Solana (Sol) drops 8% as the Middle East rivalry intensifies, the crypto sell-off driving

Solana (Sol)

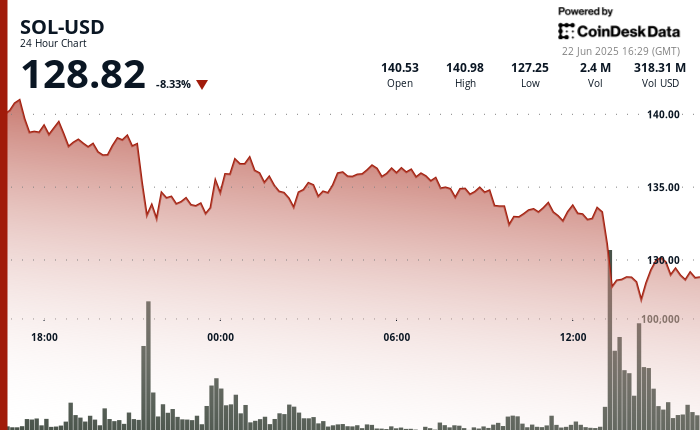

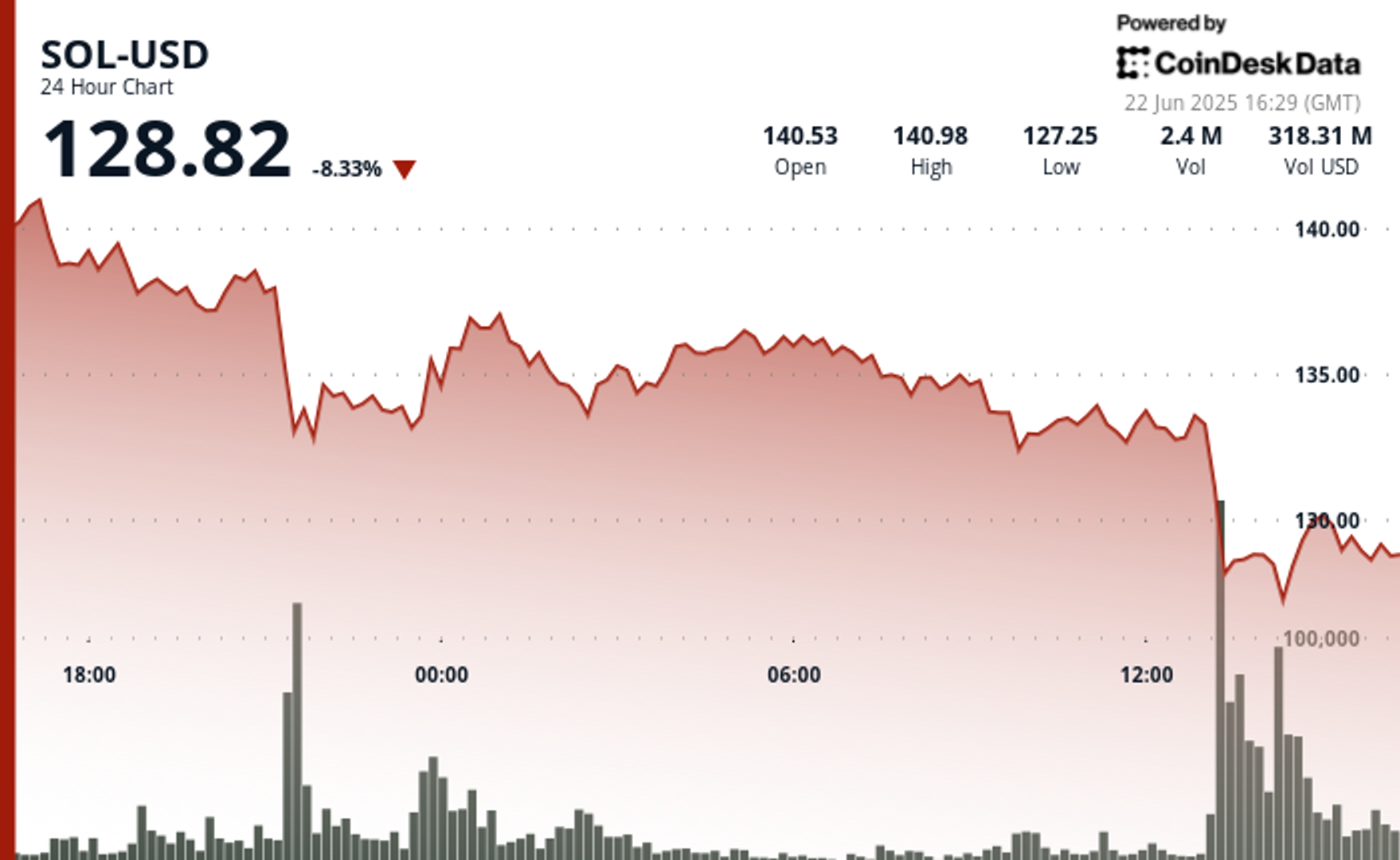

was the trading at $ 128.82, down by 8.33% in the past 24 hours, after a steep intraday correction linked to the increase of geopolitical tensions. The token dropped from $ 140.39 to $ 127.25, with a sharp -time -time decline taking place at 13:00, when the sale of spiked pressure and trading volume exceeded 4 million, according to the CoinDesk Review technical review model.

The market reaction followed the confirmed US military strike reports targeting Iran’s nuclear sites, which motivated widespread risk of risk in crypto markets.

Some entrepreneurs today remember that a closing of the Strait of Hormuz, even temporarily, could send oil prices to sink. That is likely to stoke inflation, reduce the odds of the close term reduction in the Fed rate, and extend the risk-off environment that hurts crypto markets. A direct waterway attack may intensify sales in altcoins, as Bitcoin’s dominance is historically rising in times of geopolitical disturbance.

Sol’s denial was also marked with a break below the basic technical levels, including a 200-day simple moving average near $ 149.54. Throughout the session, the SOL is printed by lower highs and struggles to maintain rebounds, pointing to the weakening of the market structure. In high volumes with red candles and technical indicators glistening bearish, entrepreneurs are now watching a $ 120- $ 125 zone as a potential support area.

Technical assessments

- Sol dropped by 8.1% from $ 140.39 to $ 129.02 at the time of review, forming a $ 11.37 decline.

- The broadest session price range is stretched from $ 141.14 to $ 126.85, a 10.2% intraday swing.

- The biggest time -a -day collapse took place at 13:00, with a price falling from $ 133.58 to $ 128.82 to 4.03m volume.

- A descending channel built throughout the session, with lower highs and lower lows confirming the bearish structure.

- The main resistance generated at $ 133.80, trapped by many rebound attempts.

- The initial support appeared at $ 127.43, while a new intraday floor was formed at $ 128.90.

- From 15:25 to 15:27, a volume of spikes pushed the price below $ 129.30 at the time of continuing sale.

- Late-session movements showed sol trading between $ 130.42 and $ 128.85 under constant sales pressure.

- Many recovery attempts near $ 130.05 failed as the volume increased with each decline.

- Significant supply concentration appeared near $ 130.20, strengthening bearish’s short -term momentum.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.