The Crypto Banking Problem in the US Will Likely Be Among the First Things Tackled Under Trump

When inauguration day rolls around in the US, the first policy domino to fall could be barriers to the banking industry, though the White House may be the wrong place to watch for the most consequential action.

The crypto industry will surely cheer loudly for some of the executive-order fireworks when President-elect Donald Trump is sworn in, which may reportedly include crypto directives, but such orders may be more smoke than fire. (President Joe Biden, after all, issued a crypto order in 2022 instructing the federal government to get a better handle on crypto.)

As the White House expresses its vision for the direction of crypto policy, concrete steps will be taken with regulatory agencies, such as the Securities and Exchange Commission and the Federal Deposit Insurance Corp. They are nominally independent regulatorsbut they will have new leadership closely aligned with Trump’s vision, even if there is a delay in confirming permanent agency heads.

At the SEC, former Commissioner Paul Atkins was on deck to accept his formal nomination to take over. But the conservative SEC veteran could be jammed in the middle of a potential bottleneck of Senate confirmations, where the most urgent appointees, such as the new Treasury secretary, would be first in line.

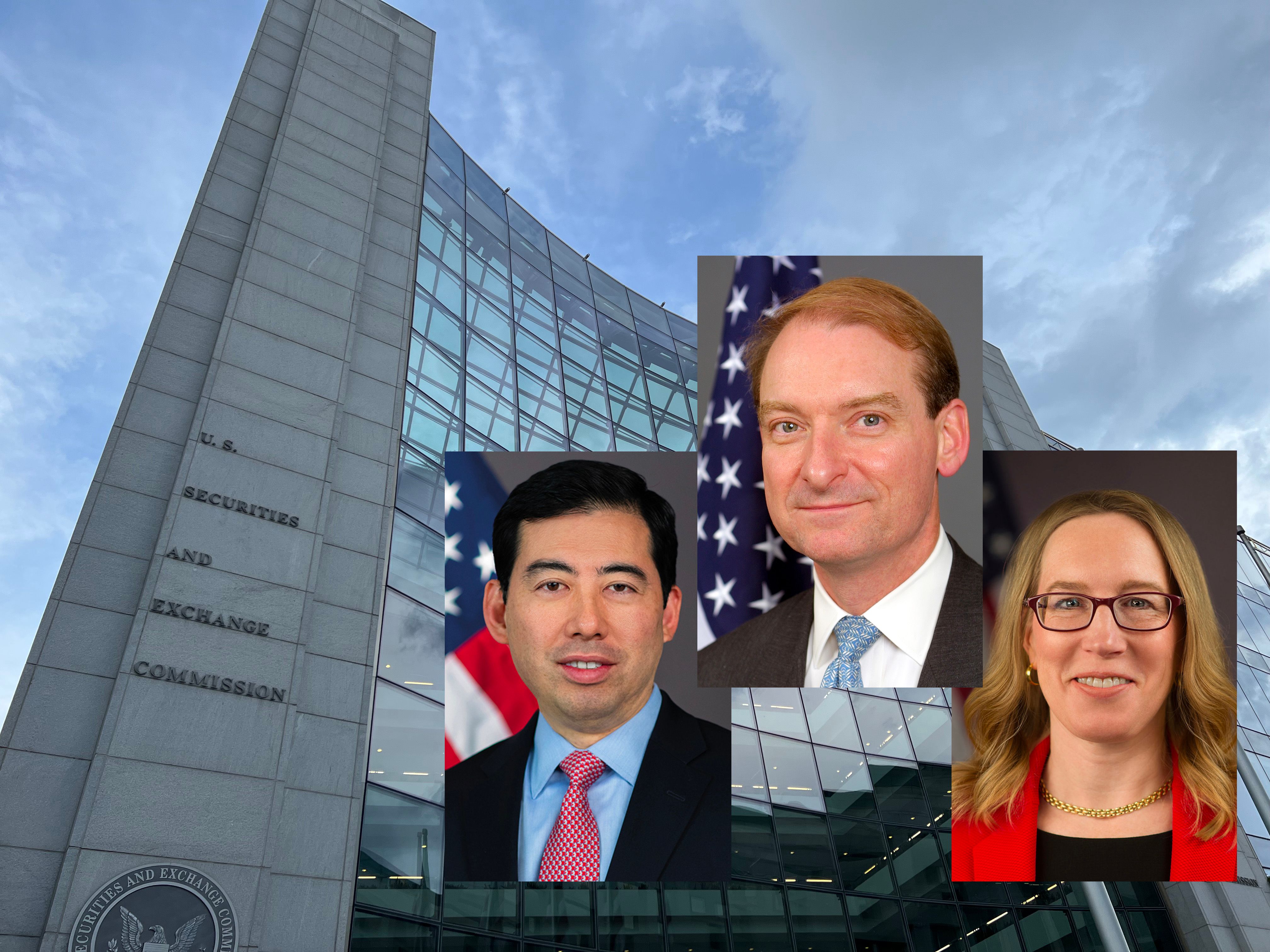

On January 21, the day after the inauguration, the commission will have just three members – two Republicans and one Democrat. Trump will be able to name one of the two sitting Republicans as acting chair, just as Biden named Allison Herren Lee to that role on January 21, 2021, at the start of his presidency. Both Republican commissioners, Mark Uyeda and Hester Peirce, once served Atkins as his advisers at the SEC, so they’re likely on the same page as him, anyway.

Some expect Commissioner Uyeda to take the nod as acting chair, and make a change immediately that will have major ramifications for crypto banking. He said he was in favor canceling the controversial Staff Accounting Bulletin No. 121 (SAB 121) effectively asking banks to treat their customers’ crypto assets as their own, accounting for the tokens on their balance sheets and taking the resulting hit to the capital they have to maintain dearly. A hypothetical Acting Chair could direct Uyeda to withdraw the bulletin, removing enforcement pressures on big banks that have been necessary to partially address crypto matters.

Commissioner Peirce too openly opposed SAB 121 from within the agency, which issued a statement that argued, “SAB does not recognize the Commission’s own role in creating the legal and regulatory risks that justify this accounting treatment.” So, if he takes over, the bulletin can be scrapped as well.

SAB 121 has been under the gun since its release, and Congress rose last year to strike it from the books in a broad, bipartisan vote to use the Congressional Review Act to overturn the SEC’s action. But President Biden bent his veto power to protect the accounting standard.

In a public statement in September, the SEC’s chief accountant, Paul Munter, held the line on SAB 121, saying his accounting staff still felt the same way that the bank’s balance sheets must “show its obligation to safeguard crypto-assets held for others.” But the agency announced Tuesday that he will be will retire next week. The overhauled agency will have a new accounting chief.

If the acting chair waits for Atkins’ arrival, the former commissioner is expected to repeal SAB 121 himself. When his name surfaced last month as Trump’s SEC pick, Representative Mike Flood, a Nebraska Republican led the House charge against in accounting standards, posted on social-media site X that he looks forward to “working with him to finish SAB 121.”

Meanwhile, US banking regulators can quickly issue orders to their squads of bank supervisors that don’t have to crack down on crypto. At the FDIC, longtime Chairman Martin Gruenberg is expected to leave the day before the inauguration. That puts Republican Vice Chairman Travis Hill at the helm, at least in an interim capacity.

“We expect Hill to advance a proposal that both clarifies that banks can engage in crypto activities and defines when regulators must first approve an activity,” said Jaret Seiberg, a financial policy analyst. at TD Cowen, in a note to clients. “It will also likely include strict deadlines for the FDIC to act.”

Last week, Hill outlined some pro-crypto policy thoughts, arguing that the agency has “stifled innovation and contributed to a public perception that the FDIC is closed for business if institutions are interested in anything related to blockchain or distributed ledger technology.” He also argued that the FDIC has instigated an inappropriate campaign to cut banking ties for crypto firms and those involved with them.

“I continue to think that a better approach would have been – and remains – for agencies to clearly and unambiguously describe for the public what activities are legally permitted and how they will be carried out in accordance with safety standards and cleanliness,” Hill said. “And if regulatory approvals are required, those must be acted upon in a timely manner, which has not been the case in recent years.”

Read more: US Banking Should Ease Path for Crypto, Republican Taking Reins on FDIC Suggests

The FDIC’s restrictions on banks’ involvement in crypto are not in the form of rules but of guidance that could be more easily overhauled. However, there are two other agencies that share the duties of regulating US banks: the Office of the Comptroller of the Currency (OCC) and the Federal Reserve.

The OCC has actually been run by an acting administrator, Michael Hsu, for more than three years. Hsu said he is waiting for a new pick to replace himas simple as the president ordering his Treasury secretary to name a “first deputy comptroller,” a designation that automatically puts that person in the acting role of comptroller under OCC rules. Trump once installed Brian Brooks in that acting duty, where Brooks — a former executive at Coinbase and other crypto companies — quickly moved to break into the banking system for crypto firms, including through a new chartering strategy.

At the Fed, the vice chairman of the board for supervision, Michael Barr, he said he would step down at the end of February. Barr was in that role when the Fed issued warnings to the banks it oversees that any crypto activity needs to be carefully run by the regulator before institutions can move forward. His departure potentially leaves an opening for a future vice chair who wants to encourage lenders to get into digital assets.

With the exit of the old guard at the SEC and the banking agencies, some of the key barriers to crypto banking have weakened.

Seiberg added a bit of Washington wisdom in his note, though: “Our caution — with a tip of the hat to Mike Tyson — is that everyone has a plan until they get punched in the face.”