Why is Pepe coming down now? Price sinks 6% in the middle of the market selling-off while whales are accumulated

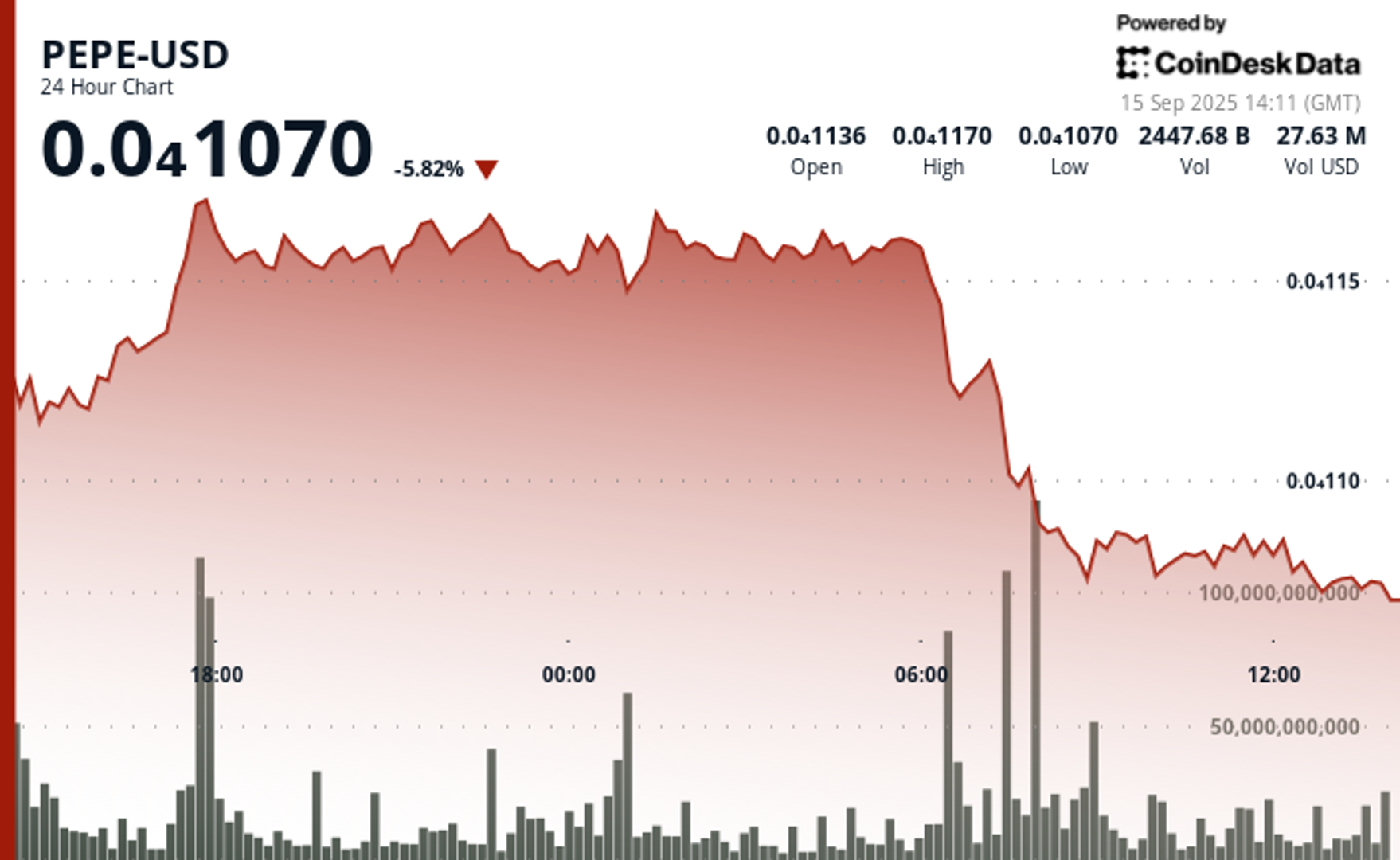

The meme-inspired cryptocurrency Pepe lost almost 6% of its value in the last 24-hour period, slipping to a $ 0.0000107 low even though large investors accumulated.

Trade volumes for cryptocurrency have advanced to the trillion of tokens in the midst of the collapse, while the token continues to not overcome to find support amid intense pressure on sale. The fall came in the middle of a broader Crypto Market drawdown, where the wider CoinDesk 20 (CD20) Lost the index of 1.8% of its value.

Memecoins are especially difficult to hit to sell-off. The CoinDesk Memecoin Index It dropped nearly 5% in the last 24 hours, while Bitcoin saw a drop of 0.8%.

Falling is just coming day After the imagination -We of the Altcoin period Growing up in cryptocurrency circles at the expected Federal Reserve interest rate later this week, which is expected to be a boon for risk ownership.

Data from Nansen It was shown that last week, the top 100 non-exchange addresses holding Pepe on the Ethereum network saw their holders growing 1.38% to 307.33 trillion tokens, while exchange wallets had a 1.45% falling in handles on 254.4 trillion tokens.

Overall -analysis of technical analysis

Pepe’s price action points to a retreat market, according to the technical review model of CoinDesk Research’s technical analysis. The token dropped from $ 0.000011484 to $ 0.000010782, with sellers leading the chart.

The price leaked to $ 0.000011732 during a resistance test, but the volume grew to 5.5 trillion tokens at that level, before the market dropped.

The support showed signs of buckling in the next stage, along with token brushing against $ 0.000010746. The trading activity intensified again, which hit 7.7 trillion tokens and strengthened the bearish sentiment.

The cryptocurrency price has fallen within a 9% intraday range, a sign that traders will remain unsure if support levels will hold.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.