SOL token can see almost 6% price swing as whales dump coins leading to US NFP release

Solana’s Sol The token prepared for a potential price swing by about 6% after several large investors, or whales, discarded their holdings in advance of the US Non-Farm Payroll (NFP) report on Friday.

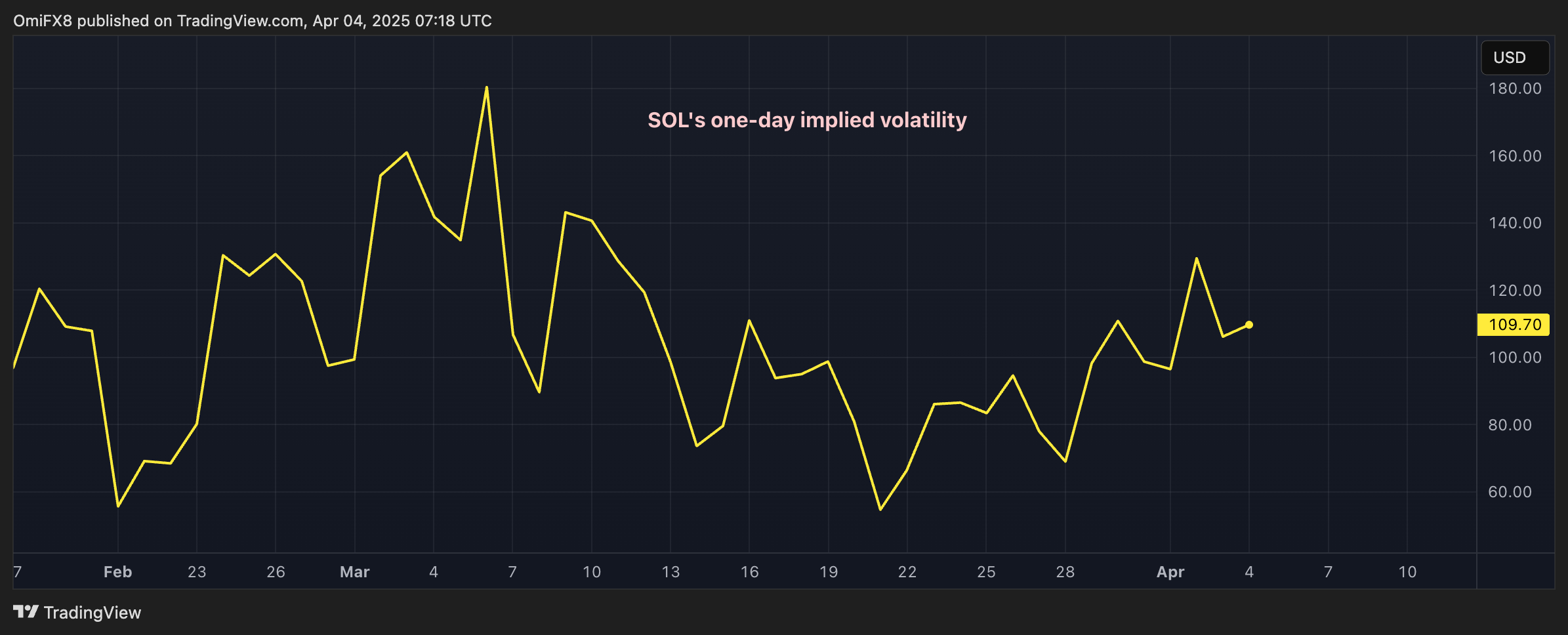

This estimate came from a day indicated Volatility Index (IV) for Sol. At the time of the press, the index showed a one -day reading annual to 109.70%, indicating an expected 24 -hour price volatility of 5.74%. (The sun -sun figure is derived by dividing the annual volatility of the square root of 365, the number of days of trading a year.)

A size movement represents moderate volatility, especially considering that cryptocurrency has experienced several days by 6% or higher volatility since early March, according to data from CoinDesk.

In other words, the market is likely to be a change of mind, but nothing in common.

Selling whale

The data tracked by Blockchain Sleuth Lookonchain Shows a lot of whales that are unchanged and dumped Sol worth $ 46.3 million in the market.

The huge offload of coins through whales often leads to price action. However, the value sold early today equals 0.97% of the 24 -hour cryptocurrency trading volume of $ 4.7 billion.

Thus, it is not surprising that the SOL traded a little changed around $ 116, printed at a low $ 112 on Thursday. Extensive speaking, cryptocurrency has been in a downtrend since reaching a high $ 295 on January 19.

Focus on payrolls

US jobs in the US, which are set to be released at 12:30 GMT, are expected to disclose that the economy added 130,000 jobs in March, slowing from 151,000 of February and less than 12-month average of 162,300, According to the factset.

The median estimate for the unemployed rate for March is 4.2%, the highest since November and up to 4.1% February reading. The average hourly income is expected to rise 0.3% month-to-month, matching February speed.

A weak-vowed figure is likely to verify the updated pricing for four 25-base-point interest rates this year, which potentially sends risk properties, including cryptocurrencies, higher.