Solana will lead the global tokenization, Hyperliquid the Perp Boom: Founder of Hedge Fund

Solana by Sol

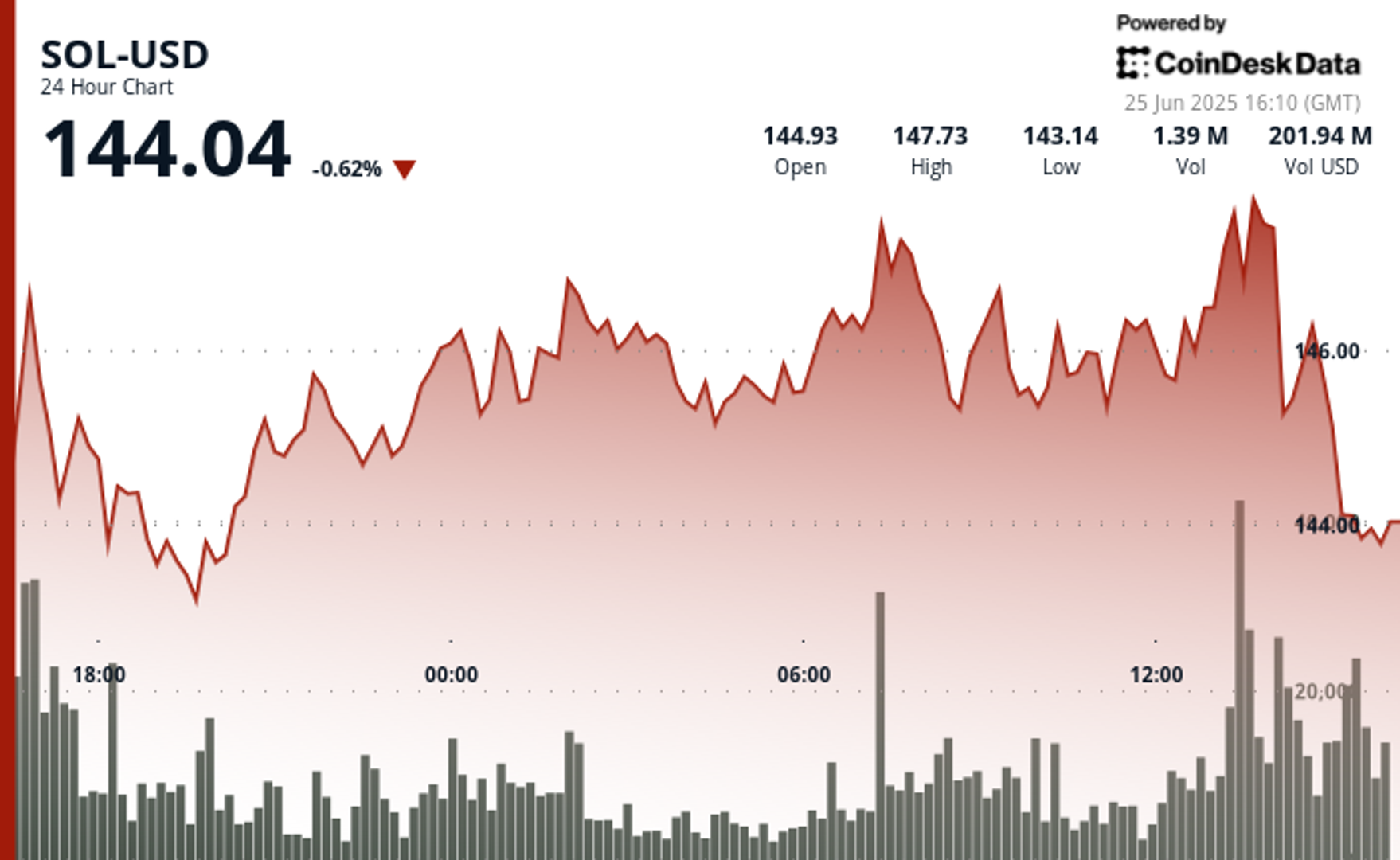

The token traded at $ 144.04, down 0.62% in the past 24 hours, after a short climb as high as $ 147.73 earlier in the session, according to the CoinDesk Research’s technical review model.

The move came in the middle of a spike in trading volume and fresh commentary from syncracy capital co-founder Ryan Watkins, who re-confirmed Solana’s long-term importance in the emerging crypto economy.

Watkins, whose firm makes concentrated, investments driven by thesis in crypto, followed A prediction he made in May. At this time, he suggested that the winner could be a $ 100 billion to $ 500 billion platform capable of reshapping capital markets.

On June 25th, in a new Post on xWatkins said Solana now appears to be set to rule out the “tokenization of all,” while Hyperliquid is positioned to dominate the endless space in futures. Comments reinforce market narratives around Solana’s potential to support the next wave of blockchain -based financial infrastructure.

The institution’s interest in Solana continues to rise, with the amount of CME futures for Sol recently hitting a record with a high 1.75 million contracts. Observers have taken it to the market as a sign of deepening the relationship from sophisticated investors even as the price action cools down from the recent highs. Current SOL support levels and structural strength draw attention in advance of potential retests of $ 148- $ 150 range.

Technical assessments

- Sol exchanged with a 24 -hour range of $ 4.96 (3.47%) from $ 145.09 to $ 147.45.

- The support was established at $ 143.02, with a resistance encountered at $ 147.98.

- Between 13:06 and 14:05 UTC, the price rose from $ 146.27 to $ 147.31, a 0.71% gain.

- The session high of $ 147.98 was recorded between 13:43 and 13:46 in strong quantities.

- A resistance band generated between $ 147.90 and $ 148.00, while the support was held at $ 146.70.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.