Bitcoin’s Coinbase Premium shows overseas consumers leading ahead of CPI release

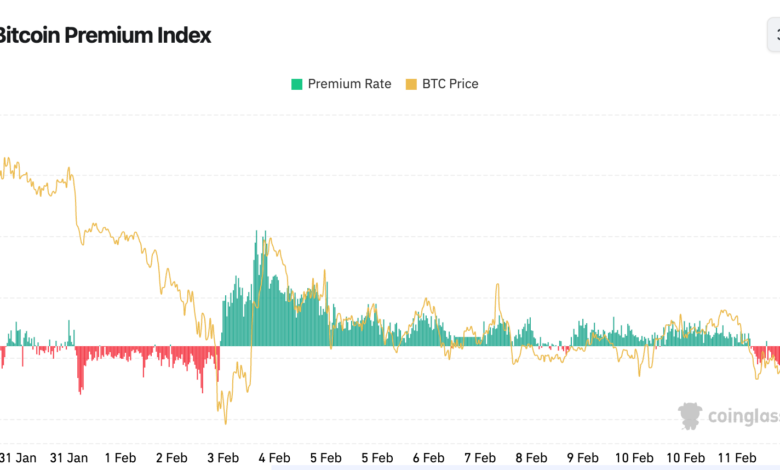

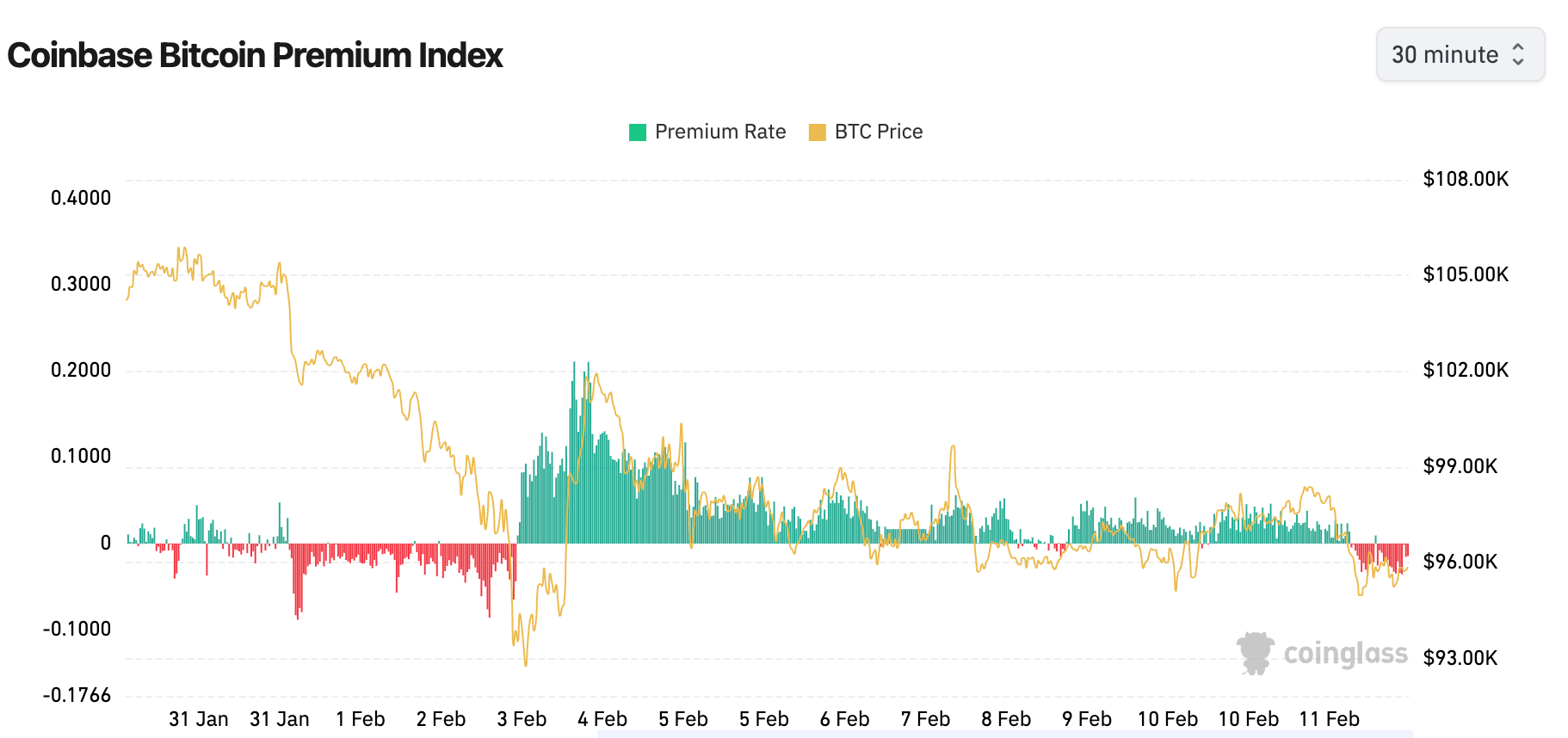

Bitcoin’s (BTC) Premium (BTC) premium indicator, which measures the spread between the BTC’s dollar dollar price in Binance’s Coinbase and Tether-Denominated price, flipped negatively to the first opportunity since the crash of February 3, according to the data resource Coinglass.

This is a sign that businessmen over the Nasdaq’s listed exchange have been careful ahead of Wednesday’s Wednesday CPI releaseAnd their offshore counterparts led the price recovery from overnight lows near $ 94,900 to $ 96,000.

History, the Bull Run has been marked by Trade prices at a premium on Coinbase, indicating strong leadership from US investors. The premium climbed two months high in early November as the BTC rose to its-after-end territory of over $ 70,000.