Strategy’s Michael Saylor skipped to Bitcoin Buy $ 125k

Strategy Inc. Co-founder and executive chairman Michael Saylor said the company had a massive $ 3.9 billion fair amount of fair value in its handling in Bitcoin in the third quarter of the year.

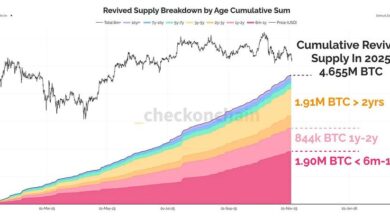

On Saturday, the Bitcoin (Btc) reached a new all-time high of $ 125,000 while the exchange balances fell to six -year lows. Saylor’s approach, a company known for adding to Bitcoin’s stockpile during new price prices, said it would skip BTC purchase this week.

In X, Saylor said that instead of a new Bitcoin purchase, the company features its returns. “There are no new orange dots this week – a $ 9 billion reminder of why we Hodl,” said Saylor, who shares a chart where orange dots represent the company’s Bitcoin purchase.

According to Saylor’s update, the company holds 640,031 BTC at an average purchase price below $ 74,000 per coin. Holders cost about $ 79 billion to week, based on the price of the Bitcoin market.

Related: Crypto Funds Smash Records with $ 5.95B flowing amidst shutdown concerns

The approach reported $ 3.9 billion to the unlucky gains in Q3

According to With the latest US Securities and Exchange Commission Filing, the approach reported $ 3.89 billion to the uncertainty of its digital assets for the third quarter of 2025, with a $ 1.12 billion deferred tax cost.

Along with the $ 5.8 billion that the approach got after the quarter cutoff, the total acquisition of the company reached more than $ 9 billion, the number that Saylor mentioned in his X post.

On September 30, the digital asset’s digital asset raised $ 73.21 billion, with related deferred tax responsibilities worth $ 7.43 billion. Updating only shows how noticeably the company’s bitcoin bet has grown in the middle of the cryptocurrency march last $ 125,000.

For many years, the executive approach lean on his reputation as Bitcoin’s Most relentless corporate buyersoften makes new purchases during or near high bitcoins.

The pausing of his purchase company has not been noticed by Crypto online entrepreneurs online.

“Do you understand that buying high is not very smart? Waiting for sinking?” an x user writeResponding to Saylor. Meanwhile, another X user Says That everyone “needs a breath” and the Saylor is no exception.

Despite the pause, the Bitcoin position of the approach remains fully profitable. According to In data from Bitcointreasuries.net, the company’s Bitcoin investment has reached 68% in general, reflecting the strength of long -term accumulation approach.

Magazine: Hong Kong is not the loophole that Chinese crypto companies think it is