The Bitcoin (BTC) Dominance Soars Leading FOMC as Volatility ‘Burst’ Looms

Bitcoin (BTC) held its grip on the crypto market on Tuesday, with dominance covering fresh four years as crypto entrepreneurs were rotated in the market owner of the market before the federal federal policy policy meeting.

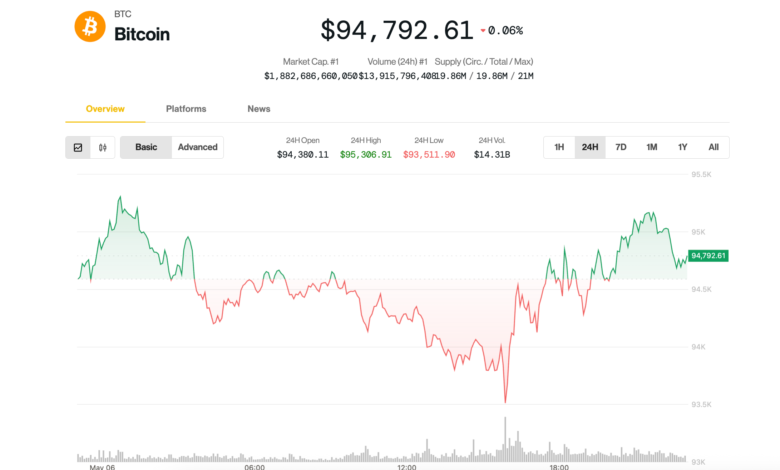

The BTC takes firmly around $ 94,000- $ 95,000 place, up to a moderate 0.4% in the past 24 hours and expanding a tight trading pattern that has continued since the weekend.

Meanwhile, the Broad-Market Cindesk 20 index slipping 0.7% lower, with Ethereum’s Ether (ETH), and SUI’s native token (SUI), Aptos (APT) and Polygon (POL) dragging the benchmark lower.

A check in traditional markets showed stocks booked back-to-back losses, including the S&P 500 and the Tech-Heavy Nasdaq closed 0.7% -0.8% down, once again unchanged at BTC.

Despite the lack of basic price action, the focus further turned to the growing part of Bitcoin of the general crypto market: the so-called Bitcoin Dominance Metric exceeded 65%, the highest reading since 2021 January, according to TradingView data, which signed capital integration with property noticed as the most resilient macroeconomic face.

Joel Kruger, a market strategist in the LMAX Group, described the current scene as one in pause and hope. “The cryptocurrency market has remained mainly from the weekly tomorrow, with prices arranging in a pattern holding while investors are waiting for an important catalyst,” he said. “This impetus may arise from the traditional markets, driven by updates on impacts related to economic effects or the Federal Reserve’s FOMC’s expected FOMC decision on May 7.”

The Federal Reserve is widely expected to hold interest rates, according to Tool of CME FedwatchBut entrepreneurs are on the edge for any transfer to the tone of Fed Chair Jerome Powell that can affect the appetite.

Bitcoin’s volatility exploded in reach -overlook

In the recent Bitcoin action of recent -only action, FOMC’s upcoming meeting “has been rigged to cause significant volatility,” said Vetle Lunde, head of research in K33. He mentioned in a Report of Tuesday BTC’s short term volatility is “abnormally compressed,” with a 7-day average decreasing to the lowest level last week in 563 days.

“Such low volatility regimes at BTC tend to be short -lived,” Lunde said. “The violent volatility of volatility usually follows this form of stability once prices begin, as leveraged trading is unchanged and entrepreneurs are re -formed in the market.”

He said a significant lower cascade is not likely, as funding rates for eternal swap are always negative. Similar periods offer great purchase opportunities for medium and long-term investors, Lunde added, favored “aggressive exposure to the area” in advance.