SUI jumped 4% as Swiss banks extended regulated access for institutional clients

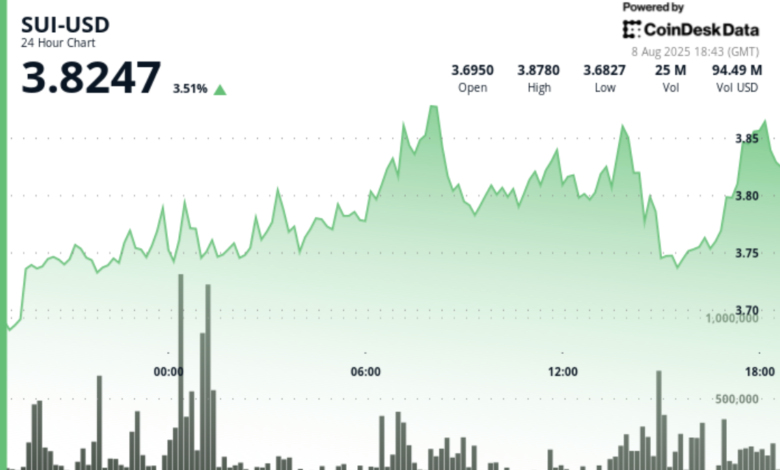

In (Sui) Price rose 4% in the past 24 hours up to $ 3.82 as Swiss Digital Asset Bank Sygnum Expanded its offerings To integrate the care, trading and lending of products tied to the blockchain for institutional clients.

Moving means regulated investors in Switzerland can now handle, trade and borrow against SUI through the Sygnum platform, expanding access to the Ecosystem of the Layer-1 Blockchain ecosystem. Bank services are aimed at professional and institutional investors looking for exposure under Swiss financial regulations.

Earlier this week, another Swiss institution, the Amina Bank, said it began to offer both trade and custodial services for SUI. Amina described the step while making it the first regulated bank in the world to support Blockchain’s native asset.

Announcements appear to have an activity market market. CoinDesk Analytics data shows the amount of trade that has emerged at 36.45 million midnight tokens, more than twice as 14.31 million sunny averages, as consumers have stepped to defend a zone support between $ 3.72 and $ 3.74. That level has been held since mid -July, suggesting short -term entrepreneurs to see it as a major price floor.

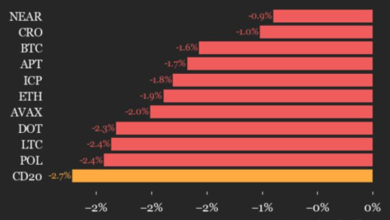

SUI -day -day gains will track near the wider crypto market, as measured by CoinDesk 20 index to climb 4.5% on the previous day. The token’s monthly performance is also positive, up to 7% in the last 30 days, but significantly lower than the wider market, with CD20 to 24%.

For institutional clients, expanding regulated access to newer blockchain projects such as SUI represents more than another trading option. This indicates the growing comfort in banks with the integration of blockchain networks beyond the largest, most established ownership. In practice, this can mean property managers, corporate treasures and high-value clients with many ways to diversify handling without leaving regulated frameworks.

The SUI, developed by Mysten Labs, aims to offer high-speed, cheap transactions using a novel data structure called “things” to improve scalability. More widespread access by banks such as Sygnum and Amina can help compete for developer’s attention and real-world applications.

If the demand for exposure to the blockchain mediated continues to grow, SUI can find itself in a stronger position to attract not only imaginary merchants but also the adoption of the business.

Divinity: The parts of this article were formed with the help from the AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk whole You have a polycy.