The BTC Market sees the sentiment shift while the $ 80k put has emerged as the most popular stakes

Do you need evidence of violent changes in sentiment in the crypto market -just? Do not look more than the derivit options market, where the $ 80,000 Bitcoin (BTC) option, which offers protection below under the said level, is now the most popular stakes.

This is an 180-degree change from early this year when calls to six-level call options get the most interesting among entrepreneurs.

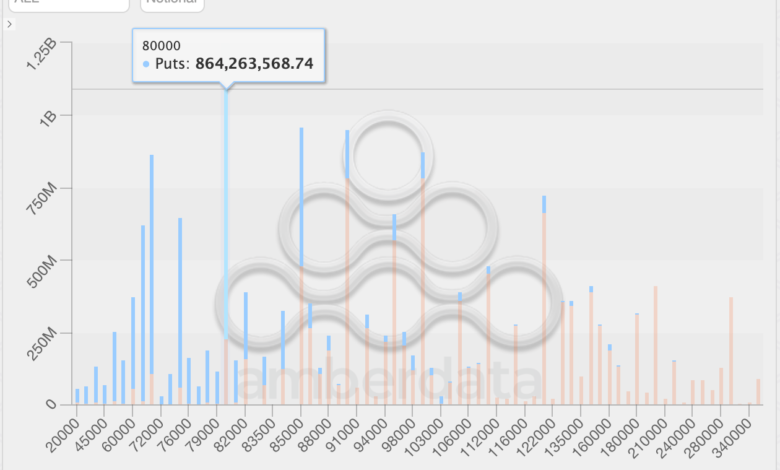

As of writing, the number of open positions in the $ 80,000 option increased 10,278 contracts, equivalent to a notional open interest of $ 864.26 million, according to Data Source AMERDATA. It makes the most popular gaming options in the derivit, where a contract represents a BTC.

It also marks a significant position transfer from early January if the call option to $ 120,000 strikes is the most popular bet with an open interest of nearly $ 1.5 billion. Last month, the $ 100,000 calls have taken the crown.

The positioning of the positioning indicates entrepreneurs to re -evaluate the reversed expectations amidst the marketplace and prolonged economic uncertainty. The BTC fell 11.66% in the first quarter, with prices slipping below $ 80,000 at some point while President Donald Trump’s tariffs were shaking on Wall Street. In addition, the failure of the lack of fresh purchases in the US strategic reserve with weight prices.

Later on Wednesday, Trump is expected to announce the removal of reward tariffs to its trade partners, which could lead to an entire trade war. With BTC entrepreneurs Chasing the downside protection.

“The BTC Volatility Smiles has moved sharply toward the OTM to be placed, reaching the levels that have not been seen since the US banking crisis in March 2023. Short-tenor volatility smile skews has been slightly recovered from their strong tilt to OTM to put,” Analytics firm said Scholes said he was told by the update of the update on the update market.