The penetration market into the crypto market

The Digital Assets market has changed from an appropriate experiment with a global resurgence of financial, commerce, and technology. In May 2025, the global crypto market appreciated $ 3.05 trillionGrowing up a pace on PAR on Internet Boom in the 90s.

A look at the growth curve

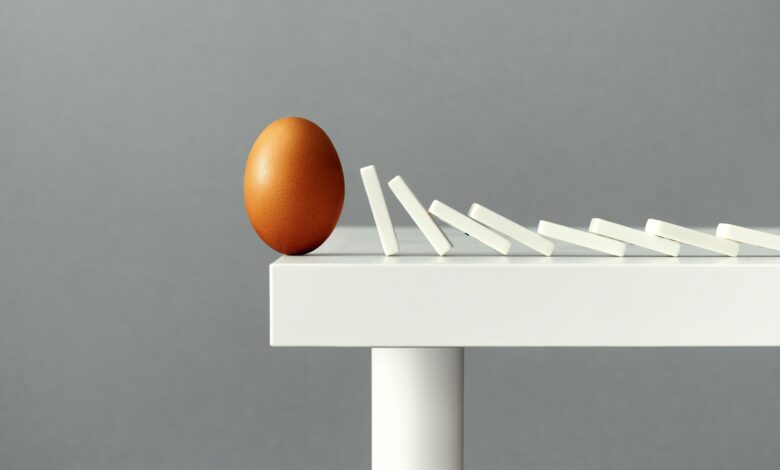

History -adoption curves for technologies such as the Internet and smartphones show that 10% penetration often marks a tipping point, after which growth accelerates greatly due to network effects and mainstream reception. Digital possessions are in this trajectory, encouraged by increasing user adoption, institutional investment and innovative cases of use. After years of public uncertainty, a pivotal milestone can be achieved this year: Cryptocurrency user penetration may exceed a critical 10% threshold, estimated to reach 11.02% worldwide in 2025 of Statesmanfrom 7.41% in 2024.

The chart below compares the early curves of the Cryptocurrency and Internet users. It featured that crypto is growing at a faster rate than the Internet did in its early years.

The 10% threshold: a catalyst for exponential growth

In expecting that the crypto will cross the 10% adoption threshold in 2025, it is important to note that the 10% mark is not justified-this is a well-documented tipping point in the technology explosion, rooted in Everett Rogers’ Departure theory of innovation. This model shows that the adoption moves from previous adopters (13.5%) to early (34%) around 10-15%penetration, marked the transition from niche to mainstream.

Crossing 10% penetration into the market promotes rapid growth as infrastructure, accessing and receiving society. Two latest examples of this are the smartphone and the internet.

For cryptocurrencies, exceeding 10% penetration in 2025 will signal a similar point of inflection, with network effects that boost adoption -more users increase liquidity, receiving merchants and developer activity, making crypto more practical for day -to -day transactions such as payments and remittances.

In the US, 28% of adults (approximately 65 million people) owned cryptocurrencies in 2025, nearly doubling from 15% in 2021. In addition, 14% of non-owned plans to get into the market this year, and 66% of current owners intention to buy morereflects significant momentum. Worldwide, two of the three American adults are familiar with digital assets, which has signed a sharp removal from the preceding haka -haka reputation. These figures emphasize the growing major reception of digital assets, which aligns with the post-10% adoption of the adoption observed with other transformation technologies.

The economic impact of crypto covers remittances, cross-border trade, and financial integration, especially in Africa and Asia, where it provides disabled.

Drivers of accelerated penetration

There are many factors that drive crypto past 10% threshold:

- Blockchain technology: Transparency and security support remittances, supply chain monitoring, and prevention of fraud, with Ethereum handling more than 1.5 million -sun -day -day transactions.

- Financial integration: Gives – -crypto Finance access for non -generated populationsEspecially in Africa and Asia, through mobile and fintech platforms.

- Clarity of regulation: Pro-Crypto policies in the UAE, Germany, and El Salvador (where Bitcoin is legal soft) that boosts adoption, even though India and China’s uncertainty is bringing challenges.

- AI integration: Almost 90 tokens based on AI In 2024 improve blockchain operating for management and payment.

- Economic inability: Crypto’s role as a fence against inflation drive of adoption in markets such as Brazil ($ 90.3 billion in Stablecoin transactions) and Argentina ($ 91.1 billion).

Adopting Institutional and Business

Invasion of institutional and business is to accelerate the basic integration of digital assets. Main financial players such as Blackrock and Fidelity will go all over the crypto services and launched Crypto (ETF) funds, including 72 ETFs awaiting SEC approved in 2025.

Businesses have adopted crypto payments to cut fees and reach global customers, especially retail and e-commerce. With the examples Burger King In Germany welcomed Bitcoin since 2019 and Paypal’s 2024 cooperation with Moonpay For us crypto purchases. Platforms such as Coinbase Commerce and Triple-Anext to partnerships such Ingenico and crypto.comEnable merchants to accept crypto with local money repair, reducing volatility risks.

Defi activity has increased dramatically in sub-Saharan Africa, Latin America, and Eastern Europe. In Eastern Europe, Defi costs more than 33% of the total crypto receivedalong with the region that puts the third worldwide in the year-to-year growth of the defi.

Challenges and speeding up early

Despite its momentum, digital assets face obstacles:

- Volatility: Crypto is a very much -changing -change of possessionIt is often too late for institutional investors.

- Security concerns: Hacks, lost private keys and third party risks all contribute to the uncertainty of investors.

- Regulation exam: Despite a very friendly stance by the United States government towards crypto and increasingly tolerant governments around the world, there are questions about how crypto can be treated in constituents, specifically related to security.

However, the trajectory promises.

Feelings of bullish and crypto-friendly regulators, in conjunction with ETF momentum and payment integration, emphasizes this trajectory. If the change continues to balance with confidence, digital assets are likely to follow the Internet and smartphone playbook – and grow faster.