Stellar slides of late as volatility returns beyond institutional milestone

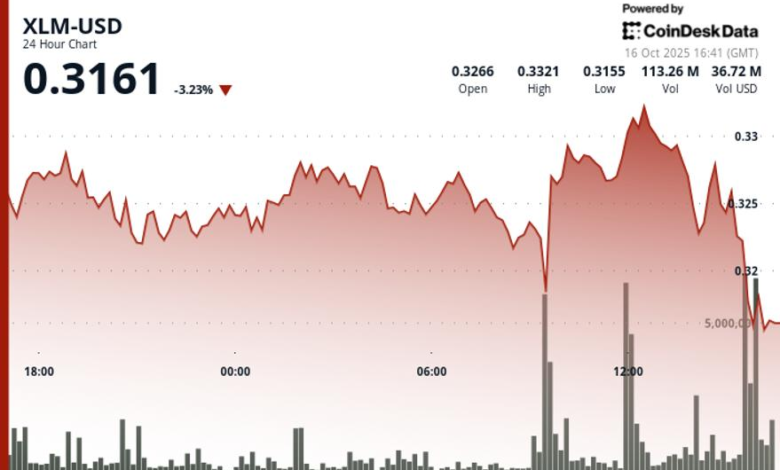

Stellar Lumens (XLM) experienced pronounced volatility during the 23-hour trading session ending October 16, moving within a 5% range between $0.32 and $0.33. After early weakness, institutional buying helped the token bounce towards midday, with volumes signaling renewed corporate participation.

Momentum faded late in the session, as XLM fell from $0.33 to just under $0.32 in late trading hours, erasing earlier gains. The decline marked a key break below established support levels, highlighting the market’s sensitivity to shifting liquidity conditions.

Institutionally, the Stellar ecosystem advanced as Wisdomtree launched the first physically-backed stellar lumens ETP, which trades across the Swiss Six and Euronext exchanges. The move improves regulated exposure to XLM, underscoring growing institutional interest despite near-term volatility.

Meanwhile, competitive pressures are mounting in the digital payments space. New entrants like Digitap are using streamlined compliance models to challenge incumbents like stellar and ripple, reshaping the business blockchain payment landscape.

Market structure analysis indicates institutional activity

- Stellar has maintained trading within a $0.02 band, representing a 5% difference between the session high of $0.33 and lows of $0.32

- The cryptocurrency showed the capacity to recover following a decline to $ 0.32 at 09:00 on October 16

- The upward momentum reached peak levels at $0.33 in midday trading, supported by a large volume of 73.74 million units during the initial rebound.

- Price support is material around the $0.32 level, where consistent buying interest has emerged.

- Resistance established near $0.33, with the asset ending the period at $0.33

- Trading volume patterns indicate increased institutional interaction during critical price movements, especially a 0.97 million unit advance at 13:31-13:32

- The conclusion of the session marked by reduced volume activity, suggesting potential liquidity constraints and confirmation of a breakdown below the established support parameters

Disclaimer: Parts of this article were generated with help from AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see Coindesk’s full AI policy.