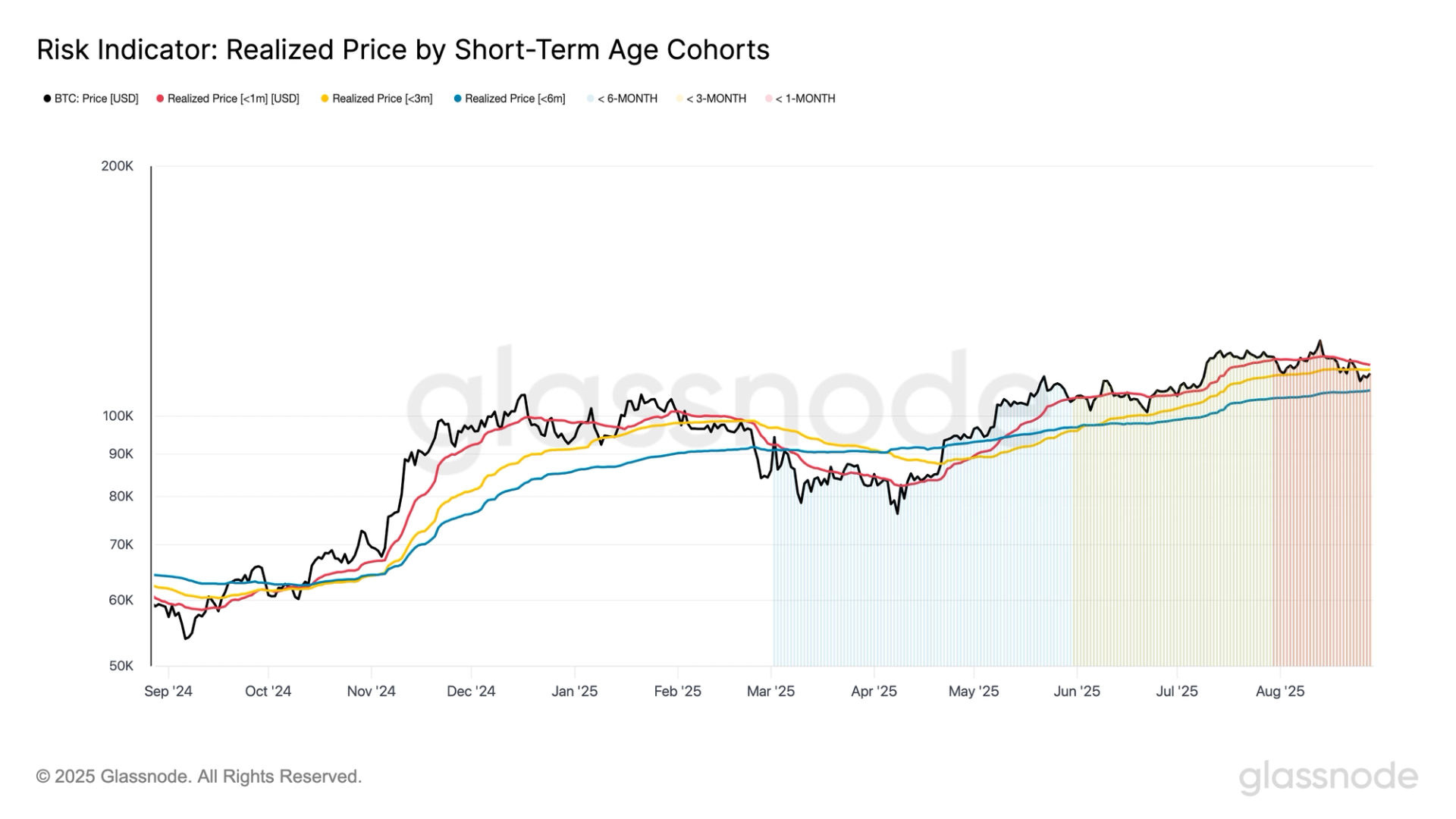

BTC faces are mounted pressure below the basic cost base

Bitcoin Stays in correction mode after reaching all times high over $ 124,500, which now walks near $ 110,000. Weekly Glassnode Newsletter Stress -mounted highlights on top consumers because the cost of investors in the last six months is under pressure.

The firm noted, “Any rally is likely to find resistance, as short -term holders are seeking to come out of Breakeven.”

The owner slipped below both 1 month and 3 months realized prices, which are currently $ 115,300 and $ 113,700. However, the 6 -month realized price, at $ 107,440, acts as a major support level.

The realized price represents the average purchase price of coins within a given time, which offers an insight into the investor positioning and feelings.

CoinDesk research It was also noted that the short term holding realized that the price was standing above $ 108,500, a level of Bitcoin had rebuilt since August 26. Meanwhile, the realized price of all 2025 consumers refused over $ 100,000, creating another important psychological threshold if the market would fall off.

This correction emphasizes the growing pressure on recent buyers and the importance of realized price levels in guiding market psychology.