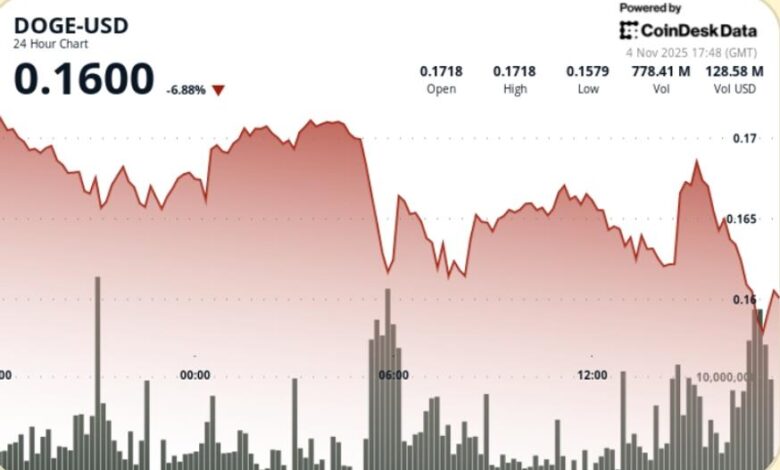

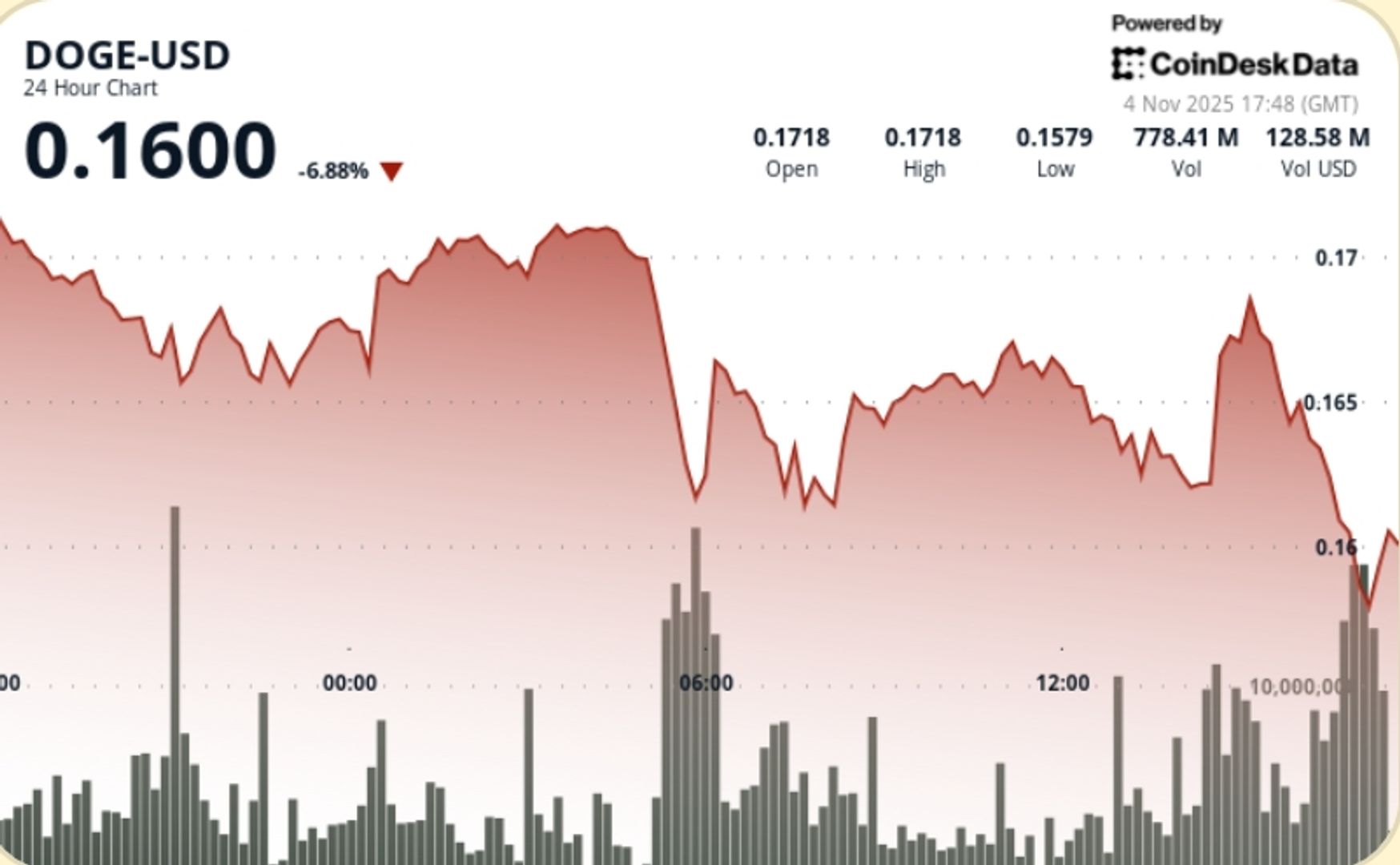

Printed lower low order as $0.17 resistance locks in

Dogecoin slipped 6.7% to $0.1605 in the last session, cracking key $0.17 support as major players exited weakness. Volume spiked ~76% above the seven-day average, reinforcing a clear distribution signal rather than emotional retail flow. Bears now control $0.16 which acts as the next battleground.

What to Know

• Doge fell from $0.1719 to $0.1605, losing 6.7%

• Volume jumped 76% above the weekly average; A 1.44b-token spike capped recovery

• Final hour Cascade Flushed Price at $0.1600 on 59m Doge Block Sell

• Underperformed CD5 by ~ 1.4% → token specific weakness

News background

The move extends a multi-session disabled whale rotation out of meme exposure and tight liquidity across the ALT majors. A 1.44b doge wall near $0.1702 rejected buyers in a morning defense attempt, triggering algo-led stops and accelerating leg. That failure today marks decisive resistance overhead as traders fade momentum until the trend flips. Wider flows reflect reduced activity and concentration in BTC, leaving doge bid-light as macro jitters weigh on higher beta plays.

Summary of Price Action

• Initial fade from $0.1719 stalled near $0.1650 → then cascade to $0.1600

• Largest dump: ~ 59M DOGE DUMPED between 16: 20–16: 25

• Session climax confirmed by sideways drifts + amount of post-flush collapse

• Maximum wick decline at $0.1702 after 1.44b Doge Turnover (~158% above 24h avg)

• Low printed at $ 0.1600; Late-session stabilization but no strong bounce

Technical Analysis

• Trend: lower high structure, bearish bias of continuation

• Support: $ 0.1600 initial defense; Next liquidity pocket $0.1550-$0.1500

• Resistance: $ 0.1630 Tactical Cap; $0.1702–$0.1714 firm supply zone

• Volume: Selling Convinced – 158% Spike in rejection confirms distribution

• Structure: A break below $ 0.17 invalidates the previous consolidation of the base

• Momentum: Oversold Readings Build but no Reversal Signal – Risk of Drift Grind Lower without catalyst

What traders are watching

• Can $0.1600 in US time or do funds force a wick towards $0.1550-$0.1500

• Returning bids to the area vs. ongoing whale net-outflow behavior

• If CD5 stabilizes – doge lagging increases degradation

• Reaction to any bounce attempts at the $0.1630 and $0.1700 supply zones

• Liquidity behavior If BTC volatility picks up again