Pump.Fun Bucks Bearish Market Trend in the Middle of Wave of Buybacks

The native token of Pump.Fun, Pump, has dropped throughout the market this week, rising by 17% as protocol platform fees to re -buy the tokens.

Buybacks are designed to support the holders by reducing the switching -shifting supply and suction of the seller’s pressure, a model that is especially common in crypto projects.

At the time of publishing, the pump traded at $ 0.0035, about 40% higher than a month ago but still dropped 50% from July’s debut, when it quickly fell from $ 0.007 to $ 0.0024 in just 10 days.

Post-launch’s sharp decline reflects the fading of the initial hype, but recent momentum suggests purchases are helping to stabilize the token market.

The driver is the pump.fun’s revenue engine. The platform earns fees on each token created by its service, a model that has formed by $ 734 Million last year, with volumes peering in January during the boom on coins driven by celebrity such as Trump and Melania, along with thousands of copycat tokens to follow.

Since the beginning, more than 12.5 million tokens have been launched and 23 million wallets have been contacted by the site, establishing a powerful user base.

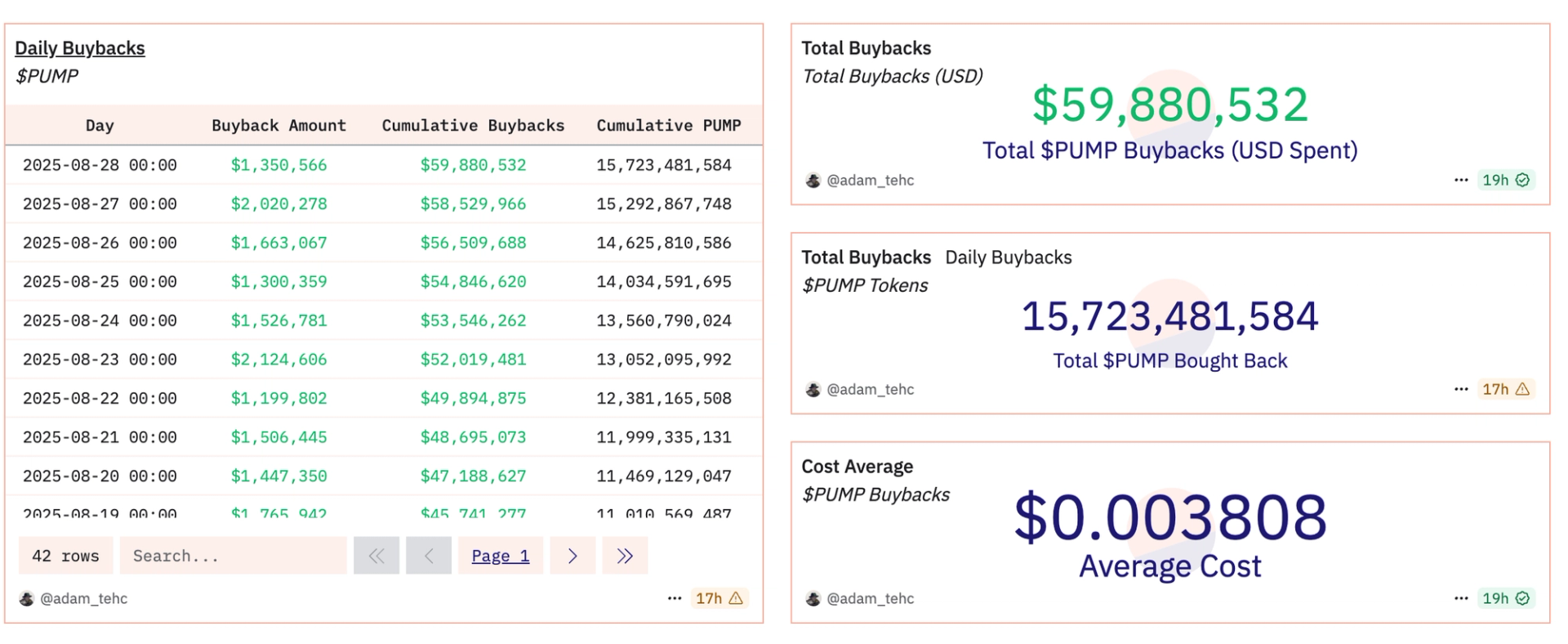

Those flows are translated to significant token support: Pump.fun has taught $ 59 million towards purchases, according to Dune dashboardwhich helps in the pump’s rebound.

The timing can be enthusiastic. Autumn is a history that has become a stronger time for digital assets after the prevention of the Tag -heat, suggesting conditions can be aligned for further upside down.

However, the pump remains far from the highs of its launch, and its trajectory depends on whether the pay revenue can remain the same in a slow market.

Meanwhile, majors remain under pressure: Bitcoin trades at $ 108,500 and Ether at $ 4,337, both between 6% and 7% this week.