Slides 6% while Bitcoin’s falling falls of bullish feelings

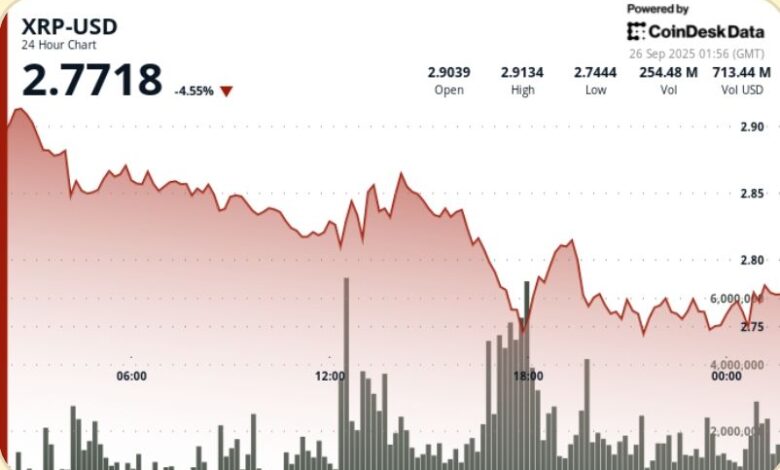

The XRP pushing above $ 2.90 collapsed under heavy sales on September 25, with a $ 277 million volume of spike hammering prices back to $ 2.75.

The move was removed by more than $ 18 billion in market value over the past week and confirmed fresh resistance to $ 2.80, leaving entrepreneurs whipping for a $ 2.70 support test.

News background

• XRP slips 5.83% in Sept. 25-26, which fell from $ 2.92 to $ 2.75 on heavy institutional sales.

• A sharp decline of $ 2.80 in 17:00 hours triggers a 276.77 million spike quantities-more than 2.5x the 24-hour average.

• Despite the SEC approved the first US XRP ETF, the optimization has been the offering of Powell’s warnings on the values and increases of the ark yield.

• Last week, the XRP market value contracted $ 18.94 billion, down 10.22%, which dropped below the $ 3.00 psychological threshold.

Summary of price action

Exchanged by XRP between $ 2.92 and $ 2.74 – a 6.3% intraday range – before closing near $ 2.75.

• Sellers rule after $ 2.80 decline in extreme quantities, creating a zone distribution that has been trapped yet.

• Subsequent recovery attempts were stuck around $ 2.81- $ 2.82, proving fresh resistance clusters.

• The last time saw a short 1.09% bounce from $ 2.75 to $ 2.78, driven by concentrated flow between 00: 50-00: 57 to volumes of more than 3 million per candle.

• Short-term support is now seen at $ 2.75- $ 2.77, with the risk of downside to $ 2.70 if violated.

Technical analysis

• Range: $ 0.18 (6.3%) between $ 2.92 high and $ 2.74 low.

• Resistance: $ 2.80 initial decline; $ 2.81– $ 2.82 cluster generated in failed retests.

• Support: $ 2.75 zone defended in a late session; $ 2.70 psychological level to the next watch.

• Volume: 276.77m at 17:00 compared to 108.42m daily average.

• Pattern: the distribution of high -volume decline signals. Short-term integration near $ 2.77 suggests unconsciousness before the next move.

What do entrepreneurs watch

• If $ 2.75 holds the Asian session or breaks to $ 2.70.

• ETF optimism compared to the true ground-the-news pattern of money-the-news pattern remains played.

• The whale flows after $ 800m in last week’s shift; The risk of positioning if selling resumes.

• Macro Overhang: Powell’s Hawkish tone, said the climbing ark, feeding the expected expected.