Blog

The idea of XRP: RSI neutral and a symmetrical triangle supports $ 3.30

News background

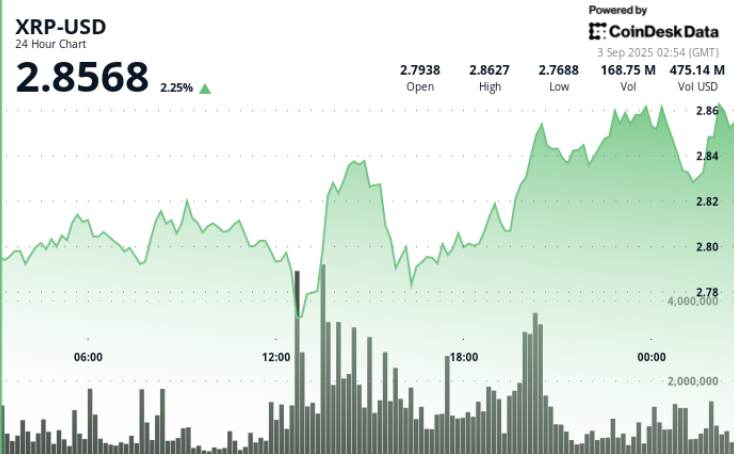

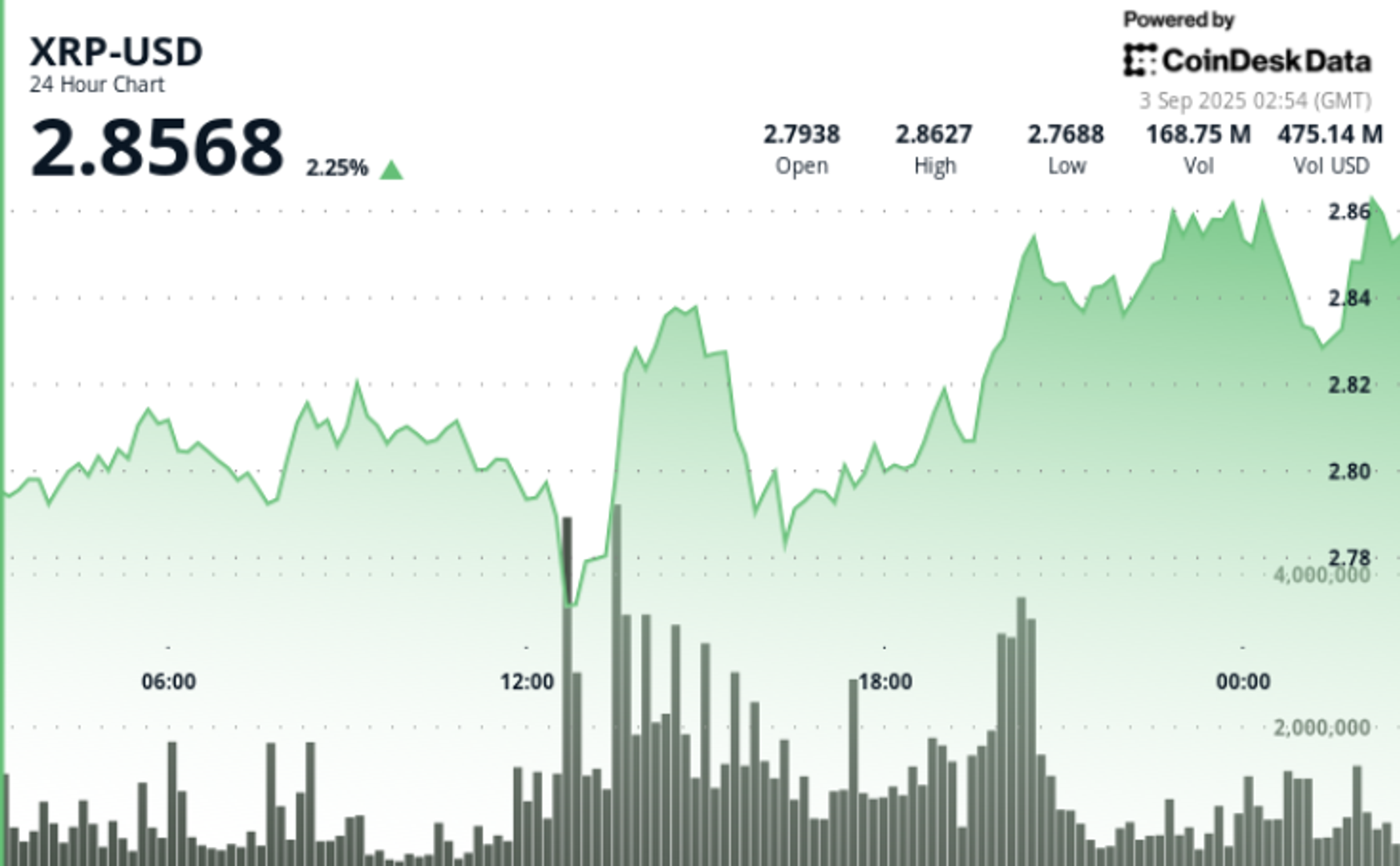

- XRP was traded in a 23 -hour volatile session from September 2 at 03:00 to 3 September at 02:00, and the move between $ 2.76 and $ 2.86.

- Political and political uncertainty continues to increase fluctuations through encryption markets. Federal reserve expectations remain in the flow after inflation data versions, which increases liquidity stress.

- The accumulation of whales

340m xrp (960 million dollars) Over the past two weeks, institutions indicate weakness despite the broader sale since July. - Analysts remain divided: some negative risks of science towards $ 2.50 if it is $ 2.76 is broken, while others cite long -term penetration settings with goals more than $ 4.00 if the resistance is given $ 3.30.

Price

- XRP opened near $ 2.79 and closed about $ 2.82, an increase of 2 % in the session.

- Inside the day low in $ 2.76 (12:00 GMT) It was quickly defended with the high level of the sound above 180 mMuch higher than average 24 hours 78 m.

- The price and then apply to $ 2.86 During 13: 00-14: 00 recovery, resistance mode.

- The last hour has witnessed another batch of $ 2.83 to $ 2.86 with 3M+ trading per minute, confirming the institutional participation.

Technical analysis

- Support: 2.76 – 2.78 dollars defended a heavy size. The next negative handrail sits at $ 2.70 and $ 2.50.

- resistance: $ 2.86 on a cover in the short term; The $ 3.00 and $ 3.30 remains basic levels.

- batch: RSI fixed in the mid -fifties, which shows neutral bias.

- MACD: The graph is close to the upper intersection, supporting the accumulation thesis.

- PatternsThe similar triangle is less than $ 3.00 is still intact. Its lowest levels indicate the increasing pressure for collapse if $ 2.86 is scanned.

What the merchants see

- Can it last 2.76 dollars under frequent tests, or does the collapse of $ 2.50 open?

- Constant closure over $ 2.86, then 3.00 dollars, as signals for continued momentum.

- Pisces and European Agreement flows: The final dates of ETF events can be an incentive.

- Whether the size remains high or fades towards the average, and determines the intermittent setting force.

publish_date