Staking protocol solv unveils first Shariah-Following BTC Ani offers to the Middle East

The bitcoin staking protocol solv, which has More than $ 2 billion worth of BTC Locked on its platform, Tuesday announced the launch of a product following Shariah called SolvBTC.Core.

The new offer, a liquid staking token for BTC, was developed in collaboration with the main ecosystem, which offers a set of defi applications, including lending, restoration, liquid staking and decentralized exchanges.

Created using the guide from Mahay Finance and being credited by Amanie Advisors for compliance with Shariah, SolvBTC.Core develops yield by securing the main blockchain network and engaged in on-chain DEFI activities while complying with financial principles in Islam in Islam.

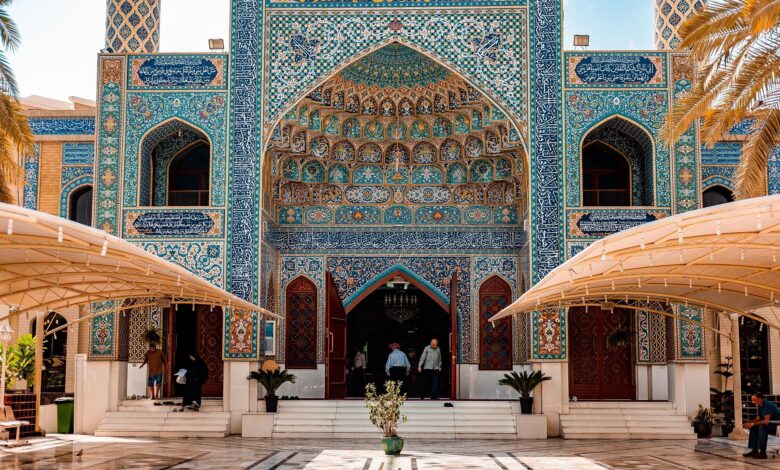

The Solv Protocol allows BTC holders to lend, stake, earn produce, and invest, to unlock the full potential of their stash. The launch of Shariah following SolvBTC.Core means that BTC holders from the Middle East can now directly participate in the expansion of the core blockchain ecosystem to produce additional yield at the top of their holdings.

Ryon Chow, founder of the Solv Protocol, said the product following Shariah could open new ways for institutional investors in the Middle East.

“By aligning both regulations in the region and global financial standards, SolvBTC.Core provides a way for sovereign wealth funds and traditional financial institutions to safely and confidently bet on Bitcoin and earn real, on-chain yield. This is a significant step in accelerating the institution by Chow in a statement shared with CoinDesk.

Shaqir Hashim, primarily contributing to Nahay Finance, said the BTC is the most widely held in markets such as Saudi Arabia, the UAE, Pakistan, Nigeria, Indonesia, and Malaysia, and the next object holders are looking for a further yield.

“The next chapter is harvested. In Mang Finance, we help the power that evolution through ethical enabling, techniques aligned with Bitcoin techniques that meet the expectations of compliance with both institutions and communities in these regions,” Hashim said.