Sol is hovering near $ 154 after the support is interrupted, with the qualifiers rising

Solana (SOL) is still under pressure as a counter -economy – especially the fears of renewable tariffs – the investor’s confidence in the death of death.

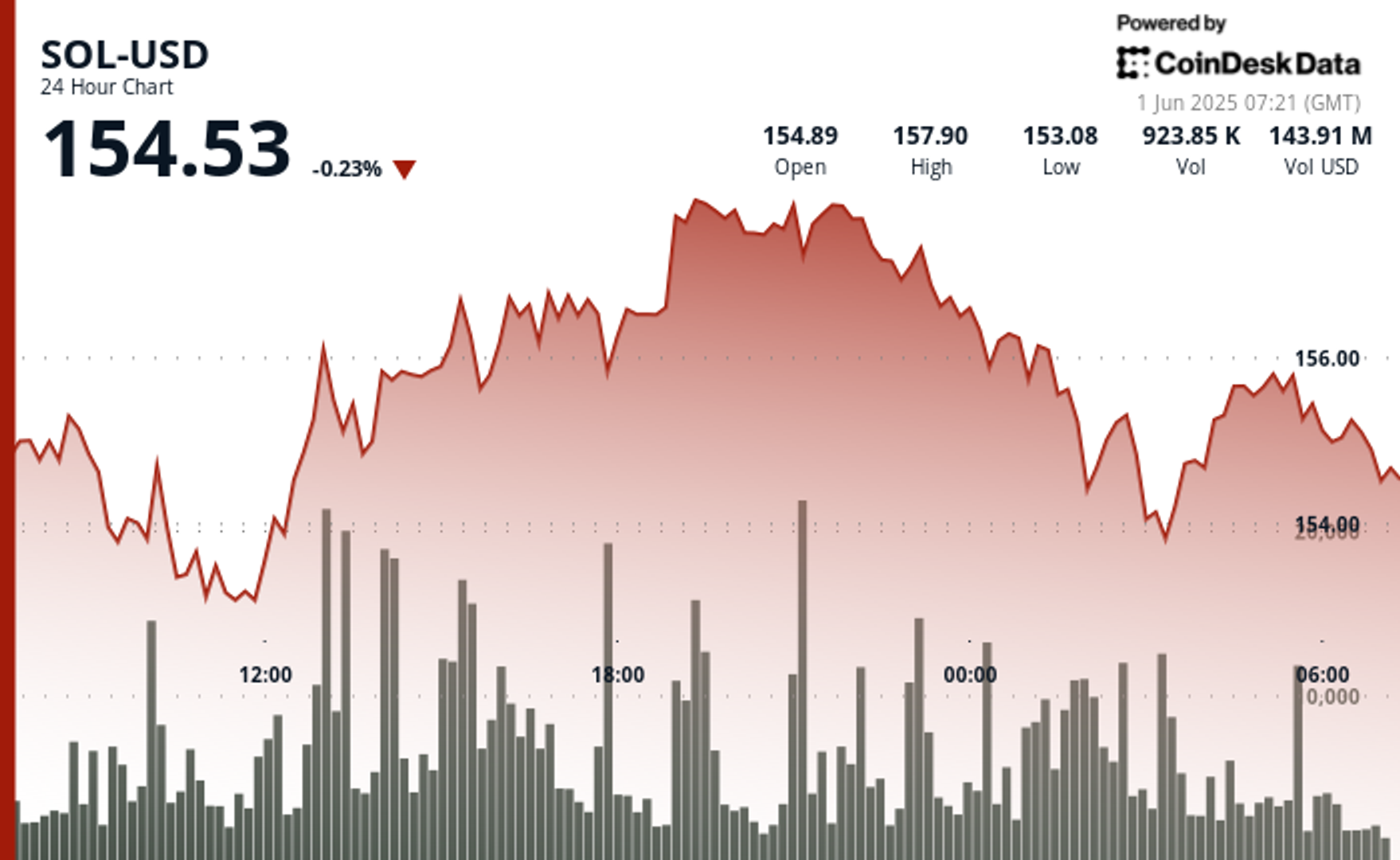

The distinctive symbol now hovers about $ 154.50 after creating a narrow trading range between $ 152.33 and $ 158.06, which reflects the 3.76 % oscillating swing over the past 24 hours, according to the technical analysis data form of Coindesk Research.

Although the upper depression had previously proposed flexibility, Seoul fell from $ 156.74 to 154.86 dollars in one hour, breaking under the decline channel in mid -April.

Details of the derivatives reflect the Haboodi feelings: The open interest in Sol Futures decreased by 2.47 % to $ 7.19 billion, while the long qualifiers increased to $ 30.97 million, indicating pressure on the positions learned. The short mattress is still minimal, which enhances negative bias.

However, the institutional interest is still clear. The last mint, which costs $ 250 million, added to Solana liquidity and has proven the STABLECOIN leadership of the series, where 34 % of all Stablecoin size has now been directed. In addition, the signals of the audit fund, which cost one billion dollars in SOL, were a billion dollar confidence in the ability to expand the protocol, even with short -term price procedures stumbled.

It highlights technical analysis

- Sol created 5.73 points (152.33 dollars-158.06 dollars), indicating 3.76 % of the swing inside the day.

- The previous price procedure follows a clear upward channel with strong support near $ 152.80, with support from heavy accumulation. Sol reached a higher session of $ 158.06 at 19:00 at a strong size, indicating a previous rise.

- A reflection was revealed in the early morning hours, as Sol fell from 156.74 dollars to $ 154.86 to increase the sale. Its peak was between 01: 53-01: 54, with more than 74,000 units trading in a sharp explosion.

- The short -term momentum turned into a declining as it has set its highest levels and the weakest final trading volume. In writing, Sol is combined near $ 154.50, indicating price stability but with the risks of the downside if the size does not improve.

publish_date