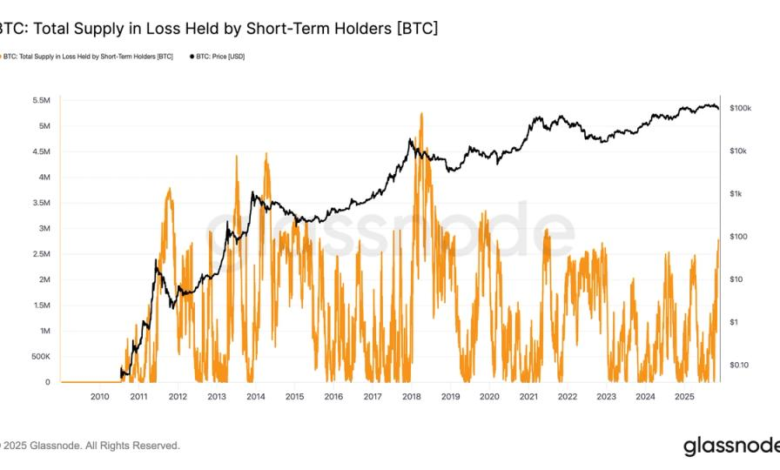

BTC supply at a loss held by short-term holders at highest level since FTX collapse

Short-term holders (STH) are almost completely underwater on their recent bitcoin purchases. Glassnode defines STHs as entities that hold Bitcoin for less than 155 days.

On June 15 (155 days ago), Bitcoin was trading at $104,000, which means that almost all the coins gained since then have sat above those levels.

Glassnode data shows that 2.8 million BTC held by STHs are missing, the highest level since the FTX crash in November 2022, when Bitcoin traded near $15,000 per coin.

Bitcoin is now down nearly 25% from its October all-time high, which is well within the typical 20% to 30% range for bull market corrections. In contrast to sths, Long Term Holder (Lths) continues to distribute. Glassnode data shows that LTH supply fell from 14,755,530 BTC in July to 14,302,998 BTC on November 16, a decrease of 452,532 BTC.

“Many holders have chosen to sell in 2025 after many years of accumulation,” said Bitcoin OG and senior board director Nicholas Gregory.

“These sales are mostly lifestyle driven rather than motivated by negative asset views, and that the launch of US ETFs and a target price of $100,000 create an attractive and highly liquid window to sell.”

This fall in Bitcoin has created a notable divergence in the US Spot Bitcoin Exchange Traded Funds (ETF) which has shown amazing resilience. US ETF assets under management (AUM) remain near their all-time highs when measured in BTC terms. Current AUM stands at 1.33 million BTC compared to a peak of 1.38 million BTC on October 10 A 3.6% decrease, according to checkonchain.

Measuring AUM in BTC instead of dollars will avoid distortions from price volatility. This divergence suggests that the recent price decline was not primarily driven by ETF inflows but by longer-term holders.