Ripple drops 3% as BTC pullback sentiment Dampens

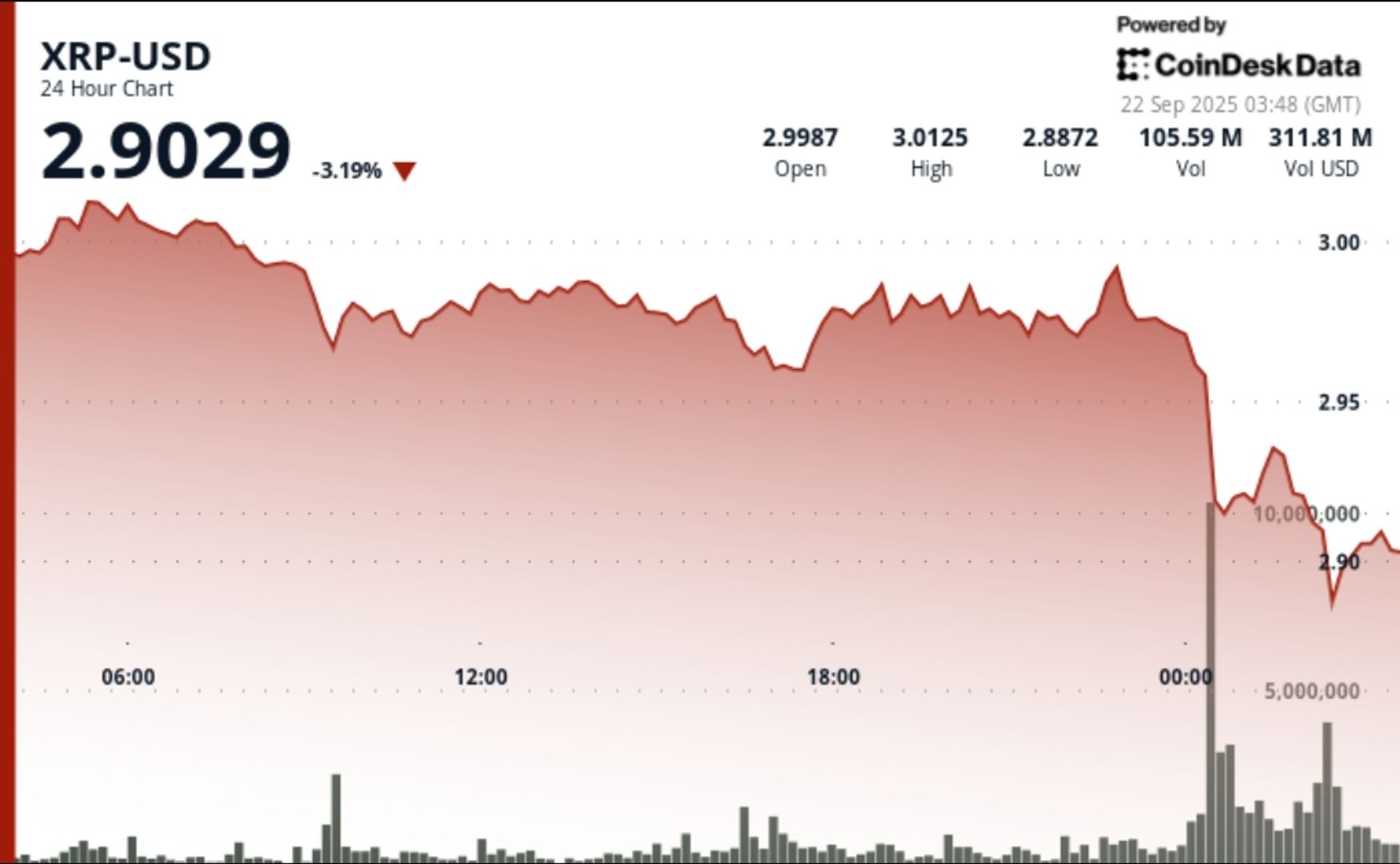

XRP endures a volatile 24 hour session from September 21 and 03:00 to September 22 at 02:00, swinging 3.46% between a $ 3.014 high and $ 2.910 low.

The sale in conjunction with the debut of the first listed XRP ETF, which sets records of $ 37.7 million in the opening of the day-to-day, but the institutional income-the bullish catalyst took greatly.

News background

• The first US-listed XRP ETF launched September 21, making up $ 37.7 million in the daily volume-ETF’s largest 2025 debut.

• Federal Reserve policy easing remains focused, with pricing markets close-specific reduction in the September rate that usually supports digital properties.

• Analysts warned the structural integration -including the ETF momentum, with a resistance that continues near $ 3.00.

Summary of price action

• XRP 3.46% collapsed within a 24 -hour period, collapsed from $ 3.01 to $ 2.91 before closing $ 2.92.

• Midnight crashing pushed prices from $ 2.973 to $ 2.910, released 261.22 million in volume -quadruple day -day averages.

• Liquids cost $ 7.93 million during the route, with a 90% long hitting position.

• The last 60 minutes saw XRP rebound from $ 2.92 to $ 2.94, only to retreat back to $ 2.92, creating a resistance cluster to $ 2.93- $ 2.94.

Technical analysis

• Trade range: $ 0.104 span representing 3.46% volatility between $ 3.014 high and $ 2.910 low.

• The resistance established at $ 2.98- $ 3.00 following a decline in high volume.

• Zone support generated at $ 2.91- $ 2.92, repeatedly tested after crashing.

• Integration appeared near $ 2.92 at the last time because the XRP failed to hold above $ 2.93.

• The explosion of 261M volume confirms the institutional -selling wave that leads overnight flow.

What do entrepreneurs watch

• Can the XRP get and maintain the closure above $ 3.00, or the resistance to the $ 2.98- $ 3.00 cap upside down?

• How the second flow from the new ETF affects, given a record-breaking day-one participation.

• Fed’s September rate decision and if Dovish policies change crypto flows.

• Reserves to exchange at 12-month high, which sign the potential supply of overhang despite institutional interests.