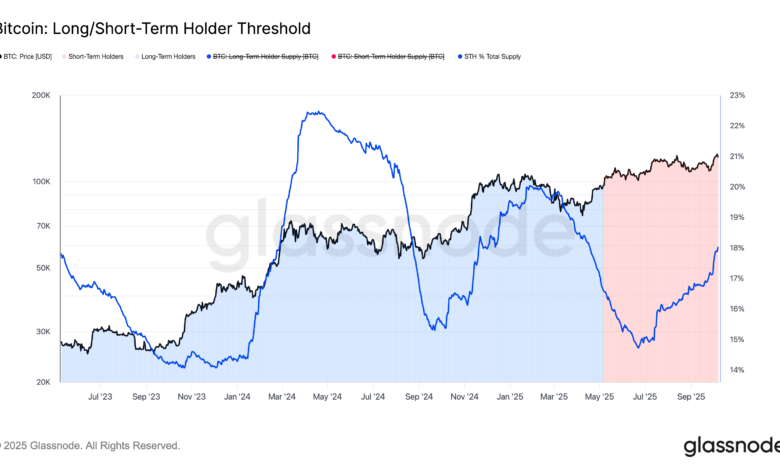

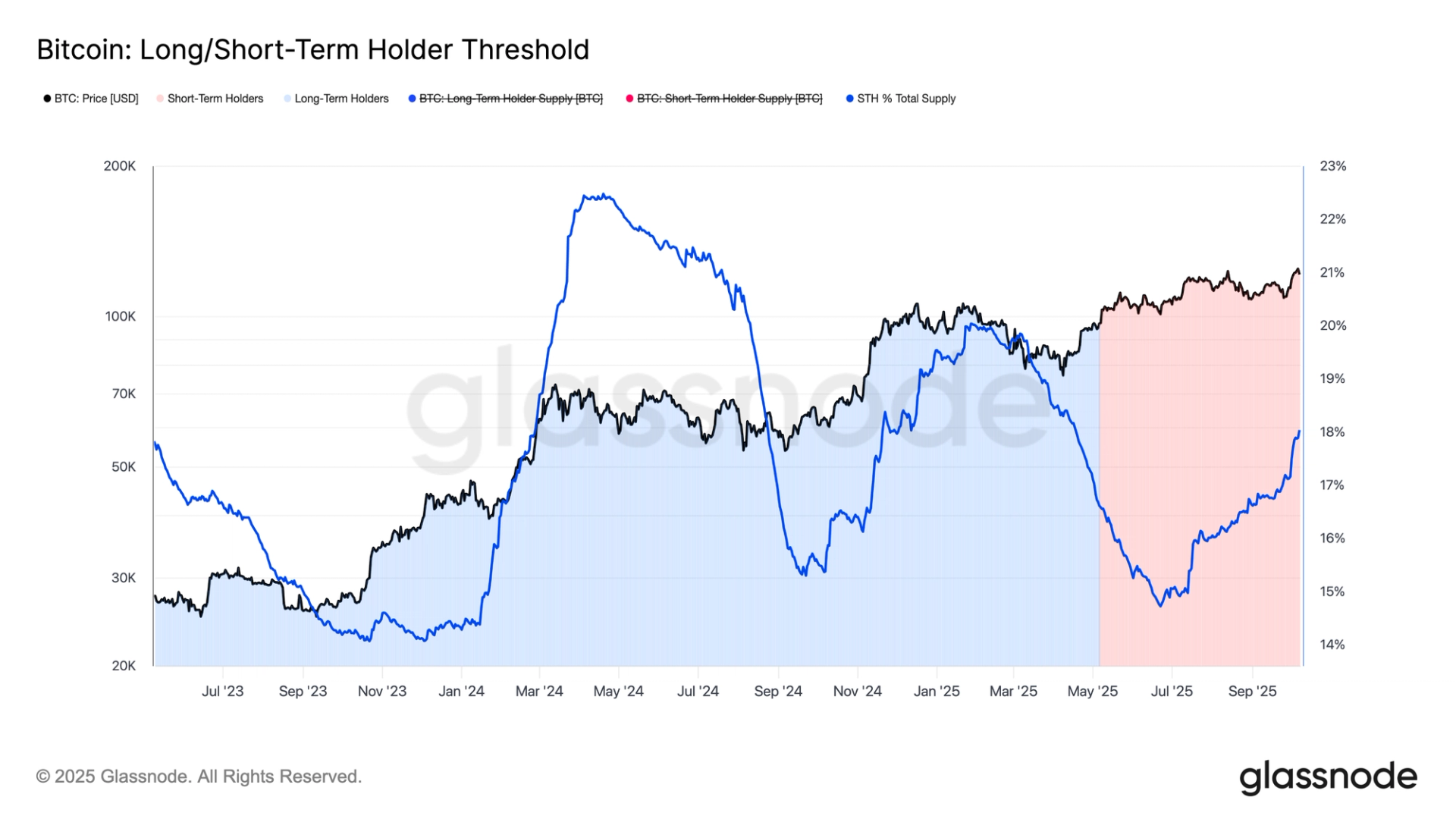

Short -term holders hold 18% of BTC supply, data suggests that euphoria is not close

Short -term holders (STH) have added nearly 450,000 BTC to their supply since July, holding 2.6 million BTC according to Glassnode data.

STHs have been defined as investors who have bought Bitcoin within the past 155 days.

This increase has marked the third unique cycle of increasing STH activity since the beginning of 2024 and usually marks a local top at the Bitcoin price.

The first peak occurred in April 2024, shortly after the entire Bitcoin hour march of $ 73,000.

The second peak arrived in January 2025, aligned at $ 110,000 throughout the time, and the latest to this day, the The third peak followed A new note of $ 126,000.

Each subsequent cycle saw a smaller sth cohort, suggesting that the general market of euphoria and speculation -awareness gradually diminished.

Throughout these three peaks, STH’s supply as a part of the total circulating -shifted supply refused from 22%to 20%, and is now sitting at about 18%, according to glassnode data.

Earlier in Q1 2025, the STHS held nearly 2.8 million BTCs, but their supply fell around 2.1 million BTC as Bitcoin refused $ 76,000. This indicates that STHs are a major pressure sales driver seen in April.

In contrast, long-term holders (the opposite of STHs) began to reduce their position during the summer months, sharing nearly 250,000 BTCs since July as combined with Bitcoin, holding 14.5 million BTC.

As Bitcoin enters the strongest quarter period, the hope is that the STH supply will continue to increase and produce new cycle highs to more than 3 million BTCs.