The ghost of Mt. Gox will stop entertaining bitcoin this Halloween

The Mt. Gox, the defunct Tokyo-based Cryptocurrency Exchange, still holds around 34,689 Bitcoin (BTC) ahead of the payment deadline of October 31.

The exchange lost around 650,000 BTC in undetected thefts from 2011 to the fall of 2014, while about 200,000 BTC was later found in an old-form wallet. Those coins became the foundation for creditor payments overseen by court-appointed administrator Nobuaki Kobayashi.

In 2017 and 2018, Kobayashi earned the nickname “Tokyo Whale” for selling Mt. Gox Bitcoin to fund Fiat payments. In mid-2024, wallet activity resurfaced with nearly 100,000 BTC being transferred between Mt. addresses. Gox for distribution, though not all are represented by actual sales.

The payment deadline was extended by one year to give creditors more time to complete the claims procedures. With nearly $3.9 billion in Bitcoin sitting on Mt. Gox related wallets, this Halloween could re-spark concerns about possible selling pressure.

Here’s how Bitcoin movements moved Mt. Gox markets throughout bankruptcy and civil rehabilitation proceedings.

The first Mt. Gox Bitcoin Sales Dump of Tokyo

Kobayashi’s first major rotation Bitcoin sales occurred between September 2017 and March 2018, with blockchain data indicating that the largest offload occurred in Feb.

That may not sound like a significant supply shock in today’s Bitcoin economy. As of Wednesday, Bitcoin had a $2.24-trillion market capitalization, but in early February 2018, that number stood at nearly $140 billion, when Kobayashi’s sales represented about 0.26% of the total asset value.

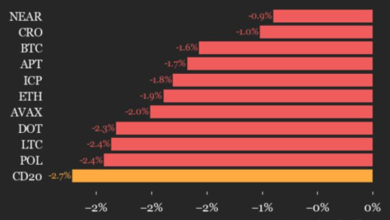

Related: $19B Crypto Market Crash: Is It Leverage, China Tariffs or Both?

The sale of Kobayashi on Feb. Bitcoin has been falling since December 2017 peak of nearly $20,000 during the Height of the initial coin offering (ICO) boom.

While Bitcoin has been struggling since the collapse of the ICO bubble, its sharp fall on February 6 closely coincided with Kobayashi’s major sell-off. Kobayashi denied that his liquid Mt. Gox went deeper in denial, but his actions Drew criticism from market observers.

Tokyo Whale stopped selling around 144,000 BTC

Following the ICO crash of early 2018, Bitcoin and the cryptocurrency industry entered what is now known as the first crypto winter, as liquidity dried up and funding slowed. Many crypto companies have had to go down or shut down.

Kobayashi didn’t help either Continuity to sell bitcoin of Mt. Gox. About 24,658 BTC were sold from April 27 to May 11, reducing the exchange’s holdings to 141,686. The first major sale on April 27 was for about 15,000 BTC. Bitcoin had a sharp fall on April 25 to 26 but rebounded on April 27 before having a small rally to the top of Q2 2018 near $10,000. Kobayashi’s second major sale on May 11 coincided again with its fall from the top.

This was the last time Kobayashi sold Mt.’s bitcoin. Gox. In June, after a creditor’s petition, the Tokyo District Court stopped the bankruptcy and opened civil rehabilitation, appointing Kobayashi as Rehabilitation Trustee. In bankruptcy, non-financial claims are converted to cash. In civil rehabilitation, bitcoin claims are illiquid, with payment set by a court-approved plan that allows distributions in BTC or Bitcoin Cash (BCH) instead of cash.

Related: Democrats Oppose US Crypto Framework; Bill stopped

With the sale of Mt. Gox table, Bitcoin held above $6,000 for most of the year until November’s Bitcoin Cash fork the market. The holdings of Mt. Gox has remained stable around 142,000 BTC during this period.

Begins Mt. Gox Bitcoin Repayment

By mid-2024, Bitcoin is in a stronger position than at the time of the Tokyo Whale, still riding the momentum of First batch of US Spot Bitcoin Exchange-traded funds. This is the center of a bull rally that will eventually send Bitcoin past $100,000 in December 2024.

In early July, Mt. Gox Wallets the Bitcoin transfer as the exchange prepares for creditor payments under the civil rehabilitation plan. The markets initially feared that the receivers would be sold immediately. Bitcoin has dropped again after Kraken, one of the exchange distribution distributions, announced this July 24 its process is complete.

Some analysts think that up to 99% of creditors can be sold as soon as they receive their share. But when the payments started, there was “no significant spike” in trading volume, according to cryptoquant founder Ki Young Ju.

On August 1, Arkham’s data revealed Mt.’s holdings. Gox has fallen by almost 100,000 BTC, leaving about 46,000 BTC still under the control of the administrator.

Mt.’s extended Bitcoin payment deadline is approaching.

On October 10, 2024, Kobayashi announced That most payments on verified credits have been completed, although many are still pending due to incomplete procedures or processing issues.

With the approval of the court, the The payment deadline has been extended From October 31, 2024, to October 31, 2025, and the administrator encouraged the remaining creditors to complete their submissions through the claim portal at Mt. Gox.

At the time of writing, Mt. Gox Wallets are still holding about 34,689 BTC worth about $3.9 billion, awaiting distribution.

In March 2025, the exchange began The transfer of assets between its walletsa likely step in preparation for additional payments before the Halloween deadline.

Magazine: Review: The Devil Takes Bitcoin, a wild history of Mt. Gox and Silk Road