Blog

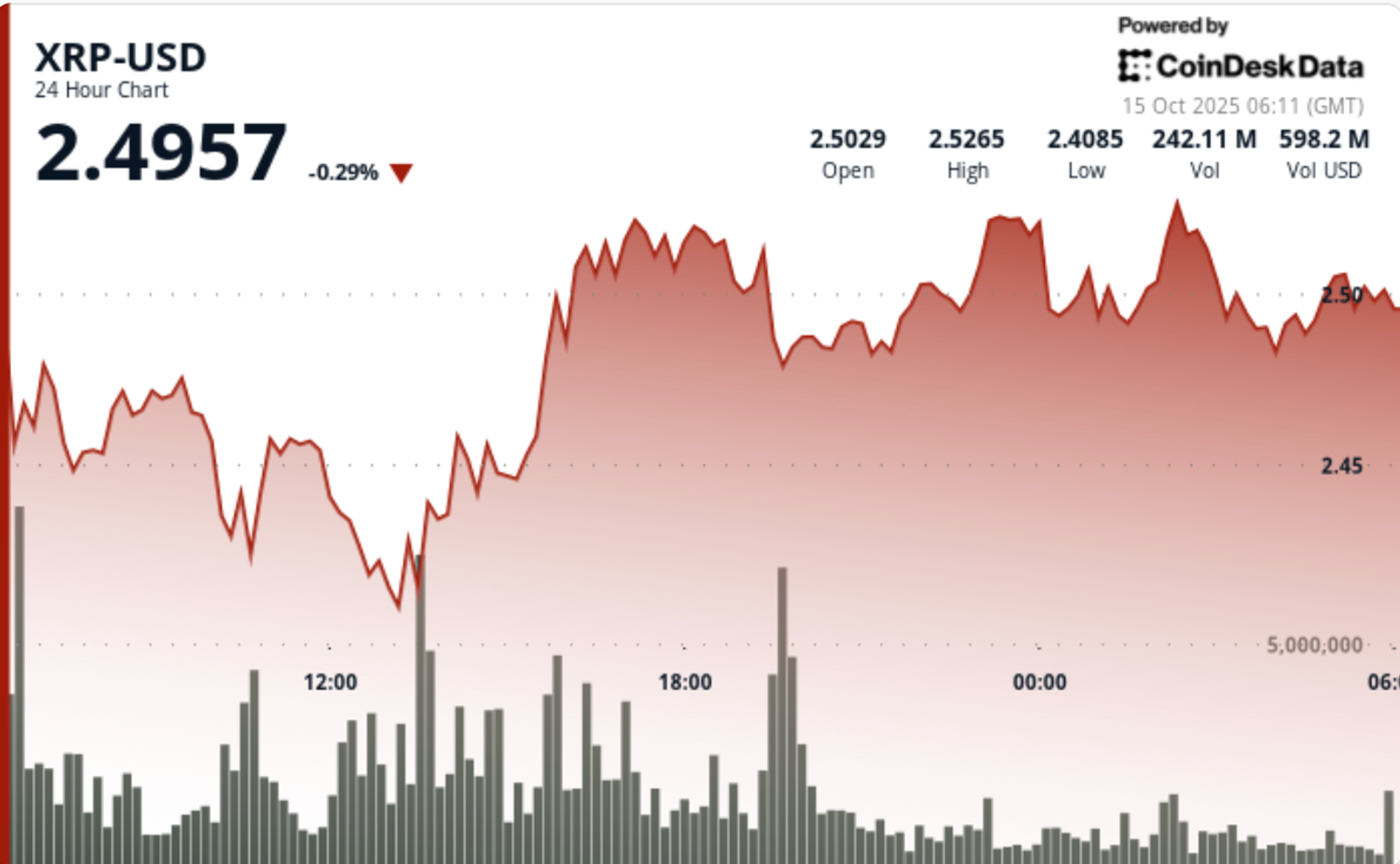

Test of $ 2.40 base after 6% swing; Eyes $ 2.65 Breakout Level

Heavy deleveraging throughout the derivatives markets dragged the XRP less before consumers defended the $ 2.40 zone, which sets a major retest support towards Asian trading.

News background

- The XRP was exchanged with the October 14-15 session as macro pressure and extensive crypto deleveraging sent open interest to 50% to $ 4.22 billion.

- Despite washing, spot volumes jump 40%, signing institutional re-entry.

- Ripple’s newly announced partnership with Immunefi – a $ 200,000 XRP Ledger Security Test running October 27 – Nov. 24-Help the anchor sentiment after an early session slide.

Summary of price action

- XRP fell 1.97%, sliding from $ 2.54 to $ 2.49 while swinging through a $ 0.16 band ($ 2.55- $ 2.39) – approximately 6% volatility of intraday.

- Consumers have repeatedly stepped to $ 2.40- $ 2.42, defending the basic support after an afternoon capitulation.

- The volume exploded at 179.4 m at 13:00, almost twice the 24 -hour average, proving accumulation of lows.

- Sellers were trapped in rebounds near $ 2.53, where constant distribution was formed by a nearby ceiling.

- The late-session trade has seen the XRP recover $ 2.50 as dip-purchases of stabilized order books.

Technical analysis

- The $ 2.40- $ 2.42 area remains a critical pivot for bulls. Multiple rebounds prove the institutional defense, but the momentum remains fragile below the $ 2.53- $ 2.55 resistance cluster.

- A long break below $ 2.40 will open the targets downside at $ 2.33 and $ 2.25, while reclaiming $ 2.53 can re-establish an advance towards the wider $ 2.65 breakout line.

- The measurement of weight volume to accumulation amid forced avoidance-a classic short-term phase of the base formation if funding is normalized.

What do entrepreneurs watch

- If $ 2.40 continues to hold on to open Asia of Monday.

- The signs of re-motivation after open interest are divided into exchanges of derivatives.

- Volume of follow-through above $ 2.50 confirming accumulation.

- Macro titles are tied to Trade-War and Fed rhetoric policy as volatility drivers.