The HyperLiIID’s Makeing Vault is growing at $ 250 million in two months despite Fayasco Jelly

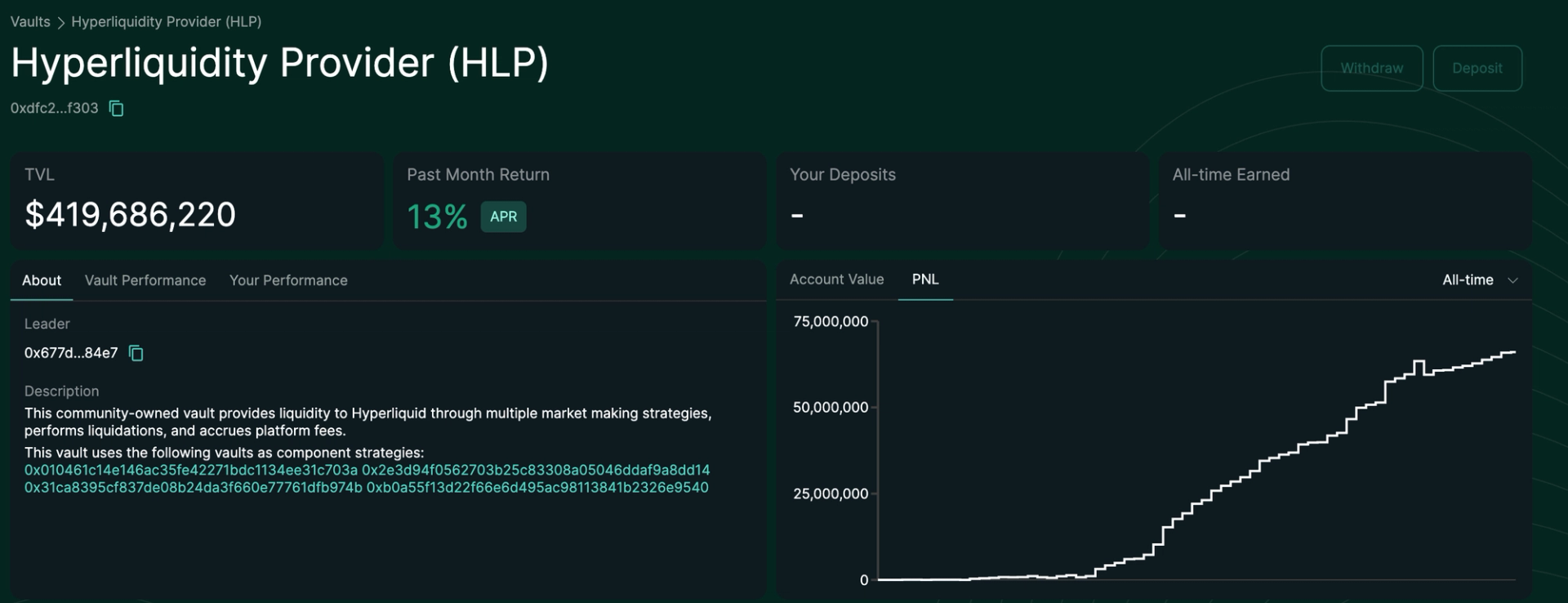

The loader of the return, which was established by the Hyperiquid for decentralized stock exchanges from $ 163 million to $ 418 million over the past two months, despite the central concerns about failure in the Jelly market in March, data from Devilia He appears.

Vauult, who was working as an internal market maker and giving depositors back, was underwater by $ 13.5 million after the user tackled the price of gel index in March.

The liquid reduced these losses by by force the Gili market by force, and settled it at $ 0.0095 for $ 0.50 that were fed to the oacles via decentralized stock exchanges.

This led to the immigration of the capital from the Hyperleliquid platform, the total closed value (TVL) decreased from $ 510 million to $ 150 million, while the noise code suffered by 20 %.

But everything was partially forgotten due to the appearance of James Win, a derivative derivative merchant and It lost 100 million dollars At the height of the liquid per week. His public deals and his suspension were born from the upscale feelings about excessive liquid, as the platform was able to deal with the nine numbers positions in terms of liquidity and slipping.

During that period, TVL increased along with the noise, which has now increased by 72 % in PAT 30 days.

Liquid cellar is currently Return 13.42 % From the annual interest, he beat the various recovery protocols that are offered About 9.1 %.

publish_date