Star thieves acquire 3 % before the network’s infrastructure repair

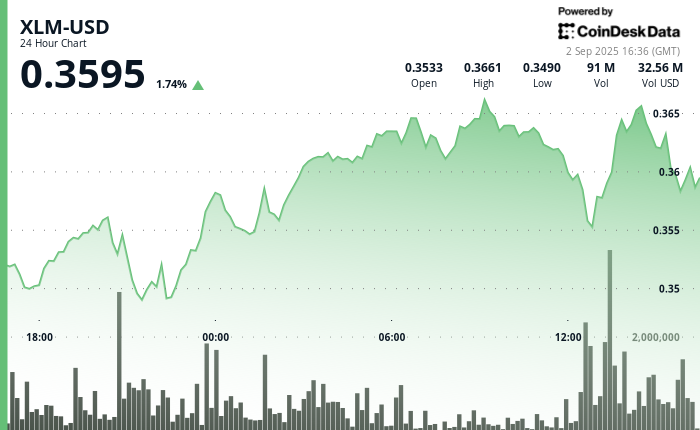

Star tomants (Xlm) Its latter has extended over the past 24 hours, as it increased by 3 %, as buyers absorbed the high pressure pressure and pushing the distinctive symbol to new resistance levels. Between September 1 at 15:00 UTC and September 2 at 14:00 UAE, XLM offers from $ 0.36 to $ 0.36, with 5 % fluctuations, which confirms active participation.

The original found support at 0.35 dollars after a short wave of sale before unifying in a range of $ 0.36. The resistance appeared about $ 0.37, as the market witnessed two points of refusal, although trading volumes are higher than the daily average of 31.2 million symbols indicating a sustainable institutional interest.

The bullish structure was implemented in the last hour of the session, when XLM gained 2 % from $ 0.36 to $ 0.37. This step was strengthened by an increase in the volume of 2.7 million units at 14:00 UAE time, allowing the distinctive symbol of penetrating $ 0.37 before settling over $ 0.36. The penetration strengthened the 24 -hour trend and the buyers suggested building a basis for more upward trend if the momentum continues.

Meanwhile, the South Korean stock exchanges and Upbit said they would hang XLM deposits and withdraw them from September 3 at 09:00 UTC. This step is part of the preparations to upgrade Stellar 23, which aims to update the network’s infrastructure and expand the inter -operating process.

The protocol 23 has been framing as a step towards expanding the interest of stars for assets in the real world, including approximately $ 460 million already revolving on the network. The price gains synchronize with network improvements highlighting an increasing narration of the institution’s adoption.

Note the technical analysis model for Coindsk Data that monotheism is above $ 0.36, as well as a systematic accumulation of major support levels, indicating the constant institutional locations that can pave the way for a continuous step exceeding $ 0.37.

Market analysis reveals the promotion of corporate interest

- The price set the basic support at 0.35 dollars during the high pressure pressure on September 1, 21:00.

- The strong accumulation activity has evolved between $ 0.36 -0.36 dollars after the decisive market recovery.

- Resistant parameters set at $ 0.37 -0.37 dollars, where the price faced double rejection events.

- Trading volume increases above an average of 24 hours, which is 31.20 million posts in the institutional market.

- Assets keep monotheism within the formation of the rising price channel.

- The possibility of penetration is higher than $ 0.37 on the validity of the continuous size.

- Trading momentum accelerated during 13: 35-13: 46 sessions with decisive upward movement.

- The improved support structure was set about $ 0.36 -0.36 dollars price levels.

Slip: Parts of this article were created with the help of artificial intelligence tools and reviewed by our editorial team to ensure accuracy and commitment Our standards. For more information, see Coindsk Full Policy Artificial Intelligence.

publish_date