Ripple, Cardano, Solana Bulls Recovery Recovery in short time

XRP tokens, Cardano (ADA), and Solana (SOL) show technical strength in a signal of potential short -term price recovery, data indicates.

Bullish patterns – $ 2.00 XRP breakout, double under ADA for $ 0.55, and Sol’s rally up to the top of $ 130 – the largest accumulation phases despite the wider volatility in the market. However, a Bitcoin collapse below $ 80,000 or intensified macro pressures may limit the acquisitions.

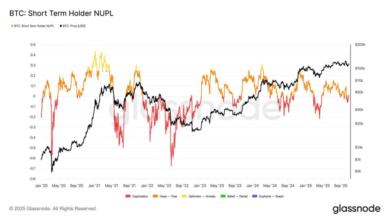

Alex Kuptsianvich, the FXPRO Chief Market Analyst, said in a note in CoinDesk that entrepreneurs should wait for the confirmation of a return of the Bitcoin trend before the long -term purchase of tokens.

“Bitcoin has not yet confirmed a backward growth,” Kupsianvich said. “The main place along the way is the $ 85,000 level, where the 50-day transfer of the average passes. Its overcome will be an important confirmation of bullish emotions, as the fluctuations below it remain a market noise.”

“XRP found the support last week in the fall of this 200-day moving averages. This small but encouraging signal suggests that market participants still follow a ‘purchase’ approach to dips’, believing in the continuation of the bullish trend,” he added.

Here are technical reviews of highlights for XRP, ADA and Sol, based on Coindesk data:

XRP: $ 2.00 Support Signals Bullish Momentum

XRP rose 11% from $ 1.87 to $ 2.07 over the past week, destroying a psychological $ 2.00 barrier earlier Monday. Recent price action shows a higher than $ 2.065, recovering at $ 2.068, with a reduction of volatility indicating accumulation.

Technical perspective:

- Support: $ 2.00- $ 2.065, reinforced by a 50-hour transfer of average to $ 2.03.

- Resistance: $ 2.10, with $ 2.15- $ 2.20 possible at a break.

- Indicators: Volume of surges during breakouts, and a higher low structure confirms the purchase of interest. RSI near 60 suggests room for upside down without much risks.

Target short -term: If holding $ 2.00, the bulls might want to watch $ 2.10- $ 2.15, with a break below a risk of $ 1.99.

Solana: Ascending Channel Eyes $ 125.50

Solana rallied 3% from a low $ 125 to nearly $ 134 in early Europe Monday, part of a 30% climbing from $ 101.30 to $ 125.48 last week that ETF’s approval (76% odds in polymarket) was driven.

The support around the $ 120 mark remains stable, with a recent integration between $ 124.50- $ 125.30 testing of $ 125.50 resistance.

Technical perspective:

- Support: $ 120- $ 124, with $ 115 as a deeper base.

- Resistance: $ 130- $ 135, with $ 145 visible on a breakout.

- Indicators: The increasing volume and tight bollinger bands indicating an explosive move. MacD’s bullish divergence supports the gains.

Target short -term: Clear $ 135 can push Sol to $ 140 and above. A drop below $ 120 is at a risk of $ 105, but the channel favors the bulls.

Cardano: Double Bottom Drive Rebound

ADA rebounds 18.6% from $ 0.537 to $ 0.637 last week, forming a double bottom of $ 0.55 with a strong volume on April 9. Despite 15% weekly Bitcoin collapse and trading tensions (34% US import tariffs), the integration of ADA above 60 cent With the upcoming channel with 63 cents support, the bulls can now target at least 70 cents.

Technical perspective:

- Support: $ 0.632- $ 0.636, supported by a 50-minute average transfer to $ 0.636 to Monday.

- Resistance: $ 0.641, with Fibonacci extensions at $ 0.645- $ 0.658.

- Indicators: Healthy volume and refusal of volatility suggest accumulation. The stochastic RSI shows the momentum of the building.

Target short -term: A break below 63 cents is at risk at 55-59 cents, but the double bottom supports upside down.

Read more: Bitcoin is facing ‘Cloud Resistance’ at $ 85k, neutralize the risk-rewarded for bulls: Godbole