keystone platform, powered by ChainLink CRE, enables verified property data to flow directly onchain, helping to build compliant digital real estate markets. The deal also underscores ChainLink’s expanding role in tokenized real-world assets (RWAS), where secure, regulated data handling is key to institutional adoption.

Meanwhile, Virtune, a Swedish-regulated Digital Asset Manager and Crypto Fund Issuer, said On Tuesday it integrated ChainLink’s Proof of Reserve Service across its $450 million digital asset exchange-traded products (ETP). This feature verifies and reports aggregate asset holdings in fun without disclosing individual wallet addresses, assuring investors that ETPs have underlying assets.

The main technical level of continuity of continuity for the link

- Support/Resistance: Key support holds at $18.21 with secondary backing near $18.30, while resistance remains firm at $18.82 with supply overhead expected near $19.00

- Assessment Volume: The breakout volume of 2.27 million tokens exceeded the average by 91%, confirming the institution’s participation and momentum.

- Chart patterns: ascending structure from $18.04 lows completed with decisive breach confirming uptrend.

- Targets and risk/reward: immediate upside target of $19.00 psychological level; The downside risk contained in the $18.40 zone support.

Disclaimer: Parts of this article were generated with help from AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see Coindesk’s full AI policy.