Solana (SOL) decreases by 8 % before the launch

Solana

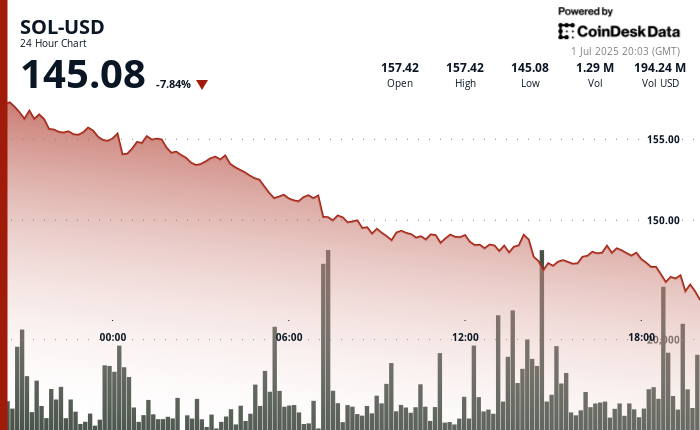

7.84 % has decreased over the past 24 hours, trading at $ 145.08 from 20:03 UTC on July 1, 2025, according to the technical analysis model of Coindsk Research; During the same period, the broader encryption market, as it indexed by Coindesk 20 {{cd20}Only 0.24 % decreased.

Just one Sol drop comes from a major landmark of the ecosystem: ETF Rex-AOSPREY SOL + Staking.

He was appointed to the first appearance on July 2, 2025, Rex-ASPrey Sol + Stoke Etf (Ticker: SSK) It is the first traded box on the United States Stock Exchange offering direct exposure to Solana’s original symbol while providing access to bonuses. Unlike the traditional ETF Crypto that only follows the price, this box enables its owners to benefit negatively from the Solana’s Proof-Stake reward system.

Nearly 80 % of ETF assets will be allocated to Sol, with approximately 50 % of these symbols that are actively distinctive. The fund was regulated by the 1940 Investment Company Law, a framework that is generally seen as more organizationally appropriate than the 1933 law. The 1940 law structure may improve investor protection and accelerate approvals, which may affect a broader institutional participation.

Analysts say this launch is a major step for Solana’s credibility between American financial institutions. By combining the generation of the return directly into the ETF, it provides more comprehensive exposure to the assets of topical tracking boxes. Some market participants believe that it can serve as a long -term incentive, especially such as other companies including gray, vanwy and BitWise applications to follow similar ETF applications.

However, despite the launch of the suspended ETF, Sol witnessed the pressure on Monday, which confirms the cautious market position before the event.

It highlights technical analysis

- Sol has decreased $ 12.34 over the past 24 hours, has decreased from 157.42 dollars to $ 145.08 – a loss of 7.84 % with the price range of $ 12.34.

- A strong resistance was faced at $ 157.42 during the first hour of the analysis window, followed by a fixed sale pressure throughout the session.

- The largest number of volumes occurred during 06:00 UAE time, exceeding 1.57 million units, with price rejection near $ 151.50.

- Upport appeared at $ 146.55 at 14:00 UTC, and also coincided with a high size, indicating the benefit of accumulation around this level.

- In the last hour of the analysis window from 19:01 to 20:00 UAE, Sol decreased from 146.31 dollars to $ 145.08, to the lowest price per day.

- The price of the price formed a well -defined convergence channel, characterized by its highest levels and low declines during the entire trading period.

Slip: Parts of this article were created with the help of artificial intelligence tools and reviewed by our editorial team to ensure accuracy and commitment Our standards. For more information, see Coindsk Full Policy Artificial Intelligence.

publish_date