Ripple, Dogecoin tokens lost their acquisitions while China announced tariffs

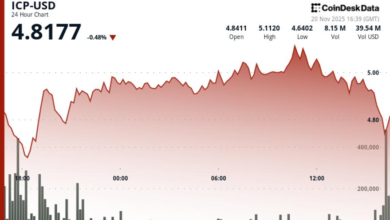

Crypto majors zoom nearly 20%, before reversal, in the past 24 hours as a purchase-dip purchase approach following Monday $ 2.2 billion that has been useful for risk, though the acquired was destroyed while China announced revenge on tariffs in the US

The bump saw a pull back on Asian morning hours while the deadline for the US to impose additional tariffs in China has passed without agreement.

XRP, Dogecoin (Doge), Solana’s Sol, and Cardano’s ADA are about 3%. Bitcoin (BTC) and Ether (ETH) are about 4% higher.

“The US-China tariff conflict can reduce appetite for risk properties and will further affect the positive emotions that have fuel a bull market in the crypto industry last year,” Ben El-Baz , Managing Director of Hashkey Global, CoinDesk told a telegram message. “Damage from tariffs can still be temporary if more policies that are friendly in the US are set in motion,” El-Baz added.

Businessmen remain mixed with the long-term impact of China’s revenge decisions, however, in markets that depend on the chance of a return or a prolonged drawdown if further actions against the country occur under Trump .

“Despite the more people who consider Bitcoin as digital gold, it is largely trading such a risk of possessing,” Min Jung, Analyst of Research in Prestro Research, CoinDesk told a Chat on the telegram. “As a result, the retaliation of China’s 10% tariff in the US is to press the crypto, just like other global risk ownership such as equally.”

“While today’s preliminary reaction may be an overreaction, increasing volatility is likely to continue as markets dissolve additional developments. The main question now is whether this move is a major negotiation tactic that will eventually Mexico – or if it indicates the start of a long -term trade conflict, given that China has become the main focus of Trump’s rhetoric, “Jung said.

Donald Trump’s decision to impose tariffs on imports from Canada, Mexico, and China led to a steep collapse in Bitcoin and greater equity markets on Monday, becoming the focus of investors from In Trump’s pro-crypto bearing up to immediate economic references.

Monday’s major extermination event offers a “buy-the-DIP” opportunity to merchants, as mentioned by a CoinDesk review, along with tariff announcements that emit interest in dollars supported by Stablecoins as a fence against economic uncertainty and volatility of money.

However, the imposition of tariffs can lead to retaliation measures from the affected countries, which potentially sparking a broader trade war and leading to further volatility throughout the crypto market in the coming days.