XLM suffers 3% decline while intensifying the sale of grip market pressure

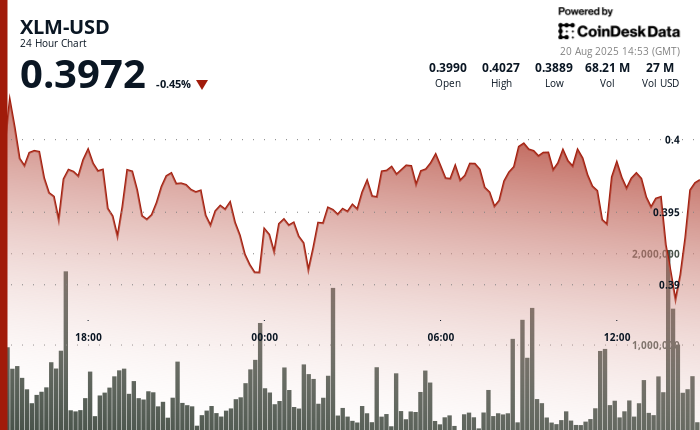

XLM has slipped into a pronounced bearish trajectory in the past 24 hours, trading between $ 0.39 and $ 0.40 and destroying below support levels. The volatility of the token intensified at the last hour of August 20’s trade, when prices fell from $ 0.40 to $ 0.39, marked a decisive support violation that had previously provided momentum. Moving signals continued pressure to own despite its attempts to combine -combining around $ 0.40 threshold.

Trade data revealed an increased distribution activity, with a transfer of 45.04 million within a 13:00 session-more than 24 hours average. The volume spike emphasizes the well -known institutional participation of the sale institution, boosting the descending momentum. The XLM failure to handle the upper levels of resistance and its violation of multiple intraday supports the point to bring conditions that are likely to continue in the near term.

The weakness in XLM has come across the ecosy system. The Stellar Development Foundation recently produced UK -based UK -based capital Archax firm, emphasizing its long -term growth approach. However, the broader market conditions will weigh over, holding Bitcoin near $ 113,500 as the altcoins face pressure correction, leaving the XLM exposed to ongoing risk.

The technical signal indicators continued degradation

- The price violation is certainly under the established $ 0.39 level of support that previously given interest in accumulation.

- Volume sprouts during the steep stages of denial, with 4.92 million recorded in 14: 17-the highest single minute reading.

- Failed to establish significant support above the $ 0.39 psychological level throughout the session.

- The continuous lower pattern of the peaks indicates the accelerated descending momentum remains intact.

- The volume of zero recorded at 14:20 suggests potential capitulation among market participants.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.