Blog

Ripple is trading higher on big flow, but technical setups of caution setup

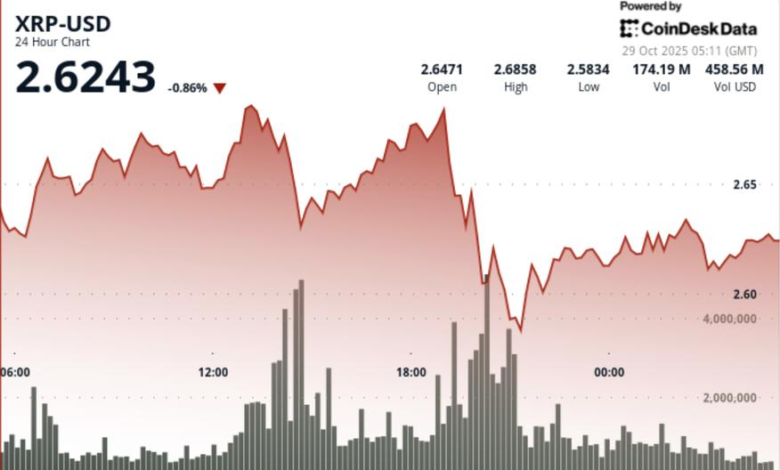

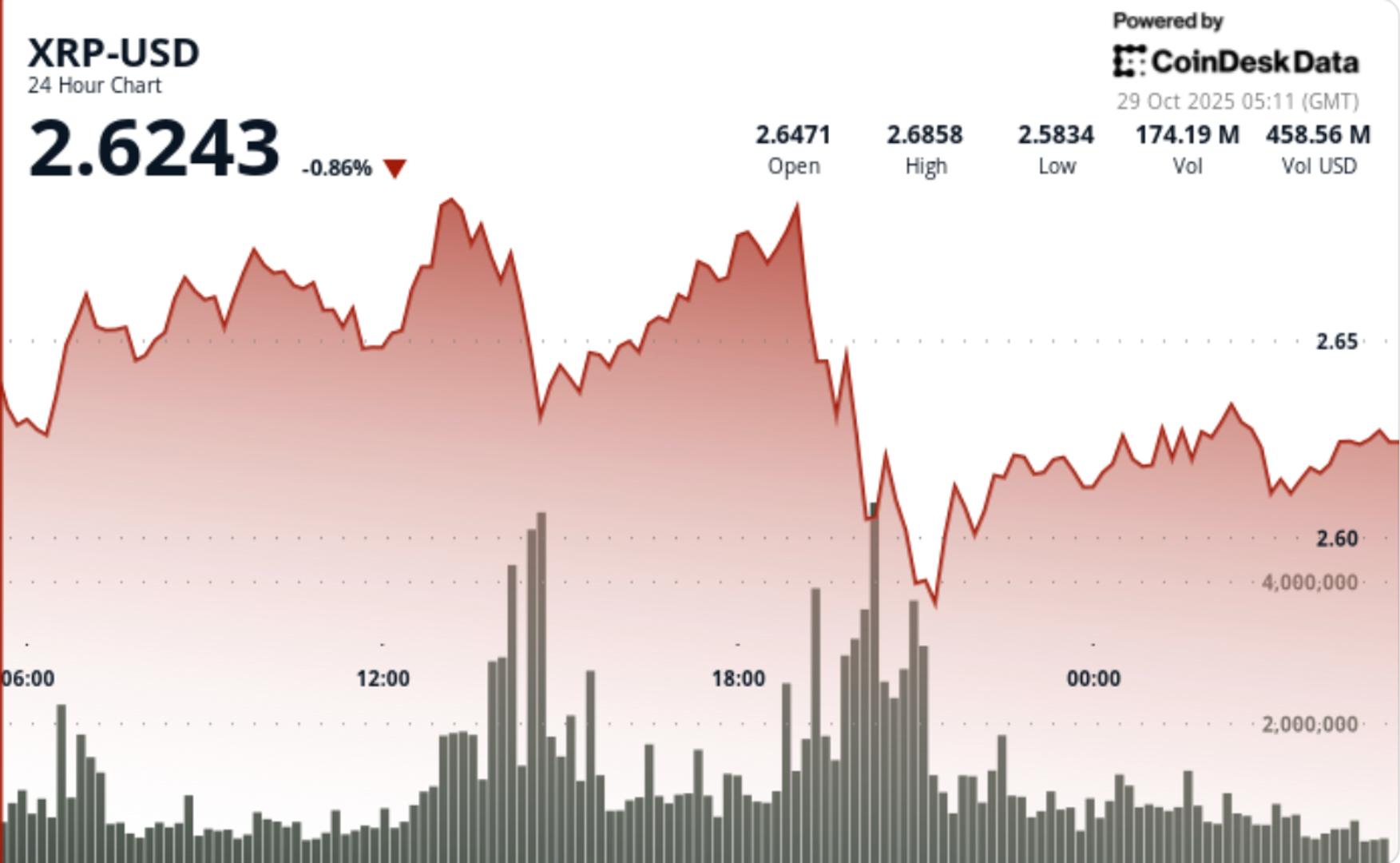

XRP advanced moderately as trading activity spiked, though momentum indicators warned of near-term risk of consolidation.

News background

- XRP climbed 0.60% to $2.623 as trading volume advanced about 47% over the seven-day average, indicating increased institutional interest amid a lack of strong breakout catalysts.

- The token is still facing resistance from a decline near $2.68 and many analysts are cautioning that while chart patterns exist, the recent momentum may be capped.

Summary of Price Action

- In the session, XRP traded a range of $0.11, oscillating between ~$2.64 and ~$2.62.

- A peak volume of ~167.3 million tokens (≈140% above the 24-hour average) was recorded during the failed breakout near the $2.68 resistance.

- The level of psychological psychological support held firm through many tests. This price action reflects controlled accumulation rather than a full breakout run.

Technical Analysis

- The breakout attempt above $2.68 was rejected, proving that resistance remains tough.

- The support zone at ~$2.60 showed firmness, yet momentum indicators – such as consecutive TDs – triggered caution signals.

- The chart structure shows consolidation between $2.60 and $2.67, which could form the basis of a future move but also warns of a possible short-term pause.

- The volume surge confirms interest but the lack of a clean breakout suggests the move is in setup mode.

What entrepreneurs should know

- Traders should monitor if XRP can hold support in the band around $2.60-$2.63.

- A sustained close above $2.65 coupled with renewed volume will tilt the bias bullish and open targets near $2.70-$2.90.

- Conversely, a break below ~$2.60 would expose a retest of ~$2.55 or lower.

- The upcoming ETF decision window and institutional inflows remain key catalysts to watch.